Question

Two Brother's Moving Company purchased a group of new moving trucks for a total amount of $125,000. The vehicles are expected to last five years

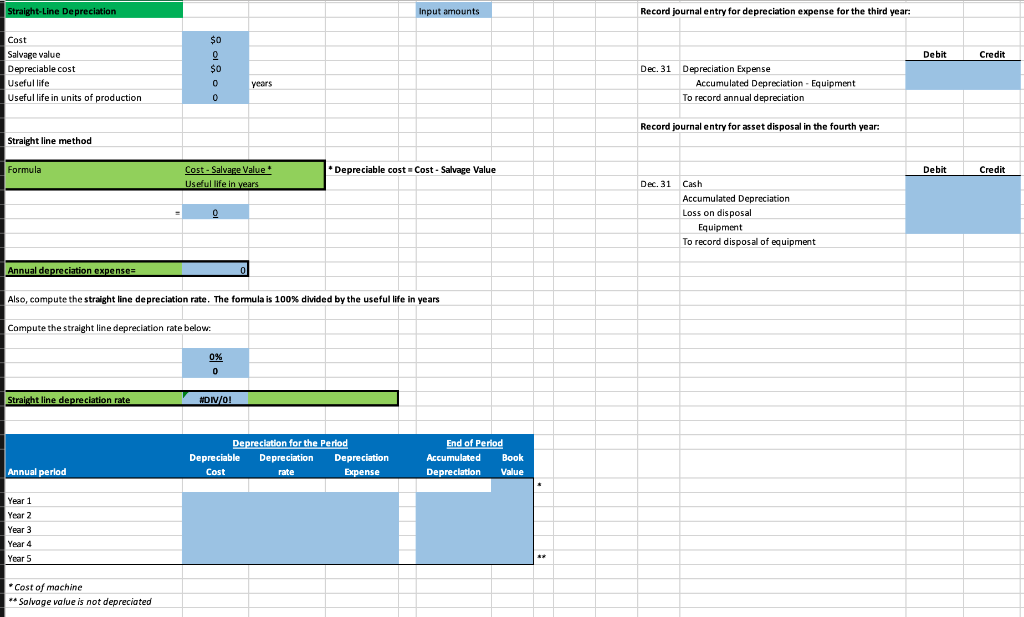

Two Brother's Moving Company purchased a group of new moving trucks for a total amount of $125,000. The vehicles are expected to last five years due to the heavy use and have a residual/scrap/salvage value of $10,000 at the end of that life. Usage of the vehicle is tracked in miles and the vehicles in total are expected to last 2,000,000 miles. During year one 750,000 miles were used, during year two 600,000 miles were used, during year three 500,000 miles were used, during year four no miles were used due to a temporary closing of the moving line of business, and during year five 150,000 miles were used. Using the depreciation template provided, determine the amount of depreciation expense for the third year under each of the following assumptions:

- The company uses the straight-line method of depreciation.

- The company uses the units-of-production method of depreciation.

- The company uses the double-declining-balance method of depreciation.

- Assuming straight line depreciation, prepare the journal entry for the third year.

- Assume the company sold the vehicles at the end of the fourth year for $50,000. Prepare a journal entry for asset disposal in the fourth year.

- Assume you are the chief accountant of this company. Determine how you will choose, based on best industry practices, the depreciation method for them to use.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started