Two Separate problems.

Q#5 & Q#6

Thank You!

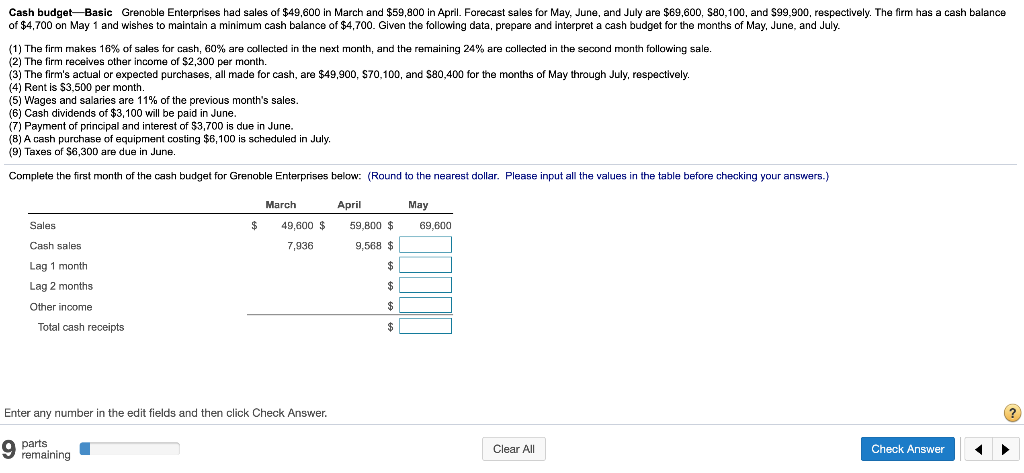

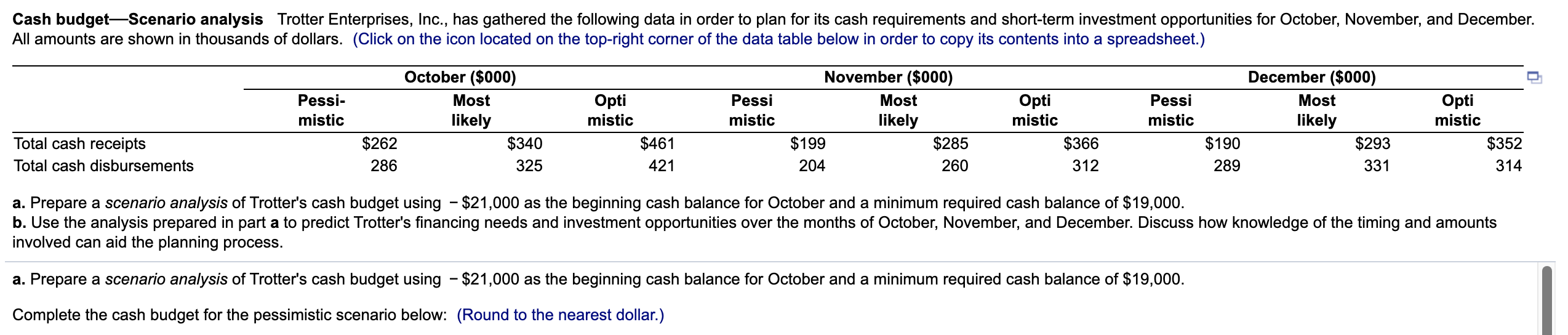

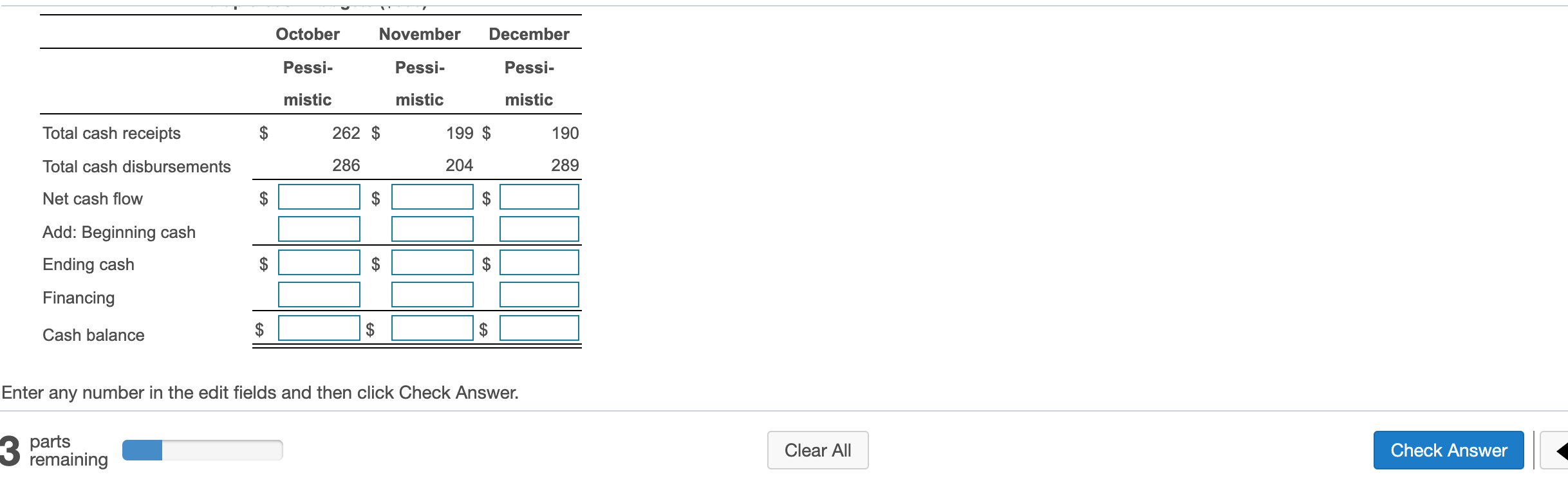

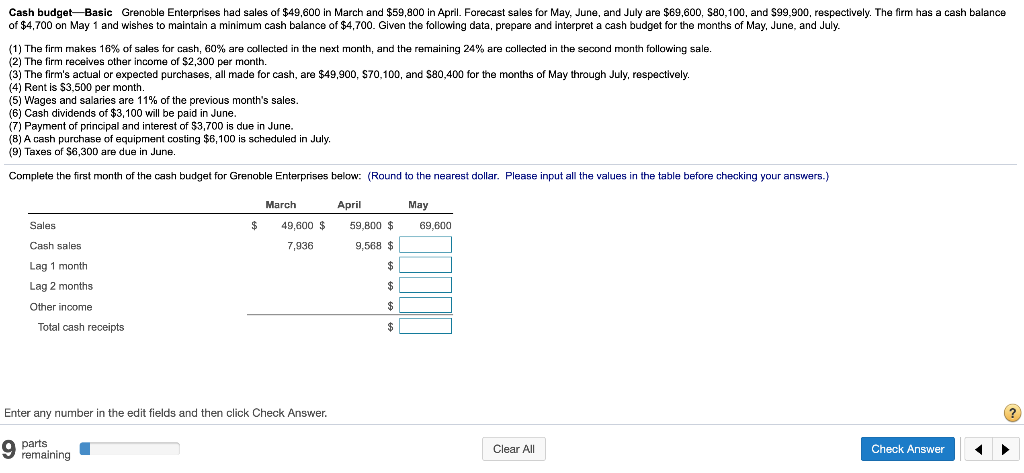

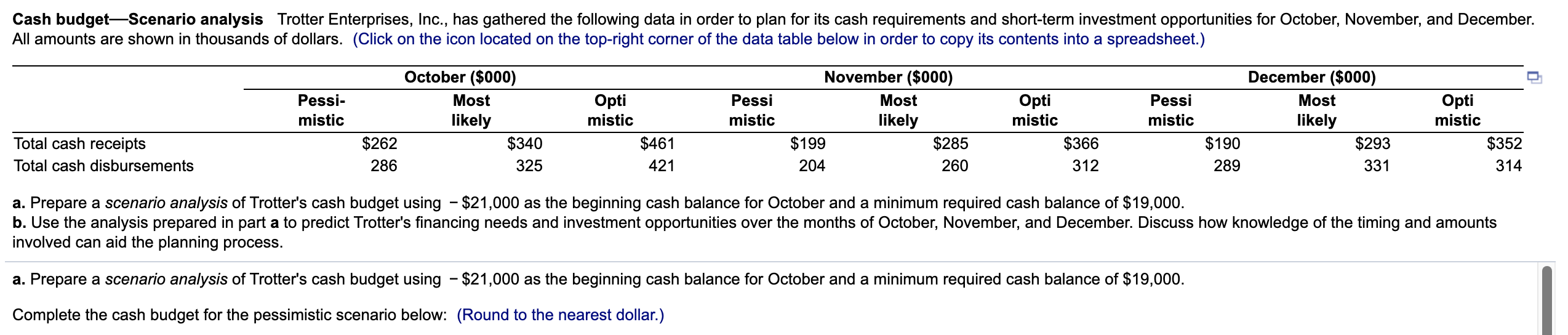

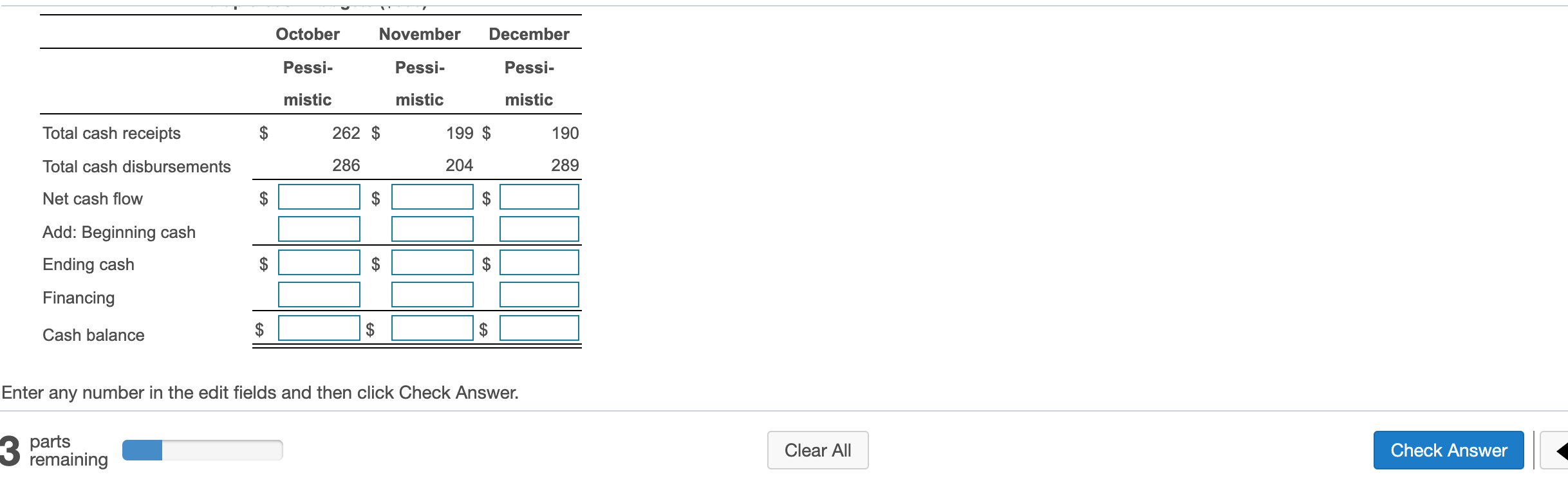

Cash budgetBasic Grenoble Enterprises had sales of $49,600 in March and $59,800 in April. Forecast sales for May, June, and July are $69,600, S80,100, and $99,900, respectively. The firm has a cash balance of $4,700 on May 1 and wishes to maintain a minimum cash balance of $4,700. Given the following data, prepare and interpret a cash budget for the months of May, June, and July. (1) The firm makes 16% of sales for cash, 60% are collected in the next month, and the remaining 24% are collected in the second month following sale. (2) The firm receives other income of $2,300 per month. (3) The firm's actual or expected purchases, all made for cash, are $49,900, S70,100, and $80,400 for the months of May through July, respectively. (4) Rent is $3,500 per month. (5) Wages and salaries are 11% of the previous