Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two questions need to be figured outAppreciate One of our client companies, EA Community Laundry Chain, asked us for a consultation on their company's operations.

Two questions need to be figured outAppreciate

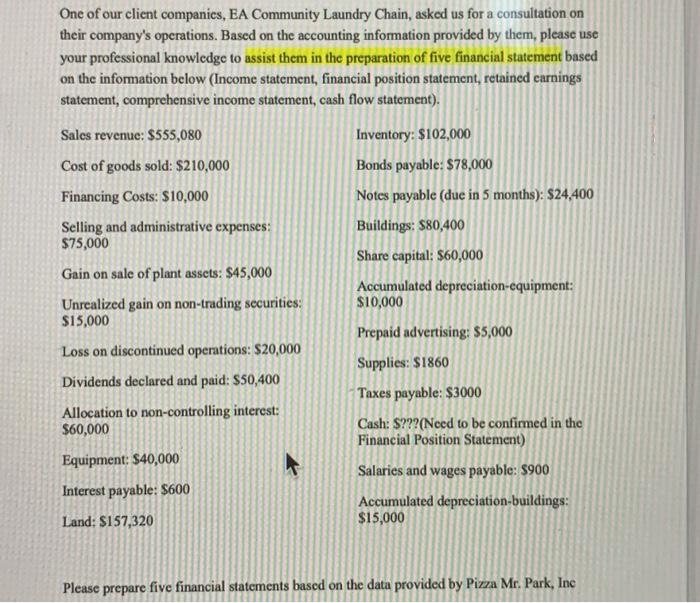

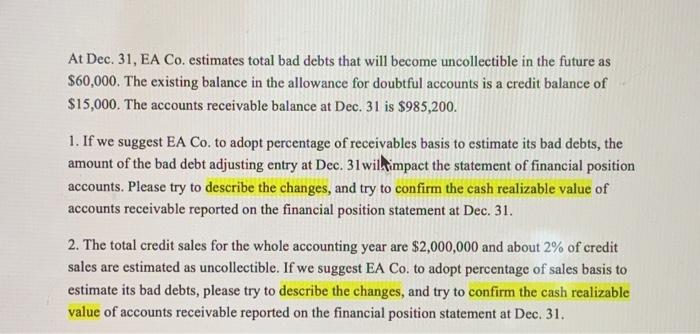

One of our client companies, EA Community Laundry Chain, asked us for a consultation on their company's operations. Based on the accounting information provided by them, please use your professional knowledge to assist them in the preparation of five financial statement based on the information below (Income statement, financial position statement, retained earnings statement, comprehensive income statement, cash flow statement). Sales revenue: $555,080 Inventory: $102,000 Cost of goods sold: $210,000 Bonds payable: $78,000 Financing Costs: $10,000 Notes payable (due in 5 months): $24,400 Selling and administrative expenses: $75,000 Buildings: $80,400 Share capital: $60,000 Gain on sale of plant assets: $45,000 Accumulated depreciation-equipment: $10,000 Unrealized gain on non-trading securities: $15,000 Prepaid advertising: $5,000 Loss on discontinued operations: $20,000 Supplies: $1860 Dividends declared and paid: $50,400 Taxes payable: $3000 Allocation to non-controlling interest: $60,000 Cash: $???(Need to be confirmed in the Financial Position Statement) Equipment: $40,000 Salaries and wages payable: $900 Interest payable: $600 Accumulated depreciation-buildings: $15,000 Land: $157,320 Please prepare five financial statements based on the data provided by Pizza Mr. Park, Inc At Dec. 31, EA Co. estimates total bad debts that will become uncollectible in the future as $60,000. The existing balance in the allowance for doubtful accounts is a credit balance of $15,000. The accounts receivable balance at Dec. 31 is $985,200. 1. If we suggest EA Co. to adopt percentage of receivables basis to estimate its bad debts, the amount of the bad debt adjusting entry at Dec. 31 wil impact the statement of financial position accounts. Please try to describe the changes, and try to confirm the cash realizable value of accounts receivable reported on the financial position statement at Dec. 31. 2. The total credit sales for the whole accounting year are $2,000,000 and about 2% of credit sales are estimated as uncollectible. If we suggest EA Co. to adopt percentage of sales basis to estimate its bad debts, please try to describe the changes, and try to confirm the cash realizable value of accounts receivable reported on the financial position statement at Dec. 31

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started