Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two firms have expected annual net operating income of $10,000 in perpetuity with identical operating conditions and business risk. Both firms are no-growth firms

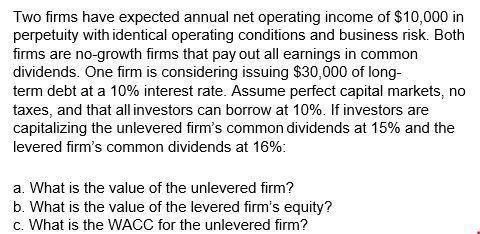

Two firms have expected annual net operating income of $10,000 in perpetuity with identical operating conditions and business risk. Both firms are no-growth firms that pay out all earnings in common dividends. One firm is considering issuing $30,000 of long- term debt at a 10% interest rate. Assume perfect capital markets, no taxes, and that all investors can borrow at 10%. If investors are capitalizing the unlevered firm's common dividends at 15% and the levered firm's common dividends at 16%: a. What is the value of the unlevered firm? b. What is the value of the levered firm's equity? c. What is the WACC for the unlevered firm?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets solve each part step by step a Value of the unlevered firm The value of the unlevered firm is t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started