Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two depository institutions have composite CAMELS ratings of 1 or 2 and are well capitalized. Thus, each institution falls into the FDIC Risk Category I

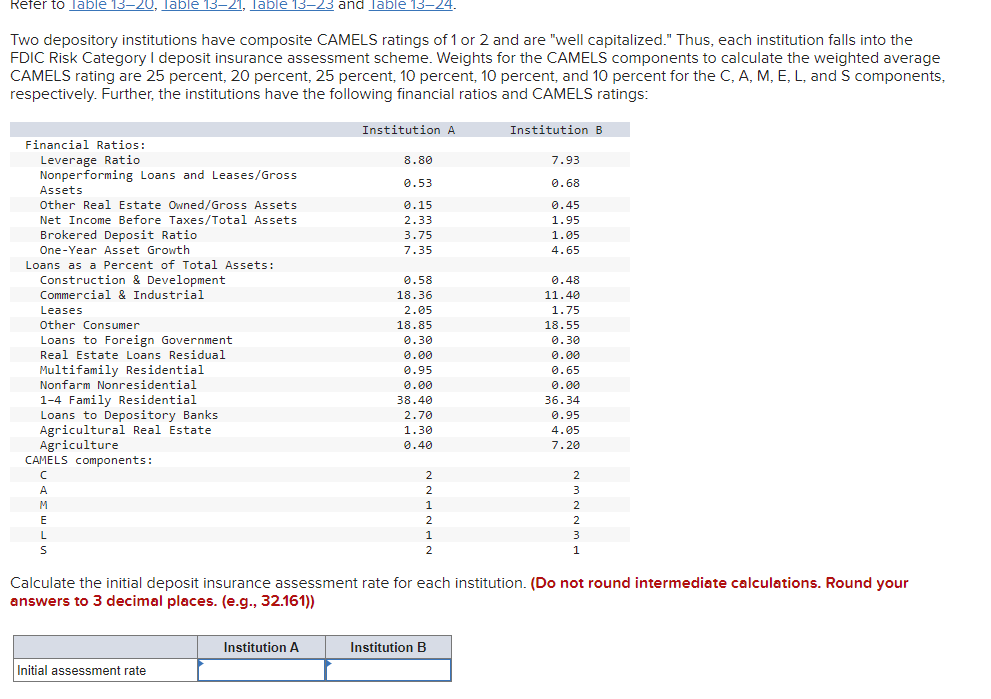

Two depository institutions have composite CAMELS ratings of or and are "well capitalized." Thus, each institution falls into the FDIC Risk Category I deposit insurance assessment scheme. Weights for the CAMELS components to calculate the weighted average CAMELS rating are percent, percent, percent, percent, percent, and percent for the C A M E L and S components, respectively. Further, the institutions have the following financial ratios and CAMELS ratings: Institution A Institution B Financial Ratios: Leverage Ratio Nonperforming Loans and LeasesGross Assets Other Real Estate OwnedGross Assets Net Income Before TaxesTotal Assets Brokered Deposit Ratio OneYear Asset Growth Loans as a Percent of Total Assets: Construction & Development Commercial & Industrial Leases Other Consumer Loans to Foreign Government Real Estate Loans Residual Multifamily Residential Nonfarm Nonresidential Family Residential Loans to Depository Banks Agricultural Real Estate Agriculture CAMELS components: C A M E L S Calculate the initial deposit insurance assessment rate for each institution. Do not round intermediate calculations. Round your answers to decimal places. eg

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started