Answered step by step

Verified Expert Solution

Question

1 Approved Answer

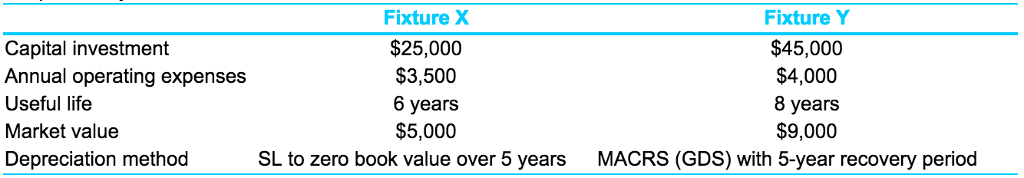

Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their comparison are summarized in the following table.

Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their comparison are summarized in the following table. The effective federal and state income tax rate is 50?%. Depreciation recapture is also taxed at 50?%. If the? after-tax MARR is 6?% per? year, which of the two fixtures should be? recommended? Assume repeatability.

Calculate the AW value for the Fixture X.

Calculate the AW value for the Fixture Y.

Based on the AW values, which ficture should be chosen?

Capital investment Annual operating expenses Useful life Market value Depreciation method SL to zero book value over 5 years MACRS (GDS) with 5-year recovery period Fixture $25,000 $3,500 6 years $5,000 Fixture Y $45,000 $4,000 8 years $9,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started