Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two individuals own land and lease the land to a tenant. The tenant pays all taxes, utility bills, and other assessments relating to the land.

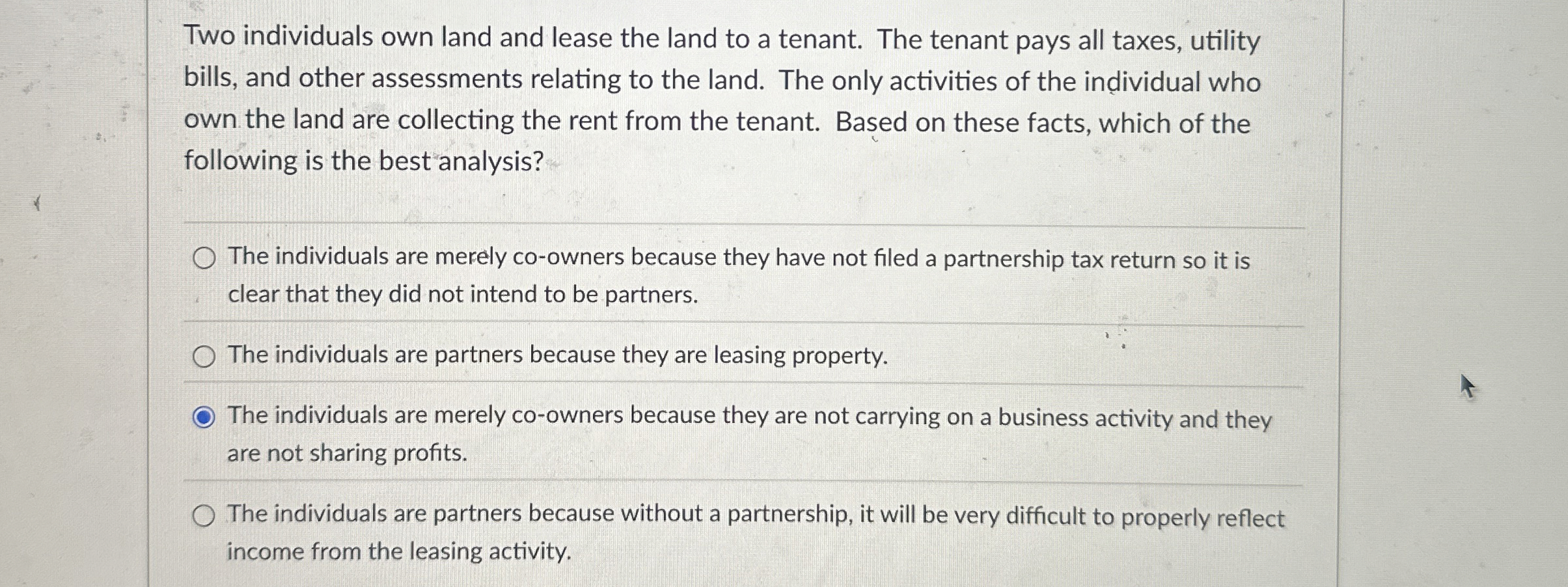

Two individuals own land and lease the land to a tenant. The tenant pays all taxes, utility

bills, and other assessments relating to the land. The only activities of the individual who

own the land are collecting the rent from the tenant. Based on these facts, which of the

following is the best analysis?

The individuals are merely coowners because they have not filed a partnership tax return so it is

clear that they did not intend to be partners.

The individuals are partners because they are leasing property.

The individuals are merely coowners because they are not carrying on a business activity and they

are not sharing profits.

The individuals are partners because without a partnership, it will be very difficult to properly reflect

income from the leasing activity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started