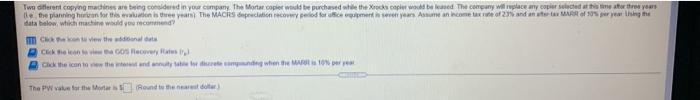

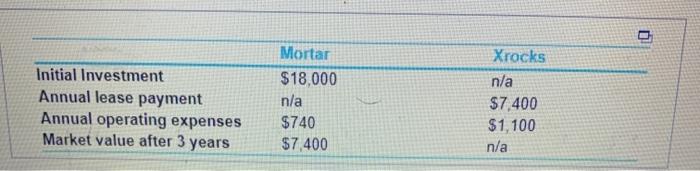

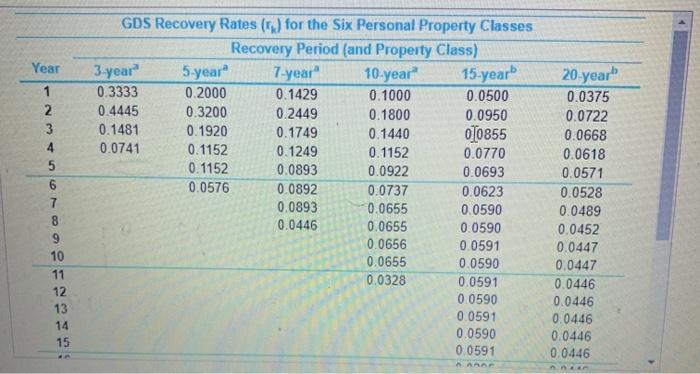

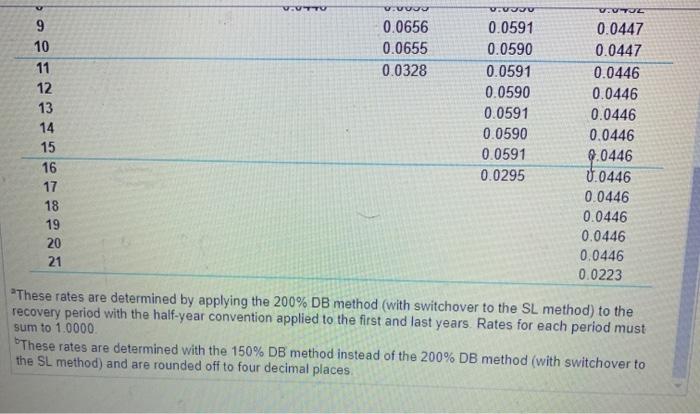

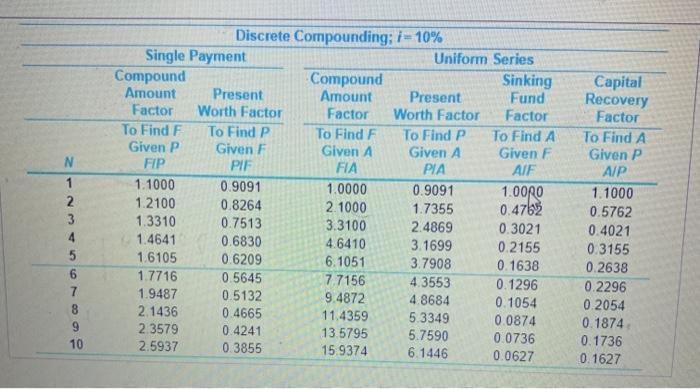

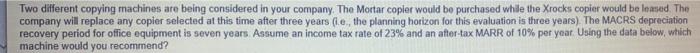

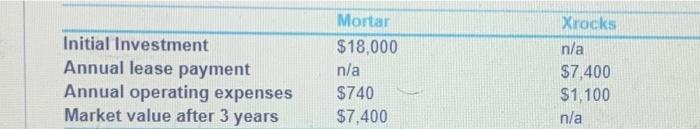

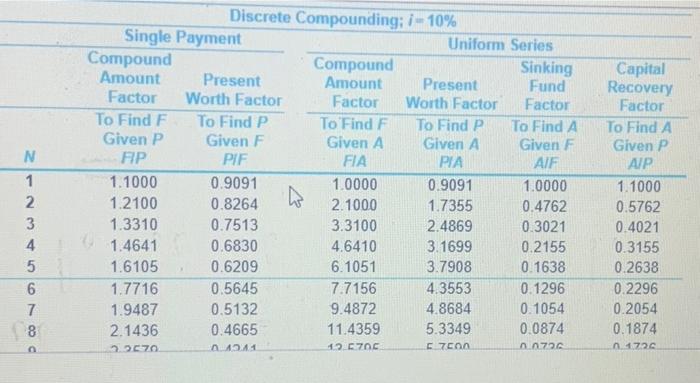

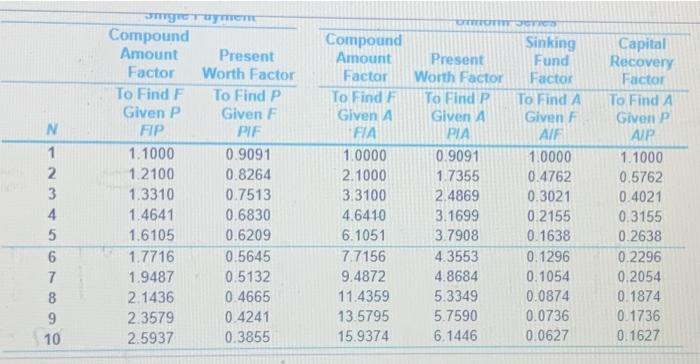

Two diferent copying machines are being considered in your company. The Mortat copier wild be purchased while the Xochscapeword beared the company will replace any copier suced at this to yours ile the planning for this win is three years the MACRS depreciation recowy pod for Bestars Anunean comerte 2011 and an RF 105 per year data helow, which machine oecond Chew the anal Clean Was Hey Click the icon to them and when the top The PW value for the Round to the 0 Initial Investment Annual lease payment Annual operating expenses Market value after 3 years Mortar $18,000 n/a $740 $7,400 Xrocks n/a $7,400 $1,100 n/a Year 1 2 3 4 5 6 7 8 GDS Recovery Rates (ru) for the Six Personal Property Classes Recovery Period (and Property Class) 3-year" 5 year 7-year" 10-year" 15-year 0.3333 0.2000 0.1429 0.1000 0.0500 0.4445 0.3200 0.2449 0.1800 0.0950 0.1481 0.1920 0.1749 0.1440 0(0855 0.0741 0.1152 0.1249 0.1152 0.0770 0.1152 0.0893 0.0922 0.0693 0.0576 0.0892 0.0737 0.0623 0.0893 0.0655 0.0590 0.0446 0.0655 0.0590 0.0656 0.0591 0.0655 0.0590 0.0328 0.0591 0.0590 0.0591 0.0590 0.0591 20-year" 0.0375 0.0722 0.0668 0.0618 0.0571 0.0528 0.0489 0.0452 0.0447 0.0447 0.0446 0.0446 0.0446 0.0446 0.0446 10 11 12 13 14 15 . . V.Vood V.VJUU VOTUL 0.0656 0.0655 0.0328 9 10 11 12 13 14 15 16 17 18 19 20 21 0.0591 0.0590 0.0591 0.0590 0.0591 0.0590 0.0591 0.0295 0.0447 0.0447 0.0446 0.0446 0.0446 0.0446 9.0446 1.0446 0.0446 0.0446 0.0446 0.0446 0.0223 *These rates are determined by applying the 200% DB method (with switchover to the SL method) to the recovery period with the half-year convention applied to the first and last years. Rates for each period must sum to 1.0000 These rates are determined with the 150% DB method instead of the 200% DB method (with switchover to the SL method) and are rounded off to four decimal places N 1 2 3 4 5 6 7 8 9 10 Discrete Compounding: 1 - 10% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP PIE FIA PIA AIF 1.1000 0.9091 1.0000 0.9091 