Answered step by step

Verified Expert Solution

Question

1 Approved Answer

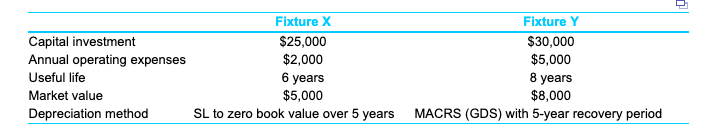

Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their comparison are summarized in the following table.

Two fixtures are being considered for a particular job in a manufacturing firm. The pertinent data for their comparison are summarized in the following table. The effective federal and state income tax rate is 35%. Depreciation recapture is also taxed at 35%. If the after-tax MARR is 10% per year, which of the two fixtures should be recommended? Assume repeatability.

Please use excel and get the correct answer! Thank you!

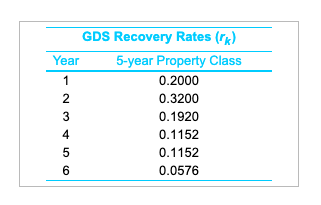

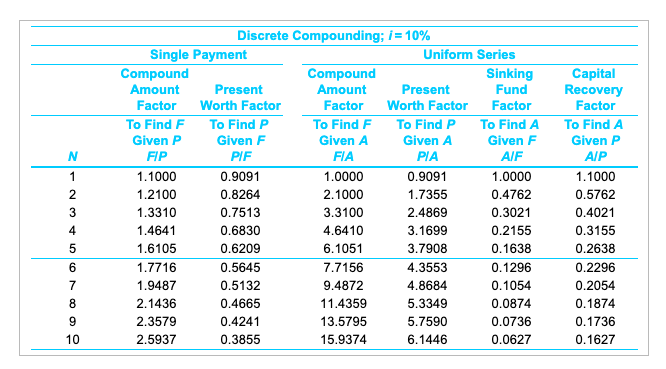

Fixture X $25,000 $2,000 6 years $5,000 Fixture Y $30,000 $5,000 8 years $8,000 Capital investment Annual operating expenses Useful life Market value Depreciation methodSL to zero book value over 5 years MACRS (GDS) with 5-year recovery period GDS Recovery Rates (rk) Year 5-year Property Class 0.2000 0.3200 0.1920 0.1152 0.1152 0.0576 4 Discrete Compounding; i-10 Single Payment Uniform Series Sinking Fund Factor To Find A Given F AIF 1.0000 0.4762 0.3021 0.2155 0.1638 0.1296 0.1054 0.0874 0.0736 0.0627 Compound Amount Compound Amount Factor To Find F Given A FIA 1.0000 2.1000 3.3100 4.6410 6.1051 7.7156 9.4872 11.4359 13.5795 15.9374 Capital Recovery Factor To Find A Given P AIP 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 Present Present Worth Factor To Find P Given A PIA 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 Factor Worth Factor To Find F Given P FIP 1.1000 1.2100 1.3310 1.4641 1.6105 1.7716 1.9487 2.1436 2.3579 2.5937 To Find P Given F PIF 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 4 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started