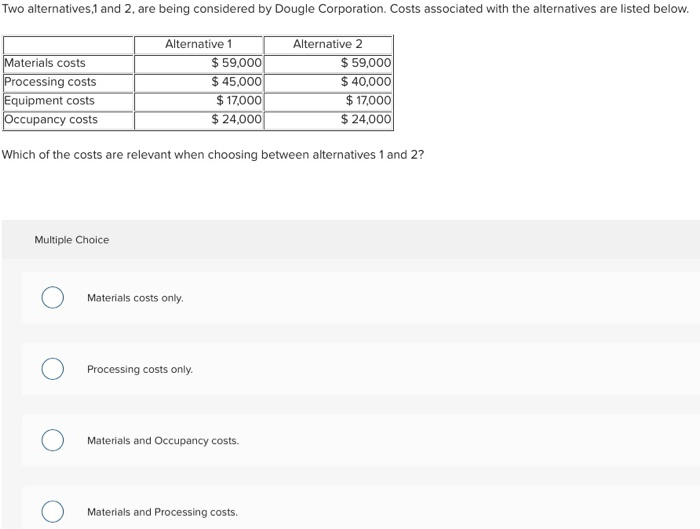

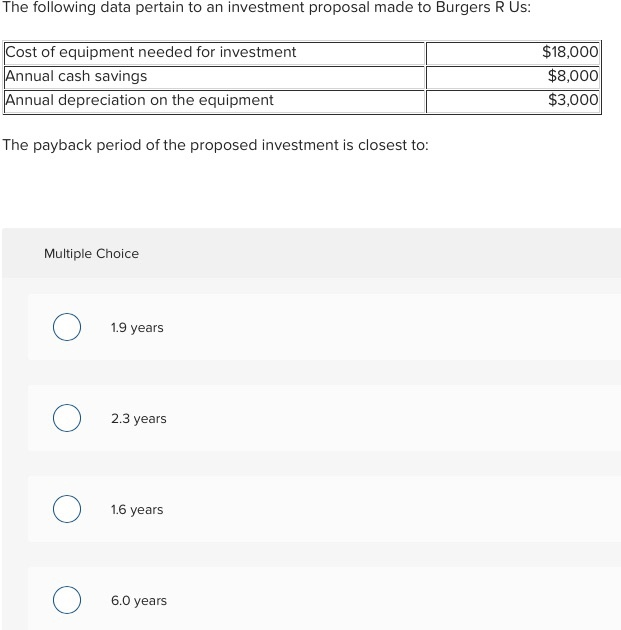

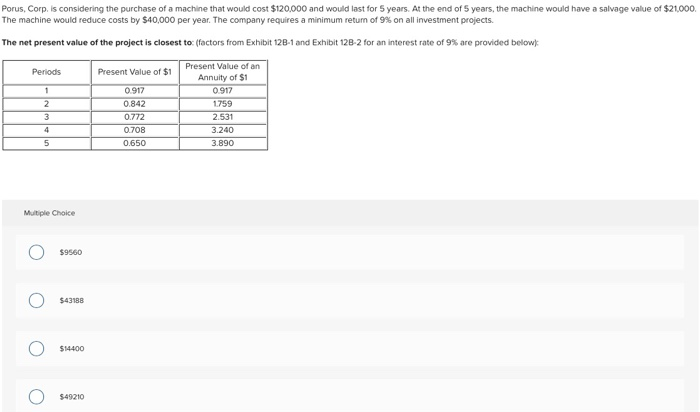

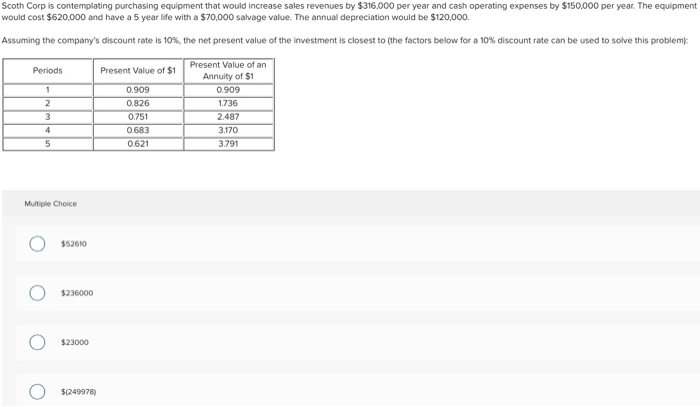

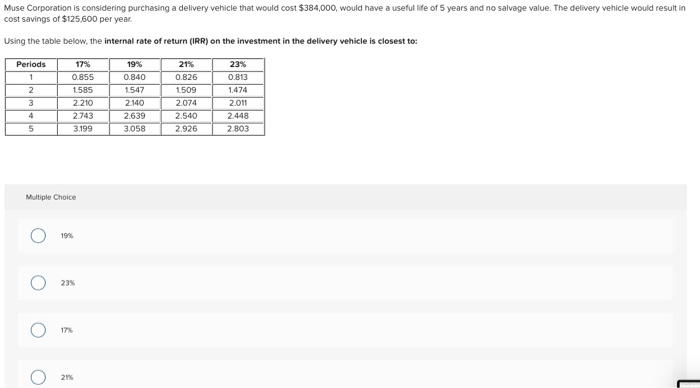

Two alternatives,1 and 2, are being considered by Dougle Corporation. Costs associated with the alternatives are listed below. Materials costs Processing costs Equipment costs Occupancy costs Alternative 1 $ 59,000 $ 45,000 $ 17,000 $ 24,000 Alternative 2 $ 59,000 $ 40,000 $ 17,000 $ 24,000 Which of the costs are relevant when choosing between alternatives 1 and 2? Multiple Choice o Materials costs only Processing costs only. o Materials and Occupancy costs. O Materials and Processing costs. The following data pertain to an investment proposal made to Burgers R Us: Cost of equipment needed for investment Annual cash savings Annual depreciation on the equipment $18,000 $8,000 $3,000 The payback period of the proposed investment is closest to: Multiple Choice 0 1.9 years 0 2.3 years 0 1.6 years 0 6.0 years Porus, Corp. is considering the purchase of a machine that would cost $120,000 and would last for 5 years. At the end of 5 years, the machine would have a salvage value of $21,000. The machine would reduce costs by $40,000 per year. The company requires a minimum return of 9% on all investment projects. The net present value of the project is closest to: (factors from Exhibit 128-1 and Exhibit 128-2 for an interest rate of 9% are provided below Periods Present Value of $1 2 Present Value of an Annuity of $1 0917 1759 2.531 3.240 3.890 3 0917 0.842 .772 0.708 .650 0 5 0 Multiple Choice $9560 To 0 0 0 543188 $14400 $49210 Scoth Corp is contemplating purchasing equipment that would increase sales revenues by $316,000 per year and cash operating expenses by $150,000 per year. The equipment would cost $620,000 and have a 5 year life with a $70,000 salvage value. The annual depreciation would be $120,000 Assuming the company's discount rate is 10%, the net present value of the investment is closest to the factors below for a 10% discount rate can be used to solve this problem Periods Present Value of $1 0.909 21 0.826 0.751 0.683 .621 Present Value of an Annuity of $1 0.909 1.736 2.487 3.170 3.791 5 10 0 Multiple Choice o O $52610 O $236000 O $23000 0 $(249978) Muse Corporation is considering purchasing a delivery vehicle that would cost $384.000, would have a useful life of 5 years and no salvage value. The delivery vehicle would result in cost savings of $125.600 per year Using the table below the internal rate of return (IRR) on the investment in the delivery vehicle is closest to: Periods 2 3 17% 19% 21% 23% 0.855 0.840 0.826 0813 15851547 15091474 2 210 2140 2.074 2011 2.743 2639 2.540 2.448 3199 305829262803 S