month's sales. (6) Cash dividends of $3,100 will be paid in June. (7) Payment of principal and interest of $3,700 is due in June. (8) A cash purchase of equipment costing $6,100 is scheduled in July, (9) Taxes of $6,300 are due in June. Complete the first month of the cash budget for Grenoble Enterprises below: (Round to the nearest dollar. Please input all the values in the table before checking your answers.) March April May 69,600 Sales 49,600 $ 59,800 $ Cash sales 7,936 9,568 $ $ Lag 1 month Lag 2 months $ Other income Total cash receipts $ Enter any number in the edit fields and then click Check Answer. ? parts remaining Clear All Check Answer Cash budgetScenario analysis Trotter Enterprises, Inc., has gathered the following data in order to plan for its cash requirements and short-term investment opportunities for October, November, and December. All amounts are shown in thousands of dollars. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Pessi- mistic October ($000) Most likely $262 $340 286 325 Pessi mistic November ($000) Most likely $199 $285 204 260 Opti mistic $461 421 Pessi mistic Opti mistic $366 312 December ($000) Most likely $190 $293 289 331 Opti mistic $352 314 Total cash receipts Total cash disbursements a. Prepare a scenario analysis of Trotter's cash budget using - $21,000 as the beginning cash balance for October and a minimum required cash balance of $19,000. b. Use the analysis prepared in part a to predict Trotter's financing needs and investment opportunities over the months of October, November, and December. Discuss how knowledge of the timing and amounts involved can aid the planning process. a. Prepare a scenario analysis of Trotter's cash budget using - $21,000 as the beginning cash balance for October and a minimum required cash balance of $19,000. Complete the cash budget for the pessimistic scenario below: (Round to the nearest dollar.) October November December Pessi- Pessi- Pessi- mistic mistic mistic Total cash receipts $ 262 $ 199 $ 190 Total cash disbursements 286 204 289 Net cash flow $ Add: Beginning cash Ending cash $ TA $ Financing Cash balance Enter any number in the edit fields and then click Check Answer. 3 parts remaining Clear All Check