Answered step by step

Verified Expert Solution

Question

1 Approved Answer

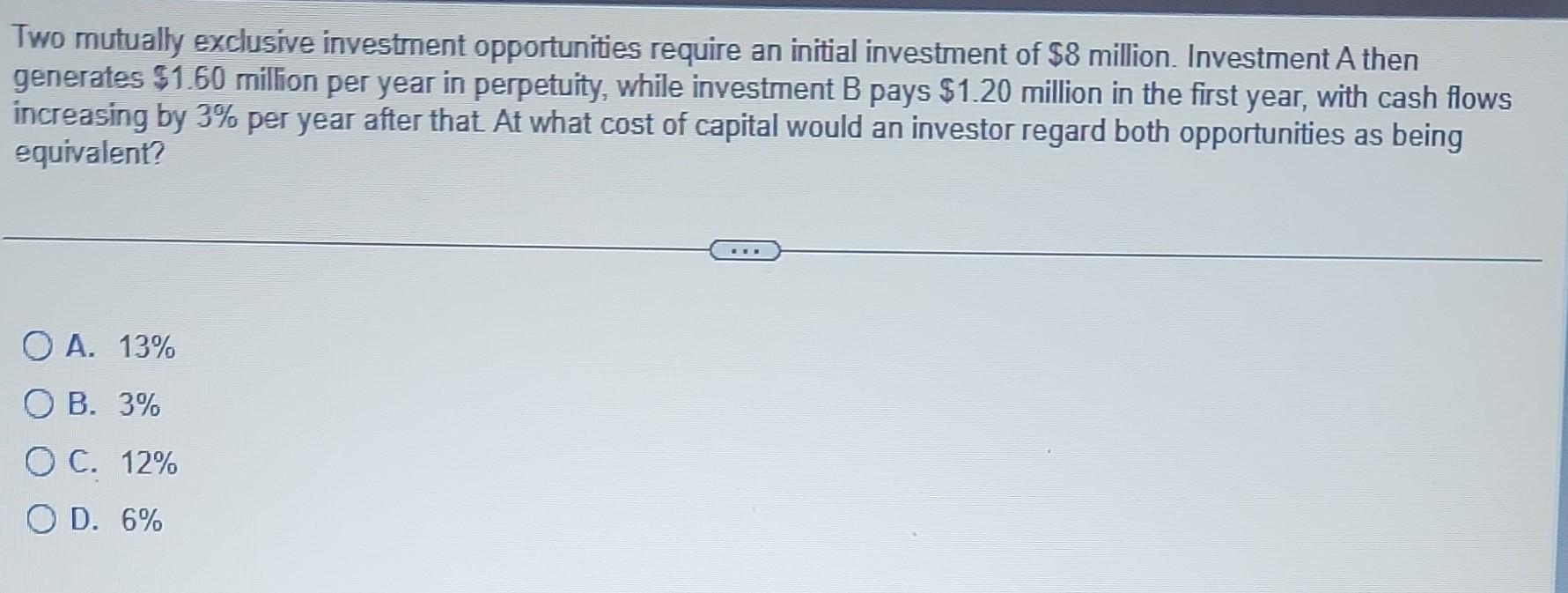

Two mutually exclusive investment opportunities require an initial investment of $8 million. Investment A then generates $1.60 million per year in perpetuity, while investment B

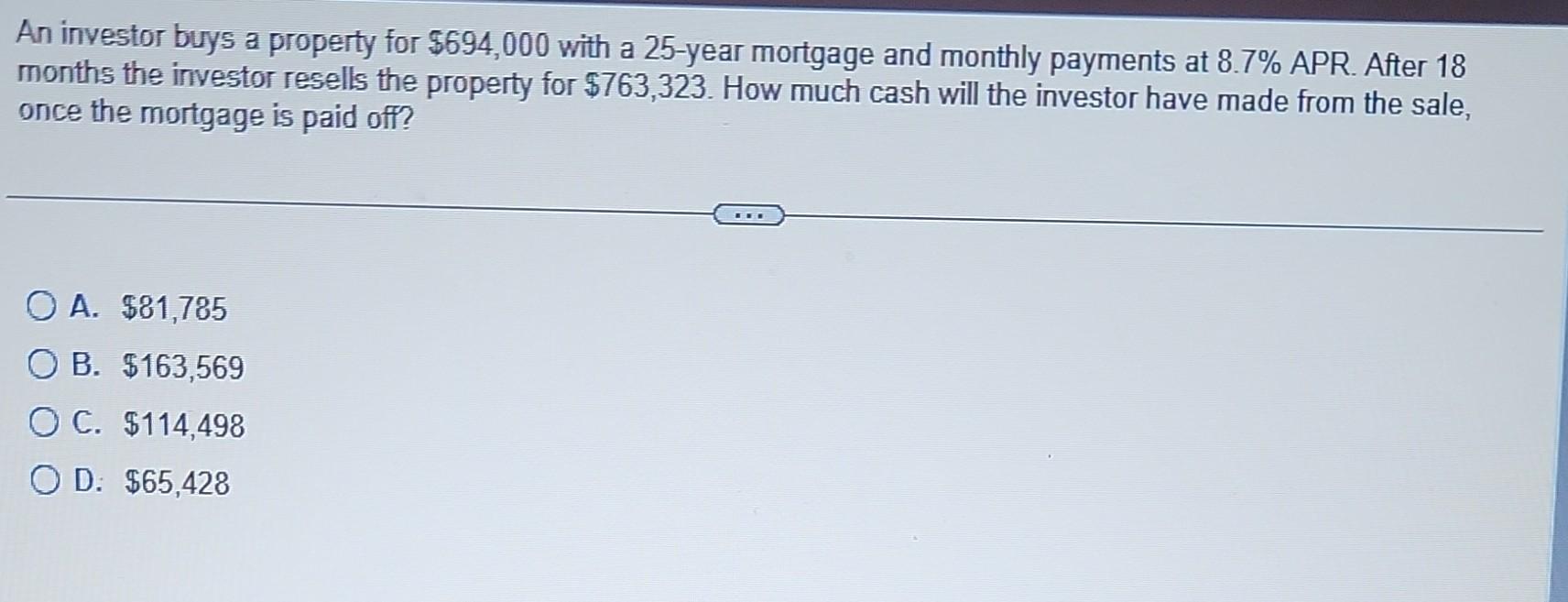

Two mutually exclusive investment opportunities require an initial investment of $8 million. Investment A then generates $1.60 million per year in perpetuity, while investment B pays $1.20 million in the first year, with cash flows increasing by 3% per year after that At what cost of capital would an investor regard both opportunities as being equivalent? A. 13% B. 3% C. 12% D. 6% An investor buys a property for $694,000 with a 25 -year mortgage and monthly payments at 8.7% APR. After 18 months the investor resells the property for $763,323. How much cash will the investor have made from the sale, once the mortgage is paid off? A. $81,785 B. $163,569 C. $114,498 D. $65,428

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started