Answered step by step

Verified Expert Solution

Question

1 Approved Answer

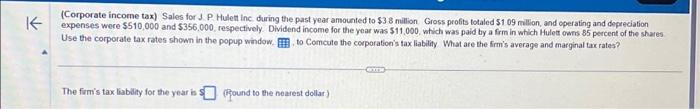

two other questions follow in this problem they are: the firm's average tax rate?_% the firm's marginal tax rate?_% (Corporate income tax) Sales for J.

two other questions follow in this problem they are: the firm's average tax rate?_%

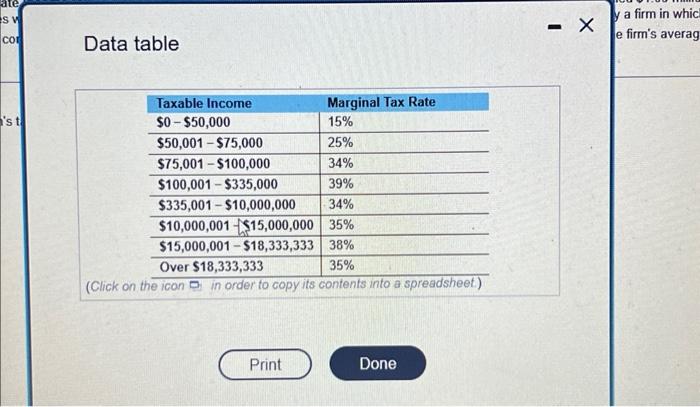

(Corporate income tax) Sales for J. P. Hulett inc during the past year amounted to $38 million. Gross profits totaled $109 million, and operating and depreciation expenses were $510,000 and $356,000, respectively. Dividend income for the year was $11,000, which was paid by a frm in which Hulet owms 85 percent of the shares. Use the corporate tax rates shown in the popup window. , to Comcute the corporation's tax liablity What are the frrm's average and marginal tax rates? cos The firmis tax liablity for the year is: (Ppound to the nearest dollar) Data table the firm's marginal tax rate?_%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started