Answered step by step

Verified Expert Solution

Question

1 Approved Answer

two individual questions . Question 2. (15 marks) Intergalactic Software Company went public three months ago. You are a sophisticated investor who devotes time to

two individual questions

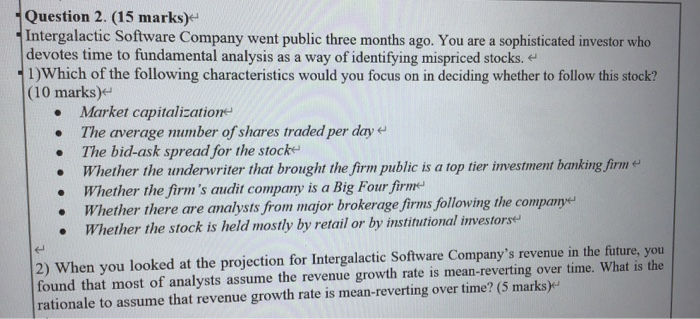

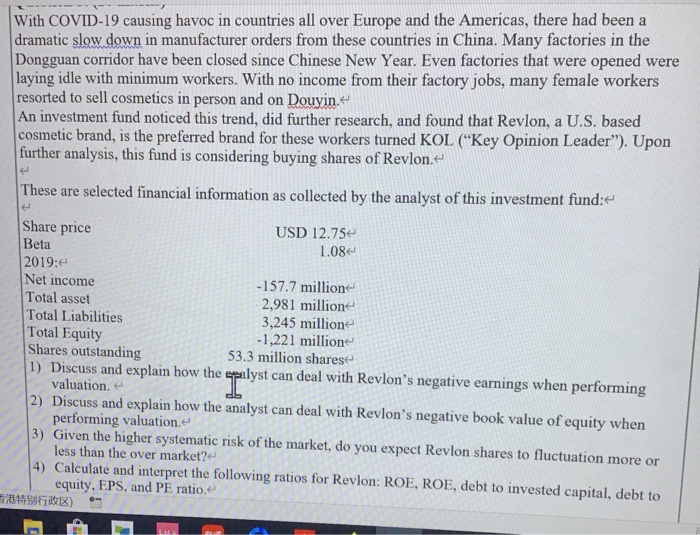

. Question 2. (15 marks) Intergalactic Software Company went public three months ago. You are a sophisticated investor who devotes time to fundamental analysis as a way of identifying mispriced stocks. 1) Which of the following characteristics would you focus on in deciding whether to follow this stock? (10 marks) Market capitalization The average number of shares traded per day The bid-ask spread for the stock Whether the underwriter that brought the firm public is a top tier investment banking firm Whether the firm's audit company is a Big Four firme Whether there are analysts from major brokerage firms following the company Whether the stock is held mostly by retail or by institutional investors . 2) When you looked at the projection for Intergalactic Software Company's revenue in the future, you found that most of analysts assume the revenue growth rate is mean-reverting over time. What is the rationale to assume that revenue growth rate is mean-reverting over time? (5 marks) With COVID-19 causing havoc in countries all over Europe and the Americas, there had been a dramatic slow down in manufacturer orders from these countries in China. Many factories in the Dongguan corridor have been closed since Chinese New Year. Even factories that were opened were laying idle with minimum workers. With no income from their factory jobs, many female workers resorted to sell cosmetics in person and on Douyin. An investment fund noticed this trend, did further research, and found that Revlon, a U.S. based cosmetic brand, is the preferred brand for these workers turned KOL ("Key Opinion Leader"). Upon further analysis, this fund is considering buying shares of Revlon. These are selected financial information as collected by the analyst of this investment fund: Share price USD 12.75 Beta 1.08 2019: Net income - 157.7 million Total asset 2,981 millione Total Liabilities 3,245 million Total Equity -1,221 million Shares outstanding 53.3 million sharese 1) Discuss and explain how the spalyst can deal with Revlon's negative earnings when performing valuation 2) Discuss and explain how the analyst can deal with Revlon's negative book value of equity when performing valuation 3) Given the higher systematic risk of the market, do you expect Revlon shares to fluctuation more or less than the over market? 4) Calculate and interpret the following ratios for Revlon: ROE, ROE, debt to invested capital, debt to equity, EPS, and PE ratio. 1891) Talyst Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started