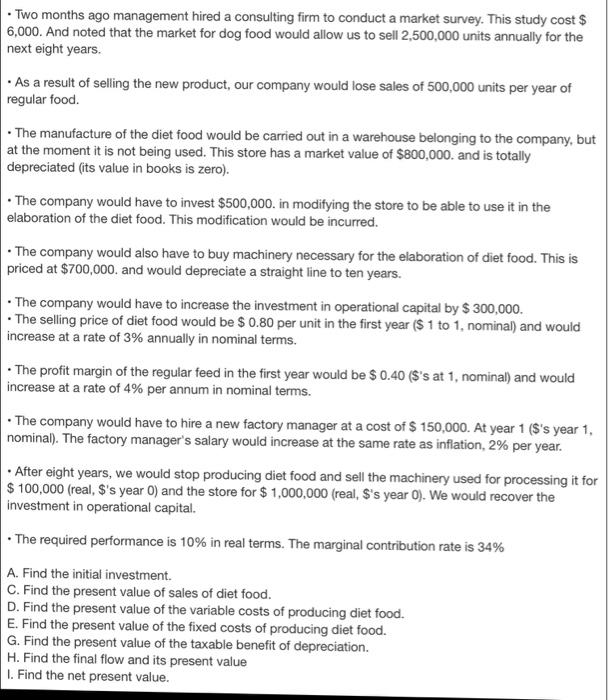

Two months ago management hired a consulting firm to conduct a market survey. This study cost $ 6,000. And noted that the market for dog food would allow us to sell 2, 500,000 units annually for the next eight years. As a result of selling the new product, our company would lose sales of 500.000 units per year of regular food. The manufacture of the diet food would be carried out in a warehouse belonging to the company, but at the moment it is not being used. This store has a market value of $800,000. and is totally depreciated (its value in books is zero). The company would have to invest $500,000. in modifying the store to be able to use it in the elaboration of the diet food. This modification would be incurred. The company would also have to buy machinery necessary for the elaboration of diet food. This is priced at $700,000. and would depreciate a straight line to ten years. The company would have to increase the investment in operational capital by $ 300,000. The selling price of diet food would be $ 0.80 per unit in the first year ($ 1 to 1. nominal) and would increase at a rate of 3% annually in nominal terms. The profit margin of the regular feed in the first year would be $ 0.40 ($'s at 1. nominal) and would increase at a rate of 4% per annum in nominal terms. The company would have to hire a new factory manager at a cost of $ 150,000. At year 1 ($'s year 1. nominal). The factory manager s salary would increase at the same rate as inflation, 2% per year. After eight years, we would stop producing diet food and sell the machinery used for processing it for $ 100,000 (real. $'s year 0) and the store for $ 1,000,000 (real, $'s year 0). We would recover the investment in operational capital. The required performance is 10% in real terms. The marginal contribution rate is 34% Find the initial investment. Find the present value of sales of diet food. Find the present value of the variable costs of producing diet food. Find the present value of the fixed costs of producing diet food. Find the present value of the taxable benefit of depreciation. Find the final flow and its present value Find the net present value