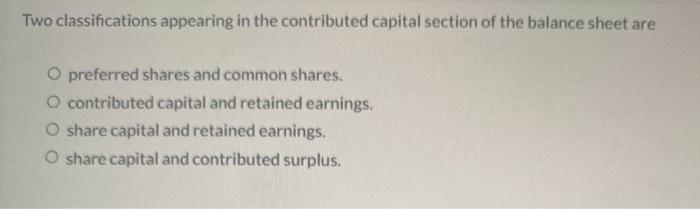

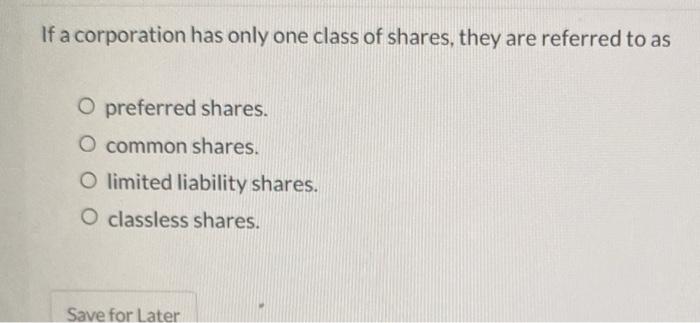

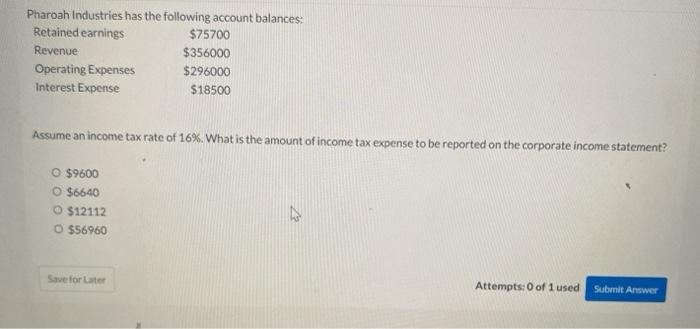

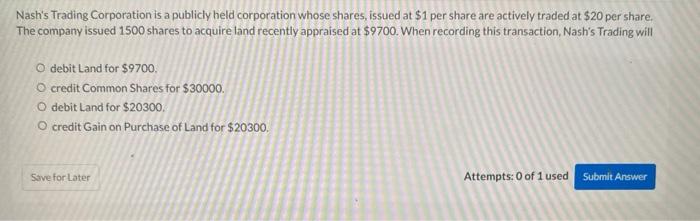

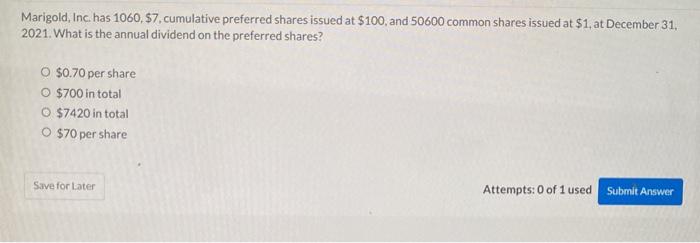

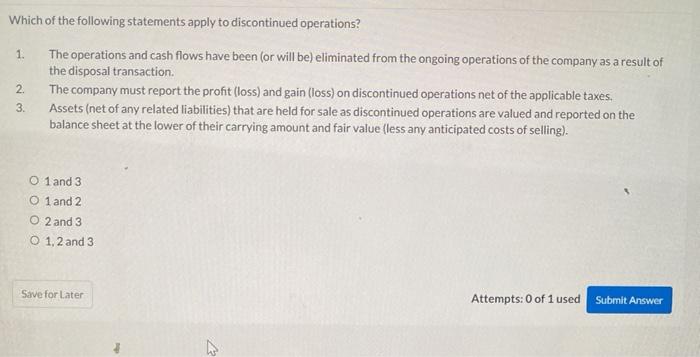

Two classifications appearing in the contributed capital section of the balance sheet are O preferred shares and common shares. O contributed capital and retained earnings. share capital and retained earnings. O share capital and contributed surplus. If a corporation has only one class of shares, they are referred to as O preferred shares. O common shares. O limited liability shares. O classless shares. Save for Later Pharoah Industries has the following account balances: Retained earnings $75700 Revenue $356000 Operating Expenses $296000 Interest Expense $18500 Assume an income tax rate of 16%. What is the amount of income tax expense to be reported on the corporate income statement? $9600 O $6640 O $12112 O $56960 IN Save for Later Attempts:0 of 1 used Submit Answer Nash's Trading Corporation is a publicly held corporation whose shares, issued at $1 per share are actively traded at $20 per share. The company issued 1500 shares to acquire land recently appraised at $9700. When recording this transaction, Nash's Trading will O debit Land for $9700 O credit Common Shares for $30000. O debit Land for $20300 O credit Gain on Purchase of Land for $20300, Save for Later Attempts: 0 of 1 used Submit Answer Marigold, Inc. has 1060, $7.cumulative preferred shares issued at $100, and 50600 common shares issued at $1, at December 31, 2021. What is the annual dividend on the preferred shares? O $0.70 per share O $700 in total O $7420 in total O $70 per share Save for Later Attempts: 0 of 1 used Submit Answer 1. Which of the following statements apply to discontinued operations? The operations and cash flows have been (or will be) eliminated from the ongoing operations of the company as a result of the disposal transaction. 2. The company must report the profit (loss) and gain (loss) on discontinued operations net of the applicable taxes, Assets (net of any related liabilities) that are held for sale as discontinued operations are valued and reported on the balance sheet at the lower of their carrying amount and fair value (less any anticipated costs of selling). 3. 0 1 and 3 1 and 2 0 2 and 3 O 1,2 and 3 Save for Later Attempts: 0 of 1 used Submit