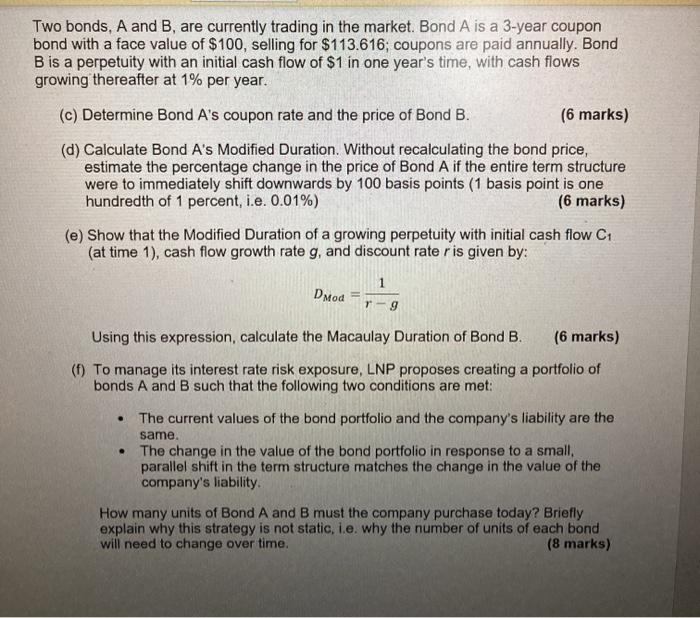

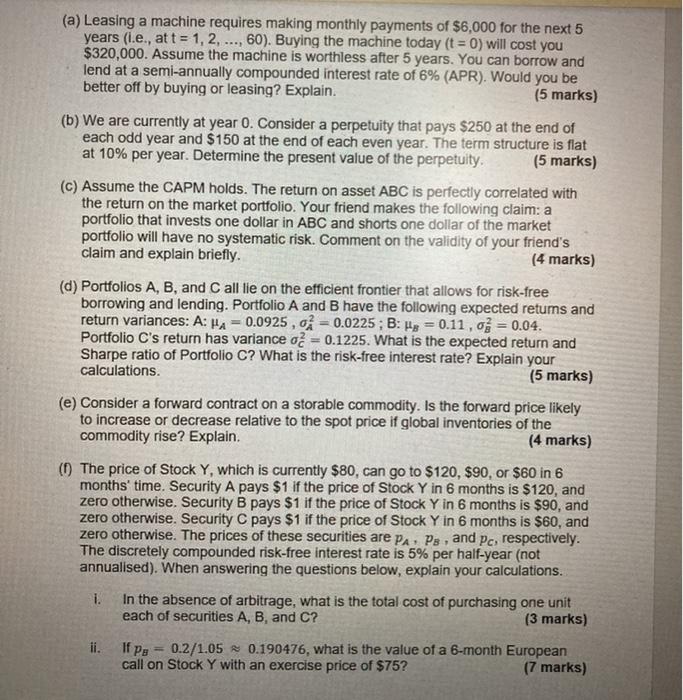

Two bonds, A and B, are currently trading in the market. Bond A is a 3-year coupon bond with a face value of $100, selling for $113.616; coupons are paid annually. Bond B is a perpetuity with an initial cash flow of $1 in one year's time, with cash flows growing thereafter at 1% per year. (c) Determine Bond A's coupon rate and the price of Bond B. (6 marks) (d) Calculate Bond A's Modified Duration. Without recalculating the bond price, estimate the percentage change in the price of Bond A if the entire term structure were to immediately shift downwards by 100 basis points (1 basis point is one hundredth of 1 percent, i.e. 0.01%) (6 marks) (e) Show that the Modified Duration of a growing perpetuity with initial cash flow C (at time 1), cash flow growth rate g, and discount rate r is given by: DMod - 9 Using this expression, calculate the Macaulay Duration of Bond B. (6 marks) (1) To manage its interest rate risk exposure, LNP proposes creating a portfolio of bonds A and B such that the following two conditions are met: The current values of the bond portfolio and the company's liability are the same. The change in the value of the bond portfolio in response to a small parallel shift in the term structure matches the change in the value of the company's liability. How many units of Bond A and B must the company purchase today? Briefly explain why this strategy is not static, i.e. why the number of units of each bond will need to change over time. (8 marks) . (a) Leasing a machine requires making monthly payments of $6,000 for the next 5 years (.e., att = 1, 2, ..., 60). Buying the machine today (t = 0) will cost you $320,000. Assume the machine is worthless after 5 years. You can borrow and lend at a semi-annually compounded interest rate of 6% (APR). Would you be better off by buying or leasing? Explain. (5 marks) (b) We are currently at year 0. Consider a perpetuity that pays $250 at the end of each odd year and $150 at the end of each even year. The term structure is flat at 10% per year. Determine the present value of the perpetuity. (5 marks) (c) Assume the CAPM holds. The return on asset ABC is perfectly correlated with the return on the market portfolio. Your friend makes the following claim: a portfolio that invests one dollar in ABC and shorts one dollar of the market portfolio will have no systematic risk. Comment on the validity of your friend's claim and explain briefly. (4 marks) (d) Portfolios A, B, and C all lie on the efficient frontier that allows for risk-free borrowing and lending. Portfolio A and B have the following expected retums and return variances: A: HA=0.0925, g = 0.0225; B: He = 0.11 , 0 = 0.04. Portfolio C's return has variance o = 0.1225. What is the expected return and Sharpe ratio of Portfolio C? What is the risk-free interest rate? Explain your calculations. (5 marks) (e) Consider a forward contract on a storable commodity. Is the forward price likely to increase or decrease relative to the spot price if global inventories of the commodity rise? Explain. (4 marks) ( The price of Stock Y, which is currently $80, can go to $120, $90, or $60 in 6 months' time. Security A pays $1 if the price of Stock Y in 6 months is $120, and zero otherwise. Security B pays $1 if the price of Stock Y in 6 months is $90, and zero otherwise. Security C pays $1 if the price of Stock Y in 6 months is $60, and zero otherwise. The prices of these securities are pa. Ps, and pc, respectively. The discretely compounded risk-free interest rate is 5% per half-year (not annualised). When answering the questions below, explain your calculations. 