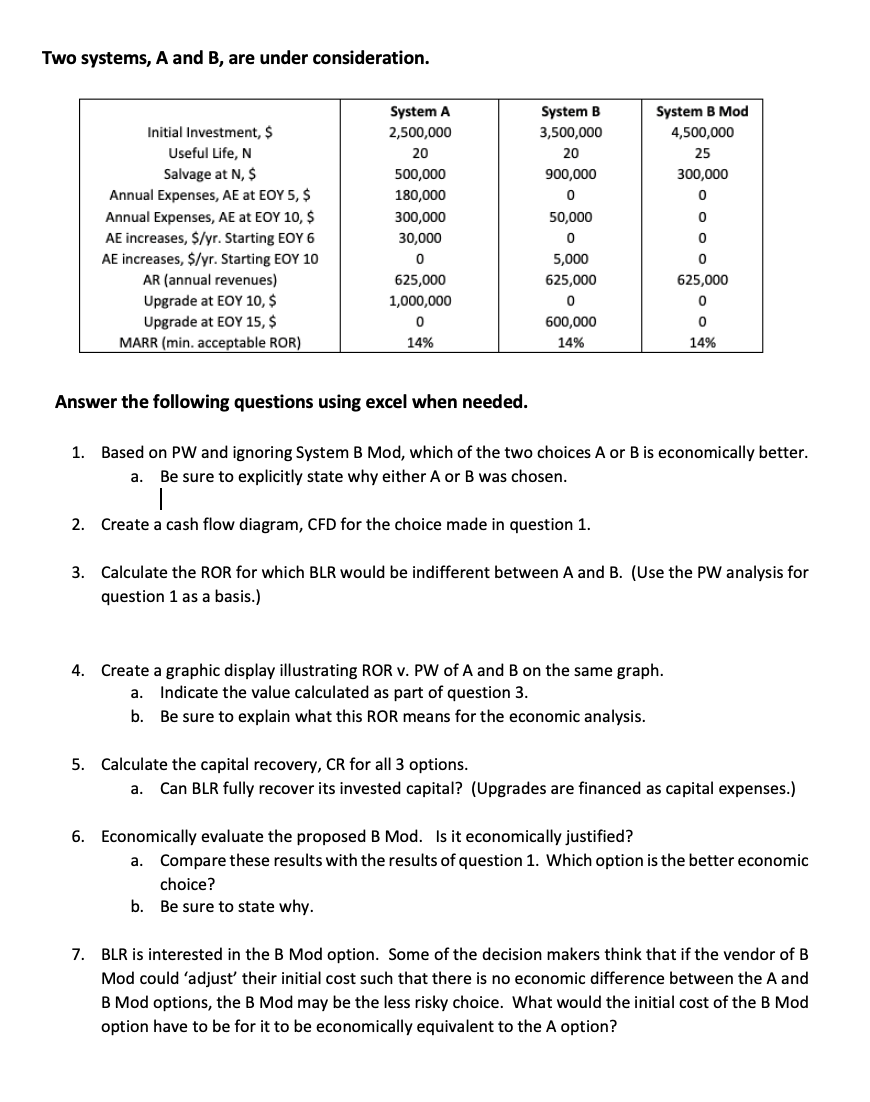

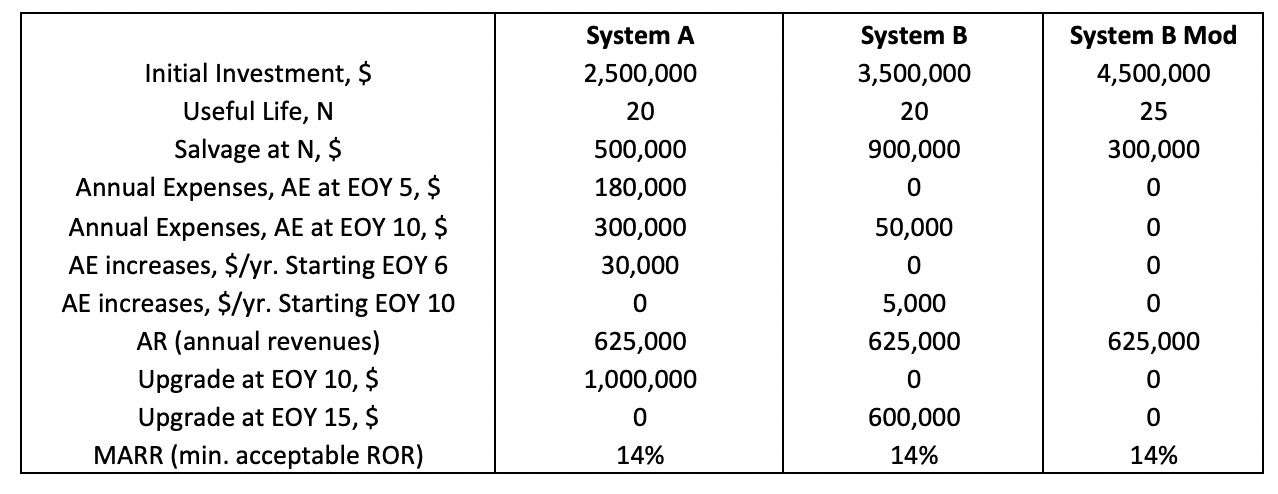

