Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two drug companies, Murcky and Pfizzier, are each considering releasing a new drug for clinical trials. Each company knows that the other company also

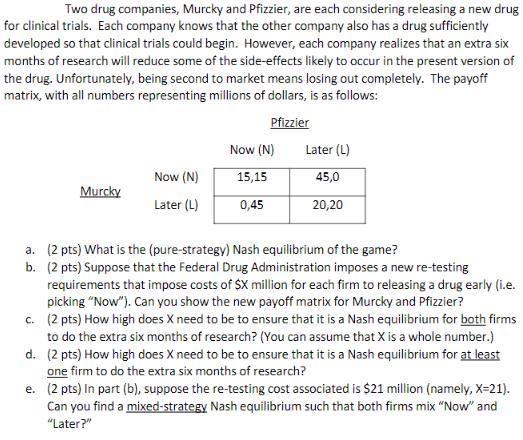

Two drug companies, Murcky and Pfizzier, are each considering releasing a new drug for clinical trials. Each company knows that the other company also has a drug sufficiently developed so that clinical trials could begin. However, each company realizes that an extra six months of research will reduce some of the side-effects likely to occur in the present version of the drug. Unfortunately, being second to market means losing out completely. The payoff matrix, with all numbers representing millions of dollars, is as follows: Pfizzier Murcky Now (N) Later (L) Now (N) 15,15 0,45 Later (L) 45,0 20,20 a. (2 pts) What is the (pure-strategy) Nash equilibrium of the game? b. (2 pts) Suppose that the Federal Drug Administration imposes a new re-testing requirements that impose costs of $X million for each firm to releasing a drug early (i.e. picking "Now"). Can you show the new payoff matrix for Murcky and Pfizzier? c. (2 pts) How high does X need to be to ensure that it is a Nash equilibrium for both firms to do the extra six months of research? (You can assume that X is a whole number.) (2 pts) How high does X need to be to ensure that it is a Nash equilibrium for at least one firm to do the extra six months of research? d. e. (2 pts) In part (b), suppose the re-testing cost associated is $21 million (namely, X-21). Can you find a mixed-strategy Nash equilibrium such that both firms mix "Now" and "Later?"

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a 2 pts What is the pure str ategy Nash equilibrium of the game ANS WER The Nash equilibrium of the game is for both companies to act now which result...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started