Two companies Katlo Ltd and Kaone Ltd carrying on similar business enter into a contract to amalgamate and form a new company called Sebilo

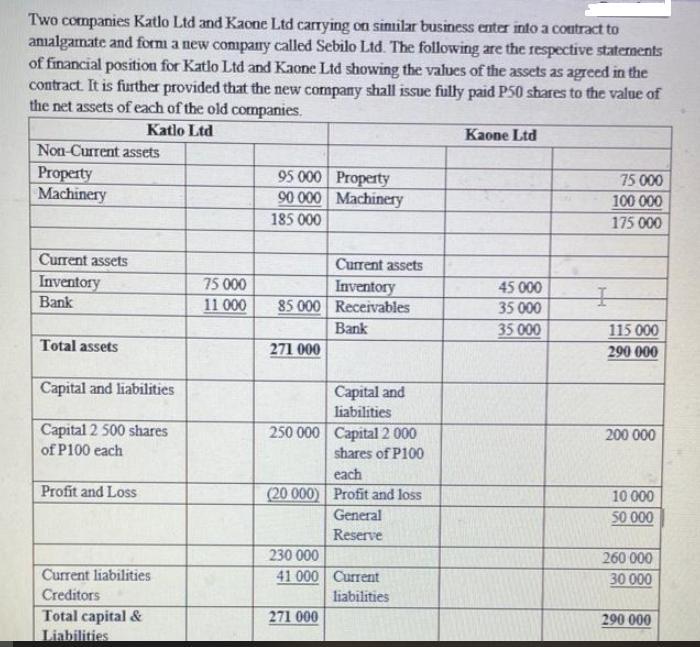

Two companies Katlo Ltd and Kaone Ltd carrying on similar business enter into a contract to amalgamate and form a new company called Sebilo Ltd. The following are the respective statements of financial position for Katlo Ltd and Kaone Ltd showing the values of the assets as agreed in the contract. It is further provided that the new company shall issue fully paid P50 shares to the value of the net assets of each of the old companies. Katlo Ltd Non-Current assets Property Machinery Current assets Inventory Bank Total assets Capital and liabilities Capital 2 500 shares of P100 each Profit and Loss Current liabilities Creditors Total capital & Liabilities 75 000 11 000 95 000 90 000 185 000 Current assets Inventory 85 000 Receivables Bank 271 000 Property Machinery 250 000 Capital 2 000 shares of P100 230 000 41 000 Capital and liabilities each (20 000) Profit and loss General Reserve 271 000 Current liabilities Kaone Ltd 45 000 35 000 35.000 75 000 100 000 175 000 I 115 000 290 000 200 000 10 000 50 000 260 000 30 000 290 000 Required to: a) State the total number of shares each company will receive from the new company b) Show the opening entries in the books of the new company c) Prepare a statement of financial position of the new company.

Step by Step Solution

3.47 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

a The total number of shares each company will receive from the new company is as follows Katlo Ltd2...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started