Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two companies, A and B, have the same expected earnings in the current year. Each company is equally risky, but company A pays out 50%

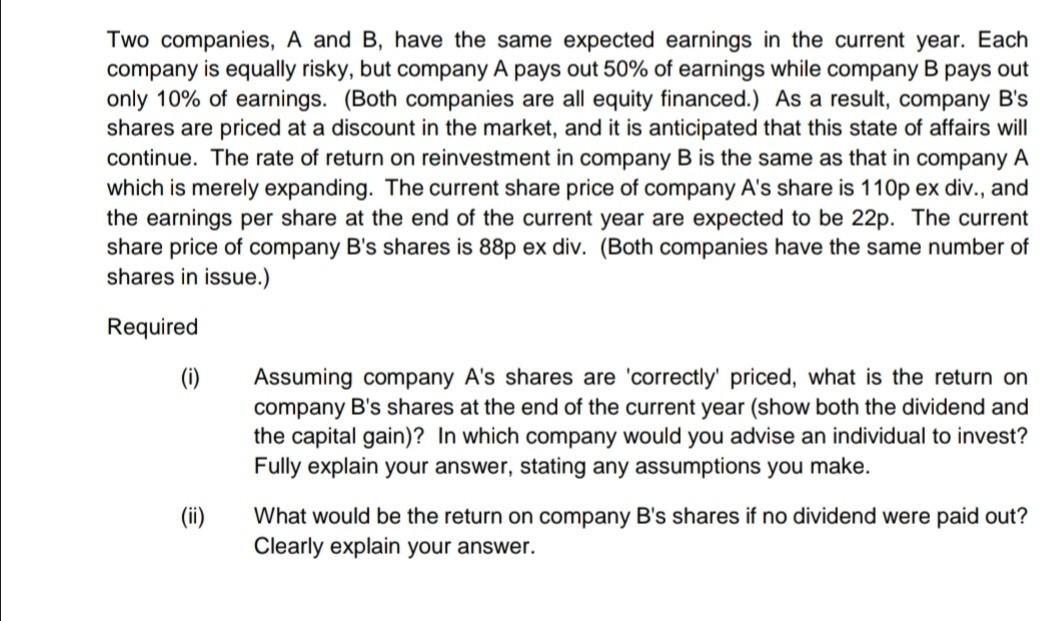

Two companies, A and B, have the same expected earnings in the current year. Each company is equally risky, but company A pays out 50% of earnings while company B pays out only 10% of earnings. (Both companies are all equity financed.) As a result, company B's shares are priced at a discount in the market, and it is anticipated that this state of affairs will continue. The rate of return on reinvestment in company B is the same as that in company A which is merely expanding. The current share price of company A's share is 110p ex div., and the earnings per share at the end of the current year are expected to be 22p. The current share price of company B's shares is 88p ex div. (Both companies have the same number of shares in issue.) Required (i) Assuming company A's shares are 'correctly priced, what is the return on company B's shares at the end of the current year (show both the dividend and the capital gain)? In which company would you advise an individual to invest? Fully explain your answer, stating any assumptions you make. (ii) What would be the return on company B's shares if no dividend were paid out? Clearly explain your answer. Two companies, A and B, have the same expected earnings in the current year. Each company is equally risky, but company A pays out 50% of earnings while company B pays out only 10% of earnings. (Both companies are all equity financed.) As a result, company B's shares are priced at a discount in the market, and it is anticipated that this state of affairs will continue. The rate of return on reinvestment in company B is the same as that in company A which is merely expanding. The current share price of company A's share is 110p ex div., and the earnings per share at the end of the current year are expected to be 22p. The current share price of company B's shares is 88p ex div. (Both companies have the same number of shares in issue.) Required (i) Assuming company A's shares are 'correctly priced, what is the return on company B's shares at the end of the current year (show both the dividend and the capital gain)? In which company would you advise an individual to invest? Fully explain your answer, stating any assumptions you make. (ii) What would be the return on company B's shares if no dividend were paid out? Clearly explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started