Question

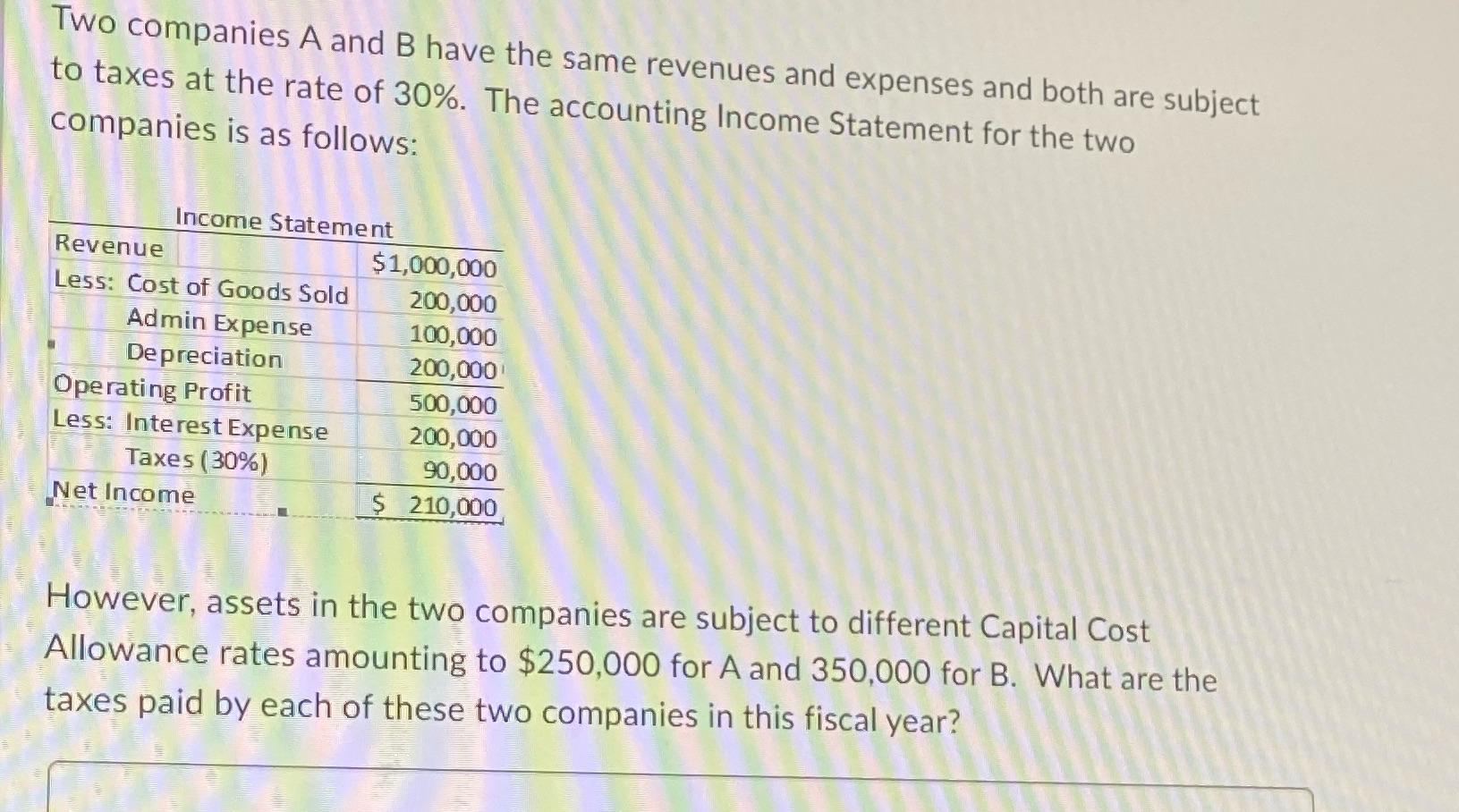

Two companies A and B have the same revenues and expenses and both are subject to taxes at the rate of 30%. The accounting

Two companies A and B have the same revenues and expenses and both are subject to taxes at the rate of 30%. The accounting Income Statement for the two companies is as follows: Income Statement Revenue Less: Cost of Goods Sold Admin Expense Depreciation Operating Profit Less: Interest Expense Taxes (30%) Net Income $1,000,000 200,000 100,000 200,000 500,000 200,000 90,000 $ 210,000 However, assets in the two companies are subject to different Capital Cost Allowance rates amounting to $250,000 for A and 350,000 for B. What are the taxes paid by each of these two companies in this fiscal year?

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Formula Taxes paid by a company Operating p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

University Physics with Modern Physics

Authors: Hugh D. Young, Roger A. Freedman, Lewis Ford

12th Edition

978-0321501479, 9780805321876, 321501470, 978-0321501219

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App