Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your broker charges $0.0023 per share per trade. The exchange charges $0.0134 per share per trade for removing liquidity and credits $0.0116 per share

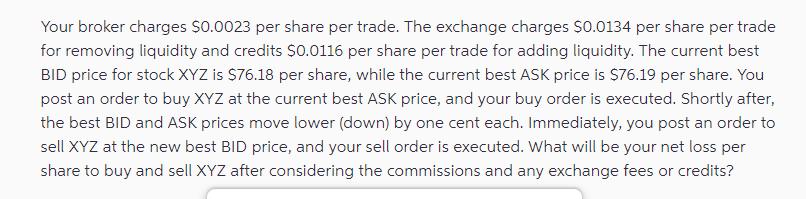

Your broker charges $0.0023 per share per trade. The exchange charges $0.0134 per share per trade for removing liquidity and credits $0.0116 per share per trade for adding liquidity. The current best BID price for stock XYZ is $76.18 per share, while the current best ASK price is $76.19 per share. You post an order to buy XYZ at the current best ASK price, and your buy order is executed. Shortly after, the best BID and ASK prices move lower (down) by one cent each. Immediately, you post an order to sell XYZ at the new best BID price, and your sell order is executed. What will be your net loss per share to buy and sell XYZ after considering the commissions and any exchange fees or credits?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the net loss per share after considering commissions and exchange feescredits we need to consider the following components Broker commiss...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started