Question

Two plans have been proposed for a high speed passenger rail line between Cincinnati and Cleveland. The plans are summarized in the table below. Costs

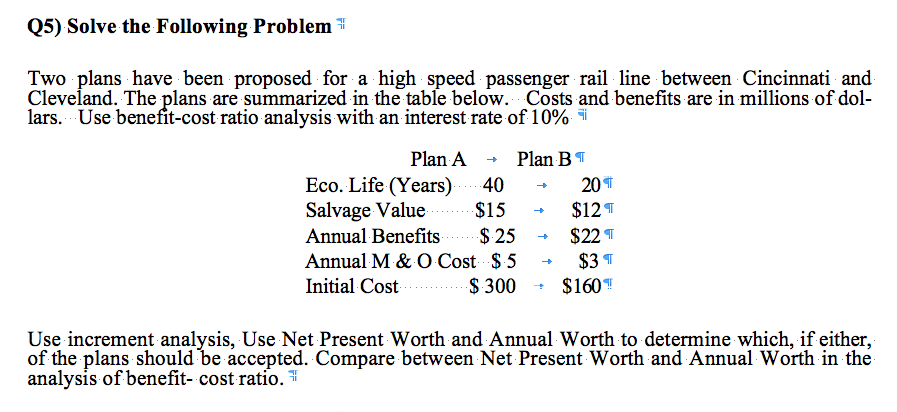

Two plans have been proposed for a high speed passenger rail line between Cincinnati and Cleveland. The plans are summarized in the table below. Costs and benefits are in millions of dollars. Use benefit-cost ratio analysis with an interest rate of 10%

Plan A Plan B

Eco. Life (Years) 40 20

Salvage Value $15 $12

Annual Benefits $ 25 $22

Annual M & O Cost $ 5 $3

Initial Cost $ 300 $160

Use increment analysis, Use Net Present Worth and Annual Worth to determine which, if either, of the plans should be accepted. Compare between Net Present Worth and Annual Worth in the analysis of benefit- cost ratio.

Please read the questions carefully. Please draw the cash flow diagrams and explain the steps that you are going to approach to solve the problems then solve the problem. Show the details in solving the problems.

Use equation for example; P= A (P/A,i,n) + G(P/G,i,n), do not use other equations or exel to solve it. Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started