1. In the absence of arbitrage, what is the total cost of purchasing one unit each of securities A, B, and C? (3 marks) ii. If Pa 0.2/1.05 0.190476, what is the value of a 6-month European call on Stock Y with an exercise price of $75? (7 marks) Two bonds, A and B, are currently trading in the market. Bond A is a 3-year coupon bond with a face value of $100, selling for $113.616; coupons are paid annually. Bond B is a perpetuity with an initial cash flow of $1 in one year's time, with cash flows growing thereafter at 1% per year. (c) Determine Bond A's coupon rate and the price of Bond B. (6 marks) (d) Calculate Bond A's Modified Duration. Without recalculating the bond price, estimate the percentage change in the price of Bond A if the entire term structure were to immediately shift downwards by 100 basis points (1 basis point is one hundredth of 1 percent, i.e. 0.01%) (6 marks) (e) Show that the Modified Duration of a growing perpetuity with initial cash flow C (at time 1), cash flow growth rate g, and discount rate r is given by: DMod - 9 Using this expression, calculate the Macaulay Duration of Bond B. (6 marks) (1) To manage its interest rate risk exposure, LNP proposes creating a portfolio of bonds A and B such that the following two conditions are met: The current values of the bond portfolio and the company's liability are the same. The change in the value of the bond portfolio in response to a small parallel shift in the term structure matches the change in the value of the company's liability. How many units of Bond A and B must the company purchase today? Briefly explain why this strategy is not static, i.e. why the number of units of each bond will need to change over time. (8 marks) . (a) Leasing a machine requires making monthly payments of $6,000 for the next 5 years (.e., att = 1, 2, ..., 60). Buying the machine today (t = 0) will cost you $320,000. Assume the machine is worthless after 5 years. You can borrow and lend at a semi-annually compounded interest rate of 6% (APR). Would you be better off by buying or leasing? Explain. (5 marks) (b) We are currently at year 0. Consider a perpetuity that pays $250 at the end of each odd year and $150 at the end of each even year. The term structure is flat at 10% per year. Determine the present value of the perpetuity. (5 marks) (c) Assume the CAPM holds. The return on asset ABC is perfectly correlated with the return on the market portfolio. Your friend makes the following claim: a portfolio that invests one dollar in ABC and shorts one dollar of the market portfolio will have no systematic risk. Comment on the validity of your friend's claim and explain briefly. (4 marks) (d) Portfolios A, B, and C all lie on the efficient frontier that allows for risk-free borrowing and lending. Portfolio A and B have the following expected retums and return variances: A: HA=0.0925, g = 0.0225; B: He = 0.11 , 0 = 0.04. Portfolio C's return has variance o = 0.1225. What is the expected return and Sharpe ratio of Portfolio C? What is the risk-free interest rate? Explain your calculations. (5 marks) (e) Consider a forward contract on a storable commodity. Is the forward price likely to increase or decrease relative to the spot price if global inventories of the commodity rise? Explain. (4 marks) ( The price of Stock Y, which is currently $80, can go to $120, $90, or $60 in 6 months' time. Security A pays $1 if the price of Stock Y in 6 months is $120, and zero otherwise. Security B pays $1 if the price of Stock Y in 6 months is $90, and zero otherwise. Security C pays $1 if the price of Stock Y in 6 months is $60, and zero otherwise. The prices of these securities are pa. Ps, and pc, respectively. The discretely compounded risk-free interest rate is 5% per half-year (not annualised). When answering the questions below, explain your calculations. 1. In the absence of arbitrage, what is the total cost of purchasing one unit each of securities A, B, and C? (3 marks) ii. If Pa 0.2/1.05 0.190476, what is the value of a 6-month European call on Stock Y with an exercise price of $75? (7 marks)