Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two companies, Elektronix and NovaCorp, each produce an identical version of an electronic gadget. At the start of each year, each company independently and

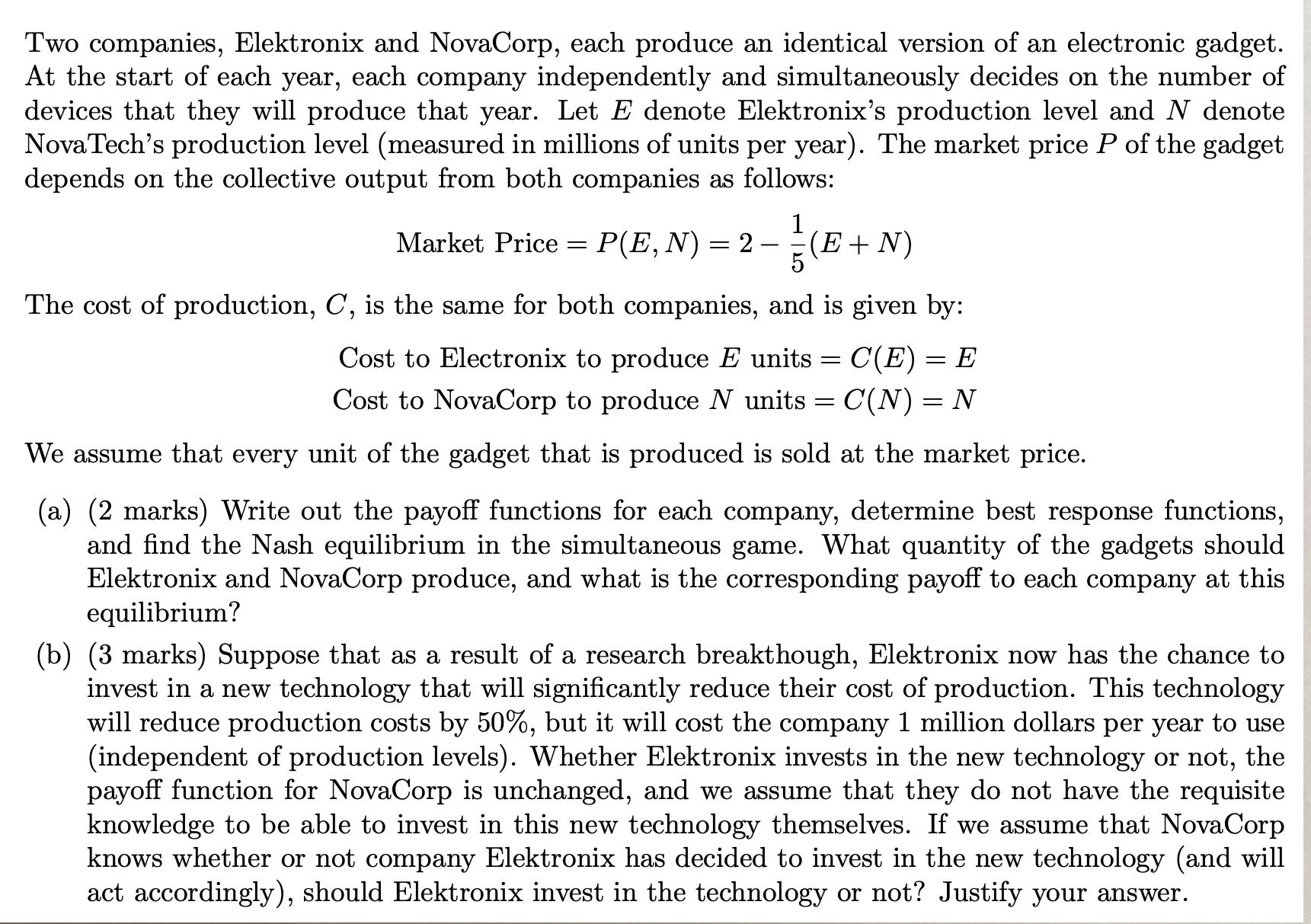

Two companies, Elektronix and NovaCorp, each produce an identical version of an electronic gadget. At the start of each year, each company independently and simultaneously decides on the number of devices that they will produce that year. Let E denote Elektronix's production level and N denote NovaTech's production level (measured in millions of units per year). The market price P of the gadget depends on the collective output from both companies as follows: 1 Market Price = P(E, N) = = 2 - (E+N) The cost of production, C, is the same for both companies, and is given by: Cost to Electronix to produce E units = C(E) = E Cost to NovaCorp to produce N units = C(N) = N We assume that every unit of the gadget that is produced is sold at the market price. (a) (2 marks) Write out the payoff functions for each company, determine best response functions, and find the Nash equilibrium in the simultaneous game. What quantity of the gadgets should Elektronix and NovaCorp produce, and what is the corresponding payoff to each company at this equilibrium? (b) (3 marks) Suppose that as a result of a research breakthough, Elektronix now has the chance to invest in a new technology that will significantly reduce their cost of production. This technology will reduce production costs by 50%, but it will cost the company 1 million dollars per year to use (independent of production levels). Whether Elektronix invests in the new technology or not, the payoff function for NovaCorp is unchanged, and we assume that they do not have the requisite knowledge to be able to invest in this new technology themselves. If we assume that NovaCorp knows whether or not company Elektronix has decided to invest in the new technology (and will act accordingly), should Elektronix invest in the technology or not? Justify your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started