1.0000 1.2100 0.8264 2 1000 1.7355 0.4762 1.3310 0.7513 3.3100 2.4869 0.3021 1.4641 0.6830 4.6410 3.1699 0.2155 1.6105 0.6209 6.1051 3.7908 0.1638 1.7716 0.5645 7.7156 4.3553 0.1296 1.9487 0.5132 9.4872 4.8684 0.1054 2.1436 0.4665 11.4359 5.3349 0.0874 2.3579 0.4241 13.5795 5.7590 0.0736 2.5937 0.3855 15.9374 6.1446 0.0627 Capital Recovery Factor To Find A Given P AIP 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 Two different copying machines are being considered in your company. The Mortar copier would be purchased while the Xrocks copier would be leased. The company will replace any copier selected at this time after three years (le, the planning horizon for this evaluation is three years) The MACRS depreciation recovery period for office equipment is seven years. Assume an income tax rate of 23% and an after-tax MARR of 10% per year. Using the data below, which machine would you recommend? Initial Investment Annual lease payment Annual operating expenses Market value after 3 years Mortar $18,000 n/a $740 $7,400 Xrocks n/a $7,400 $1,100 n/a N 1 2. 3 4 5 6 7 8 Discrete Compounding; i -10% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F HP PIF FIA PIA AIF 1.1000 0.9091 1.0000 0.9091 1.0000 1.2100 0.8264 2.1000 1.7355 0.4762 1.3310 0.7513 3.3100 2.4869 0.3021 1.4641 0.6830 4.6410 3.1699 0.2155 1.6105 0.6209 6.1051 3.7908 0.1638 1.7716 0.5645 7.7156 4.3553 0.1296 1.9487 0.5132 9.4872 4.8684 0.1054 2.1436 0.4665 11.4359 5.3349 0.0874 2007 4.41 12.670C 7con Capital Recovery Factor To Find A Given P AIP 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 n.720 N 1 2. 3 4 5 6 7 8 9 10 MicroT Compound Amount Present Factor Worth Factor To Find F To Find P Given P Given F FIP PIF 1.1000 0.9091 1.2100 0.8264 1.3310 0.7513 1.4641 0.6830 1.6105 0.6209 1.7716 0.5645 1.9487 0.5132 2.1436 0.4665 2.3579 0.4241 2.5937 0.3855 Compound Amount Factor To Find Given A FIA 1.0000 2.1000 3.3100 4.6410 6.1051 7.7156 9.4872 11.4359 13.5795 15.9374 TOTTICO Sinking Present Fund Worth Factor Factor To Find P To Find A Given A Given F PIA AIF 0.9091 1.0000 17355 0.4762 2.4869 0.3021 3.1699 0.2155 3.7908 0.1638 4.3553 0.1296 4.8684 0.1054 5.3349 0.0874 5.7590 0.0736 6.1446 0.0627 Capital Recovery Factor To Find A Given P AIP 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 The PW value for the Mortar is $ (Round to the nearest dollar.)