Two firms are identical except their capital structure. Specifically, the unlevered firm does not have any debt, but the levered firm has $5000 in debt borrowed at an interest rate of 4%. More details are reported in the tables below.

| Unlevered | Levered |

Assets | $20,000 | $20,000 |

Debt | $0 | $5,000 |

Equity | $20,000 | $15,000 |

Debt/Equity Ratio | 0 | 5000/15000, or 1/3 |

Interest | n.a. | 4% |

Shares outstanding | 400 | 300 |

Share price | $50 | $50 |

| | |

| Unlevered | Levered |

EBIT | 1100 | 1100 |

EPS | $2.75 | $3.00 |

ROE | 5.5% | 6% |

Your grandpa has $400 invested in the leveredfirm, but he would like to have the same return as if he bought into the unlevered firm without actually investing in it. Assume grandpa can borrow and lend at the 4% interest rate without any restrictions.

- What would his strategy be? Borrow or lend? By how much? SHOW YOUR WORK.

- Follow the tables on either slide #24 or slide #27 (depending on your strategy from part 1), detail his strategy. SHOW YOUR WORK.

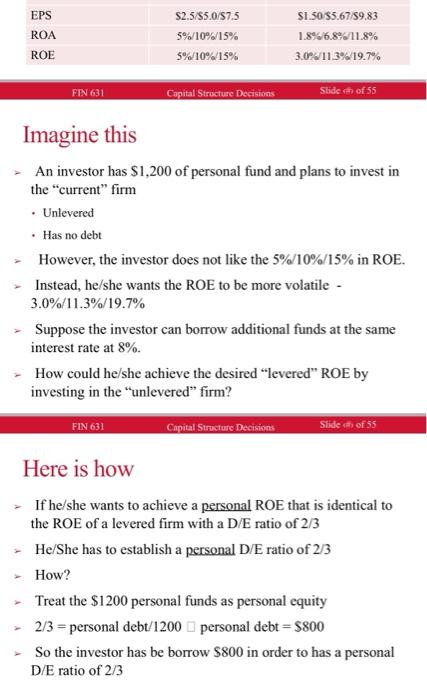

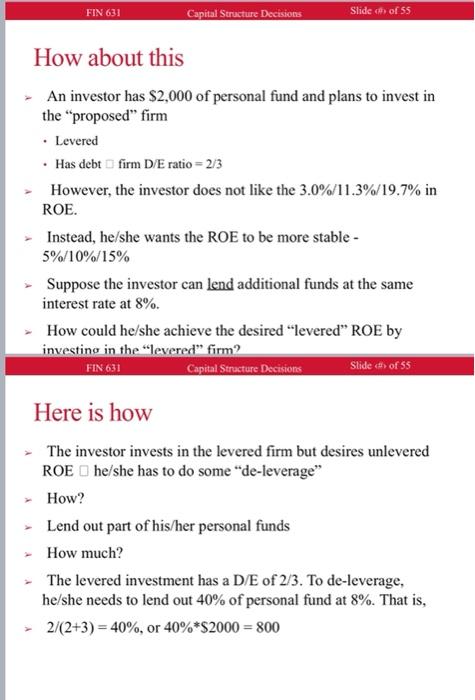

EPS ROA $2.5/85.0/57.5 5%/10%/15% 5%/10%/15 $1.50/55.67/89.83 1.8%36.8%/11.8% 3.0%/11.3%/19.7% ROE FIN 631 Capital Structure Decisions Slidech of 55 Imagine this An investor has $1,200 of personal fund and plans to invest in the "current" firm Unlevered Has no debt However, the investor does not like the 5%/10%/15% in ROE. Instead, he/she wants the ROE to be more volatile - 3.0%/11.3%/19.7% Suppose the investor can borrow additional funds at the same interest rate at 8%. How could he/she achieve the desired levered" ROE by investing in the "unlevered firm? FIN 631 Capital Structure Decisions Slide of 55 Here is how > If he/she wants to achieve a personal ROE that is identical to the ROE of a levered firm with a D/E ratio of 2/3 He/She has to establish a personal D/E ratio of 23 How? Treat the $1200 personal funds as personal equity 2/3 = personal debt/1200 personal debt = $800 So the investor has be borrow $800 in order to has a personal D/E ratio of 2/3 FIN 631 Capital Structure Decisions Slide of 55 How about this An investor has $2,000 of personal fund and plans to invest in the proposed" firm Levered Has debt firm D/E ratio = 2/3 However, the investor does not like the 3.0%/11.3%/19.7% in ROE. Instead, he/she wants the ROE to be more stable - 5%/10%/15% Suppose the investor can lend additional funds at the same interest rate at 8%. How could he/she achieve the desired "levered" ROE by investing in the "levered" firm? FIN 631 Capital Stracture Decisions Slide # of 55 Here is how The investor invests in the levered firm but desires unlevered ROE he/she has to do some "de-leverage" How? >Lend out part of his/her personal funds How much? The levered investment has a D/E of 2/3. To de-leverage, he/she needs to lend out 40% of personal fund at 8%. That is, > 2/(2+3)= 40%, or 40%*$2000 = 800 EPS ROA $2.5/85.0/57.5 5%/10%/15% 5%/10%/15 $1.50/55.67/89.83 1.8%36.8%/11.8% 3.0%/11.3%/19.7% ROE FIN 631 Capital Structure Decisions Slidech of 55 Imagine this An investor has $1,200 of personal fund and plans to invest in the "current" firm Unlevered Has no debt However, the investor does not like the 5%/10%/15% in ROE. Instead, he/she wants the ROE to be more volatile - 3.0%/11.3%/19.7% Suppose the investor can borrow additional funds at the same interest rate at 8%. How could he/she achieve the desired levered" ROE by investing in the "unlevered firm? FIN 631 Capital Structure Decisions Slide of 55 Here is how > If he/she wants to achieve a personal ROE that is identical to the ROE of a levered firm with a D/E ratio of 2/3 He/She has to establish a personal D/E ratio of 23 How? Treat the $1200 personal funds as personal equity 2/3 = personal debt/1200 personal debt = $800 So the investor has be borrow $800 in order to has a personal D/E ratio of 2/3 FIN 631 Capital Structure Decisions Slide of 55 How about this An investor has $2,000 of personal fund and plans to invest in the proposed" firm Levered Has debt firm D/E ratio = 2/3 However, the investor does not like the 3.0%/11.3%/19.7% in ROE. Instead, he/she wants the ROE to be more stable - 5%/10%/15% Suppose the investor can lend additional funds at the same interest rate at 8%. How could he/she achieve the desired "levered" ROE by investing in the "levered" firm? FIN 631 Capital Stracture Decisions Slide # of 55 Here is how The investor invests in the levered firm but desires unlevered ROE he/she has to do some "de-leverage" How? >Lend out part of his/her personal funds How much? The levered investment has a D/E of 2/3. To de-leverage, he/she needs to lend out 40% of personal fund at 8%. That is, > 2/(2+3)= 40%, or 40%*$2000 = 800