Question

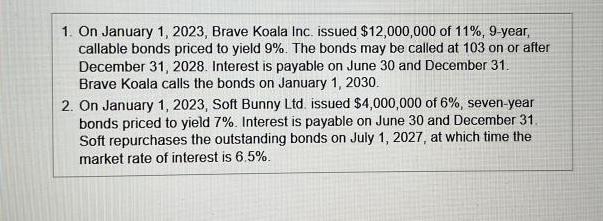

Two independent situations follow. (Click the icon to view the independent situations.). 1. On January 1, 2023, Brave Koala Inc. issued $12,000,000 of 11%,

![]()

Two independent situations follow. (Click the icon to view the independent situations.). 1. On January 1, 2023, Brave Koala Inc. issued $12,000,000 of 11%, 9-year, callable bonds priced to yield 9%. The bonds may be called at 103 on or after December 31, 2028. Interest is payable on June 30 and December 31. Brave Koala calls the bonds on January 1, 2030. 2. On January 1, 2023, Soft Bunny Ltd. issued $4,000,000 of 6%, seven-year bonds priced to yield 7%. Interest is payable on June 30 and December 31. Soft repurchases the outstanding bonds on July 1, 2027, at which time the market rate of interest is 6.5%. Prepare journal entries to record the sale and retirement of the bonds in scenario 1. (Use a financial calculator for any present value computations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting Volume 2

Authors: Kin Lo, George Fisher

4th Edition

0135220491, 9780135220498

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App