Question

Two friends (Mary and William) independently decided to establish separate consulting practices, and they have discussed sharing office space. While their consulting practices will be

Two friends (Mary and William) independently decided to establish separate consulting practices, and they have discussed sharing office space. While their consulting practices will be completely separate, they can both benefit from sharing the fixed costs of office space. Through an acquaintance, Mary learned of a very special opportunity to obtain office space in a prime location. The office suite includes three private offices and normally rents for $4,200 a month. The location is highly sought after. Mary was offered an opportunity to lease the space for $2,400 a month under a three-year lease. The discounted rent of $2,400 for a space that rents for $4,200 is the result of Mary being in the right place at the right time. The property is involved in a contentious family dispute and they were willing to take a lower rent from Mary in return for a three-year lease. Mary is not troubled by the three year term, relocation at the end of three years would not be a problem. Quick to take advantage of this extraordinary opportunity, Mary signed a three-year lease for this space. Now Mary needs to make arrangements to sublet the two offices she does not need. Under the terms of the lease, Mary is allowed to sublet offices to others at her discretion. However, Mary is personally responsible for paying the $2,400 monthly rental under the terms of the lease. After learning of Williams strong interest in sharing the space, Mary asked William for his thoughts on what to do with the third office. Pursuant to their conversation, Mary decided to mention the opportunity Griffin who is acquainted with both Mary and William. When approached, Griffin responded very positively because he also needs office space for a venture he intends to launch and three years is the ideal time frame for him. When Griffin came to view the vacant office space, he came with tape measure in hand. Griffin quickly determined that this could be a very good opportunity for him. Now, all they need to do is to come to terms regarding a financial agreement on how they will allocate the cost of the office rent. Mary and William met separately to discuss their respective positions on the allocation question. William suggested that they simply divide the $2,400 by three and then draw straws to decide who gets which office. Mary has observed that William, in general, seems willing to pay more if he can avoid potential conflicts. Mary said nothing, but she was stunned by Williams position. Mary believes she should benefit from her position as signatory on the lease. It is because of her efforts that the lease was secured at the highly advantageous rate of $2,400 per month, and she is the responsible party on the lease. Mary intends to take the largest office and because of the generous common space and the fact that only the largest and the smallest offices have windows, Mary regards the other two offices as interchangeable. Marys thinking is that each of the other two parties should pay $1,000 a month and she will pay the remaining balance of $400. In her view, this is more than fair to the other two because without the bargain lease she obtained, a monthly rental of $4,200 divided by 3 would come to $1,400 each. Thus, they each saved $400 per month. If William decides to claim the larger of the two remaining offices, because he was the first on-board, she will agree. After all, Griffin doesnt bring anything special to the party and his enthusiasm for an arrangement could indicate that he realizes being associated with Mary and William in the same suite will provide him with a halo effect. While Mary and William were silently reflecting on their respective positions in the negotiation, Griffin was busy reviewing his accounting text book. Griffin observed that the three private offices share common space that includes a reception area, a small kitchen, and a rest room. Also, each private office is a different size. After some serious thought, Griffin concluded that a two-stage allocation would be appropriate (Griffin felt certain this scheme would make his accounting professor very proud of his work).

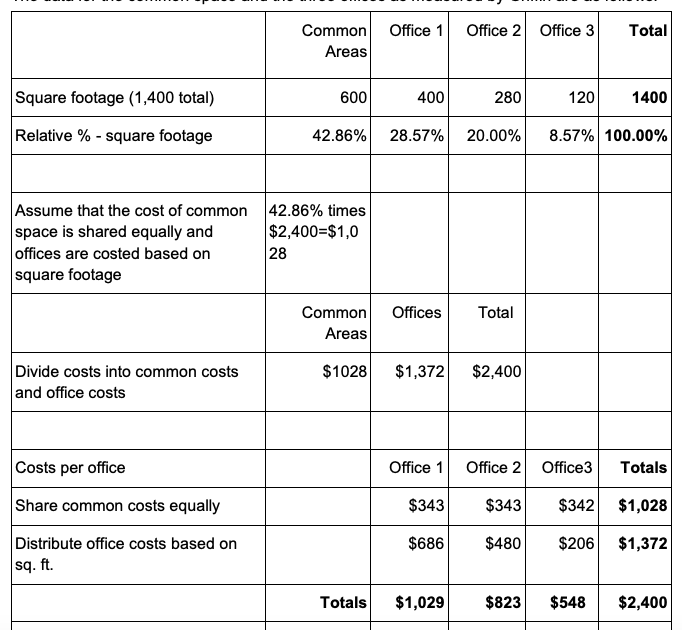

The data for the common space and the three offices as measured by Griffin are as follows:

Questions to Answer Mary, William, and Griffin have scheduled a meeting to present their proposals. William plans to propose that they each pay $800 and draw straws for offices. Mary plans to propose that Griffin and William should each pay $1,000 and she will take the largest office (she will let William deal with the question of who gets the remaining offices). Griffin has determined that while an association with Mary and William will be very beneficial for his new consulting practice, he really does not need a big office (especially in light of his weak cash position). Thus, Griffin will propose that he take Office 3 for $548 and that Mary and William take the other two offices with the understanding that the costs will be allocated according to the table that Griffin has prepared ($1,029 and $823). Thus there are three different answers to the question: how should the costs of the office space be allocated? In a negotiation, the decision made by the parties to the negotiation becomes by mutual agreement their right answer.

Required:

1. Provide three short statements to defend each of the three different approaches presented by Mary, William, and Griffin.

2. Mary has the decision rights. After thinking back to the start of the negotiation, Mary regrets that she made the mistake telling William and Griffin that she obtained the $4,200 space at a below market rate of $2,400 by bragging that she was quick to take advantage of a good thing when she saw it. If she had it to do over, she would not have disclosed the financial terms of her lease arrangement. However, the market for office space is very competitive and if Mary does not make an arrangement with William and/or Griffin, she will not make that mistake in the next negotiation. Do you expect Mary to agree with Griffins rationale for allocating the costs? Do you expect Mary to accept Griffins offer of $548 per month? Explain fully.

Office 1 Office 2 Office 3 Total Common Areas Square footage (1,400 total) 600 400 280 120 1400 Relative % - square footage 42.86% 28.57% 20.00% 8.57% 100.00% Assume that the cost of common 42.86% times space is shared equally and $2,400=$1,0 offices are costed based on 28 square footage Offices Total Common Areas $1028 $1,372 $2,400 Divide costs into common costs and office costs Costs per office Office 1 Office 2 Office3 Totals Share common costs equally $343 $343 $342 $1,028 Distribute office costs based on $686 $480 $206 $1,372 sq. ft. Totals $1,029 $823 $548 $2, $2,400 Office 1 Office 2 Office 3 Total Common Areas Square footage (1,400 total) 600 400 280 120 1400 Relative % - square footage 42.86% 28.57% 20.00% 8.57% 100.00% Assume that the cost of common 42.86% times space is shared equally and $2,400=$1,0 offices are costed based on 28 square footage Offices Total Common Areas $1028 $1,372 $2,400 Divide costs into common costs and office costs Costs per office Office 1 Office 2 Office3 Totals Share common costs equally $343 $343 $342 $1,028 Distribute office costs based on $686 $480 $206 $1,372 sq. ft. Totals $1,029 $823 $548 $2, $2,400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started