Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two developers in Dallas, TX are developing a tract of land where they plan to build 30 new single-family homes, specifically 20 3-bedroom homes

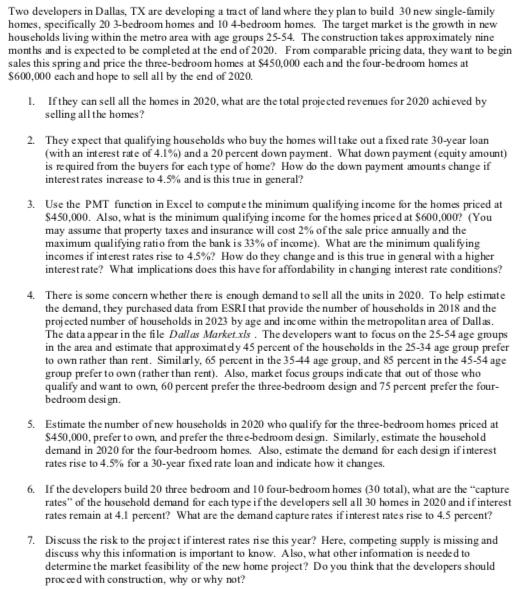

Two developers in Dallas, TX are developing a tract of land where they plan to build 30 new single-family homes, specifically 20 3-bedroom homes and 10 4-bedroom homes. The target market is the growth in new households living within the metro area with age groups 25-54. The construction takes approximately nine months and is expected to be completed at the end of 2020. From comparable pricing data, they want to begin sales this spring and price the three-bedroom homes at $450,000 each and the four-bedroom homes at $600,000 each and hope to sell all by the end of 2020. 1. If they can sell all the homes in 2020, what are the total projected revenues for 2020 achieved by selling all the homes? 2. They expect that qualifying households who buy the homes will take out a fixed rate 30-year loan (with an interest rate of 4.1%) and a 20 percent down payment. What down payment (equity amount) is required from the buyers for each type of home? How do the down payment amounts change if interest rates increase to 4.5% and is this true in general? 3. Use the PMT function in Excel to compute the minimum qualifying income for the homes priced at $450,000. Also, what is the minimum qualifying income for the homes priced at $600,000? (You may assume that property taxes and insurance will cost 2% of the sale price annually and the maximum qualifying ratio from the bank is 33% of income). What are the minimum qualifying incomes if interest rates rise to 4.5%? How do they change and is this true in general with a higher interest rate? What implications does this have for affordability in changing interest rate conditions? 4. There is some concern whether there is enough demand to sell all the units in 2020. To help estimate the demand, they purchased data from ESRI that provide the number of households in 2018 and the projected number of households in 2023 by age and income within the metropolitan area of Dallas. The data appear in the file Dallas Market xls. The developers want to focus on the 25-54 age groups in the area and estimate that approximately 45 percent of the households in the 25-34 age group prefer to own rather than rent. Similarly, 65 percent in the 35-44 age group, and 85 percent in the 45-54 age group prefer to own (rather than rent). Also, market focus groups indicate that out of those who qualify and want to own, 60 percent prefer the three-bedroom design and 75 percent prefer the four- bedroom design. 5. Estimate the number of new households in 2020 who qualify for the three-bedroom homes priced at $450,000, prefer to own, and prefer the three-bedroom design. Similarly, estimate the household demand in 2020 for the four-bedroom homes. Also, estimate the demand for each design if interest rates rise to 4.5% for a 30-year fixed rate loan and indicate how it changes. 6. If the developers build 20 three bedroom and 10 four-bedroom homes (30 total), what are the "capture rates of the household demand for each type if the developers sell all 30 homes in 2020 and if interest rates remain at 4.1 percent? What are the demand capture rates if interest rates rise to 4.5 percent? 7. Discuss the risk to the project if interest rates rise this year? Here, competing supply is missing and discuss why this information is important to know. Also, what other information is needed to determine the market feasibility of the new home project? Do you think that the developers should proceed with construction, why or why not?

Step by Step Solution

★★★★★

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the total projected revenues for 2020 achieved by selling all the homes we need to multiply the number of homes sold by their respective prices Number of 3bedroom homes sold 20 Price pe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started