Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two institutions plain to issue $10 million in debt and are negotiating an interest rate swap that will help them lower their borrowing costs

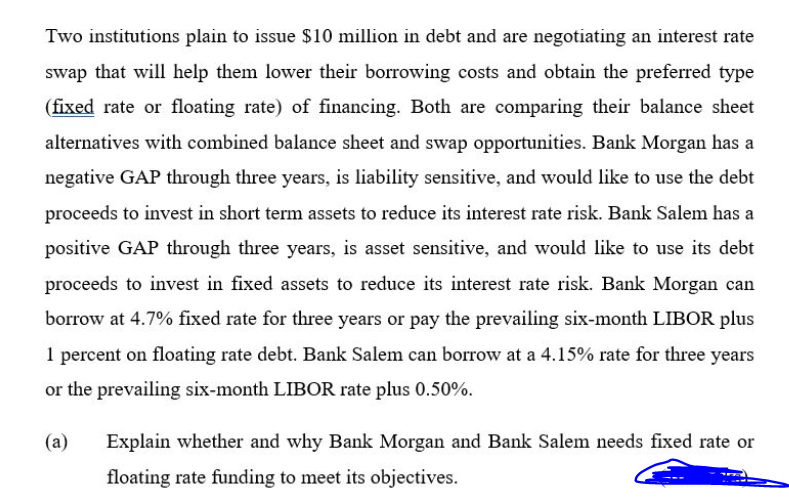

Two institutions plain to issue $10 million in debt and are negotiating an interest rate swap that will help them lower their borrowing costs and obtain the preferred type (fixed rate or floating rate) of financing. Both are comparing their balance sheet alternatives with combined balance sheet and swap opportunities. Bank Morgan has a negative GAP through three years, is liability sensitive, and would like to use the debt proceeds to invest in short term assets to reduce its interest rate risk. Bank Salem has a positive GAP through three years, is asset sensitive, and would like to use its debt proceeds to invest in fixed assets to reduce its interest rate risk. Bank Morgan can borrow at 4.7% fixed rate for three years or pay the prevailing six-month LIBOR plus 1 percent on floating rate debt. Bank Salem can borrow at a 4.15% rate for three years or the prevailing six-month LIBOR rate plus 0.50%. (a) Explain whether and why Bank Morgan and Bank Salem needs fixed rate or floating rate funding to meet its objectives.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Bank Morgan with a negative GAP and being liability sensitive would benefit from fixedrate funding Heres why 1 Liability Sensitivity Bank Morgan is co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started