Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two firms, which have zero marginal cost and no fixed cost, produce some good, each producing q; 0, ie {1, 2}. The demand for

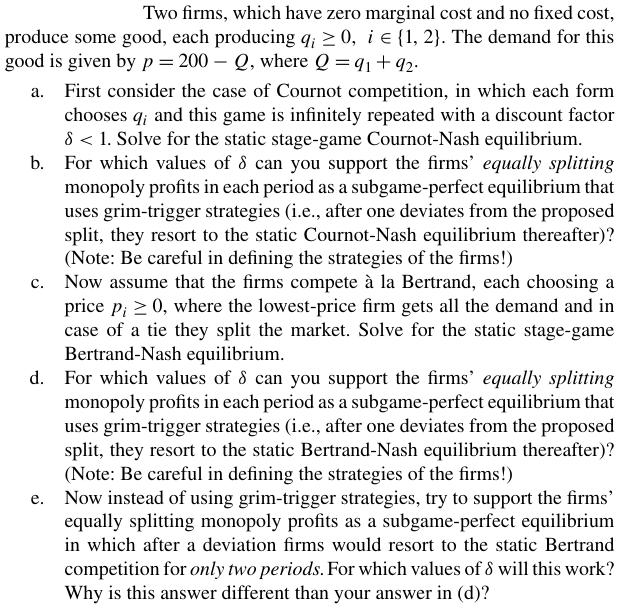

Two firms, which have zero marginal cost and no fixed cost, produce some good, each producing q; 0, ie {1, 2}. The demand for this good is given by p = 200-Q, where Q = 91 +92 a. First consider the case of Cournot competition, in which each form chooses q; and this game is infinitely repeated with a discount factor 8 < 1. Solve for the static stage-game Cournot-Nash equilibrium. b. For which values of 8 can you support the firms' equally splitting monopoly profits in each period as a subgame-perfect equilibrium that uses grim-trigger strategies (i.e., after one deviates from the proposed split, they resort to the static Cournot-Nash equilibrium thereafter)? (Note: Be careful in defining the strategies of the firms!) C. Now assume that the firms compete la Bertrand, each choosing a price p; 0, where the lowest-price firm gets all the demand and in case of a tie they split the market. Solve for the static stage-game Bertrand-Nash equilibrium. d. For which values of 8 can you support the firms' equally splitting monopoly profits in each period as a subgame-perfect equilibrium that uses grim-trigger strategies (i.e., after one deviates from the proposed split, they resort to the static Bertrand-Nash equilibrium thereafter)? (Note: Be careful in defining the strategies of the firms!) Now instead of using grim-trigger strategies, try to support the firms' equally splitting monopoly profits as a subgame-perfect equilibrium in which after a deviation firms would resort to the static Bertrand competition for only two periods. For which values of 8 will this work? Why is this answer different than your answer in (d)?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started