Two dealers compete to sell you a new car with a list price of $45000. Dealer A offers to sell it for $40000 if

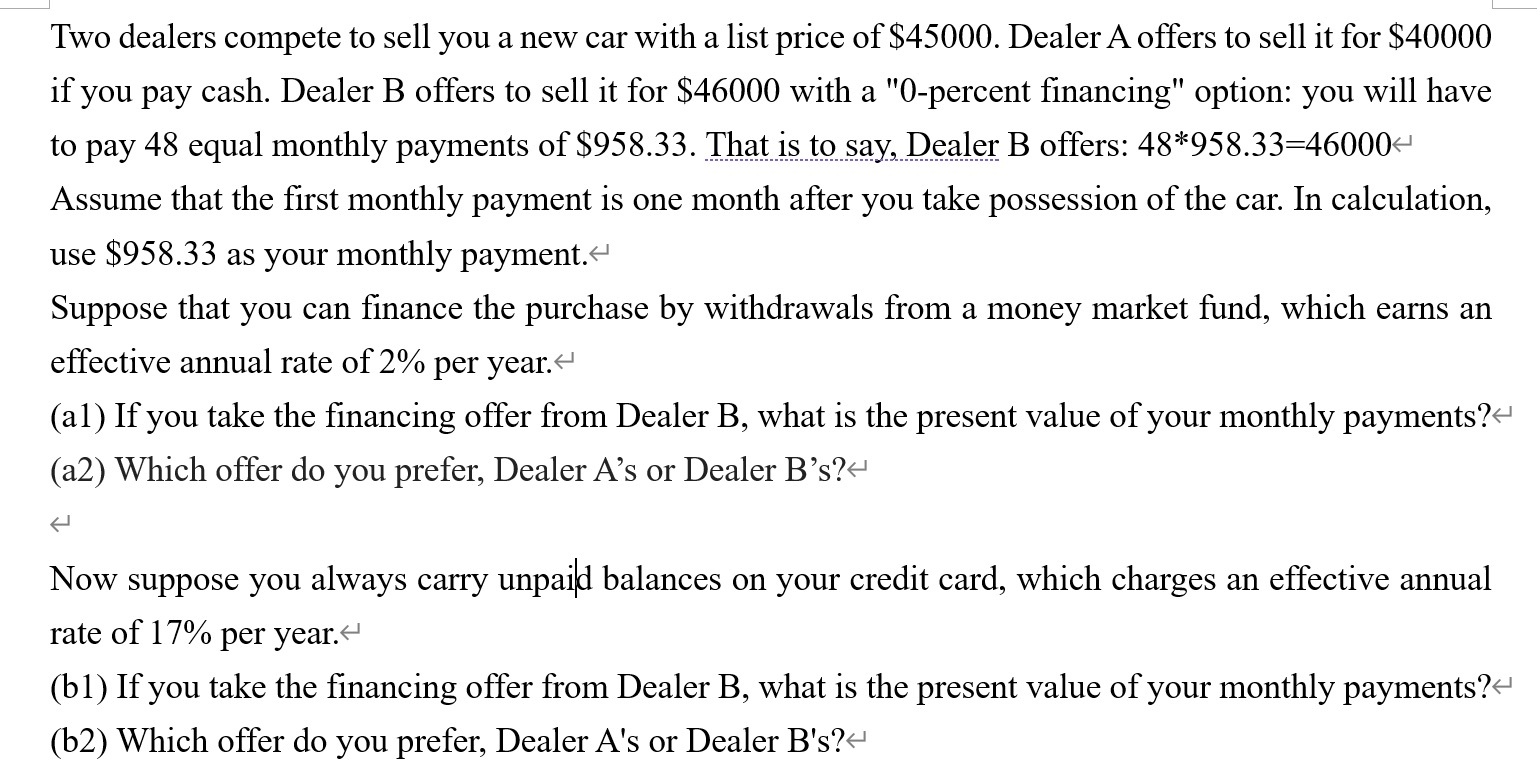

Two dealers compete to sell you a new car with a list price of $45000. Dealer A offers to sell it for $40000 if you pay cash. Dealer B offers to sell it for $46000 with a "0-percent financing" option: you will have to pay 48 equal monthly payments of $958.33. That is to say, Dealer B offers: 48*958.33=46000 < Assume that the first monthly payment is one month after you take possession of the car. In calculation, use $958.33 as your monthly payment. < Suppose that you can finance the purchase by withdrawals from a money market fund, which earns an effective annual rate of 2% per year. (al) If you take the financing offer from Dealer B, what is the present value of your monthly payments? < (a2) Which offer do you prefer, Dealer A's or Dealer B's? < Now suppose you always carry unpaid balances on your credit card, which charges an effective annual rate of 17% per year. (b1) If you take the financing offer from Dealer B, what is the present value of your monthly payments? (b2) Which offer do you prefer, Dealer A's or Dealer B's?

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a1 To calculate the present value of the monthly payments from Dealer B we can use the formula for t...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started