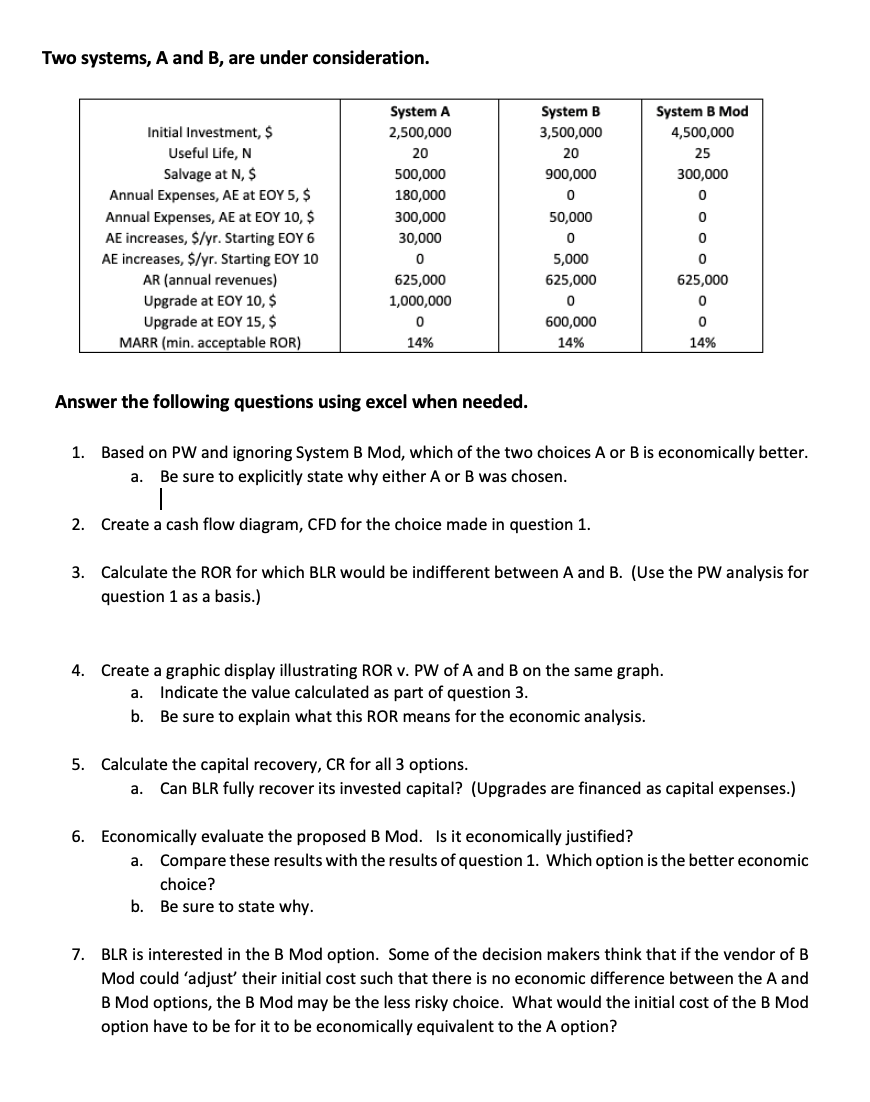

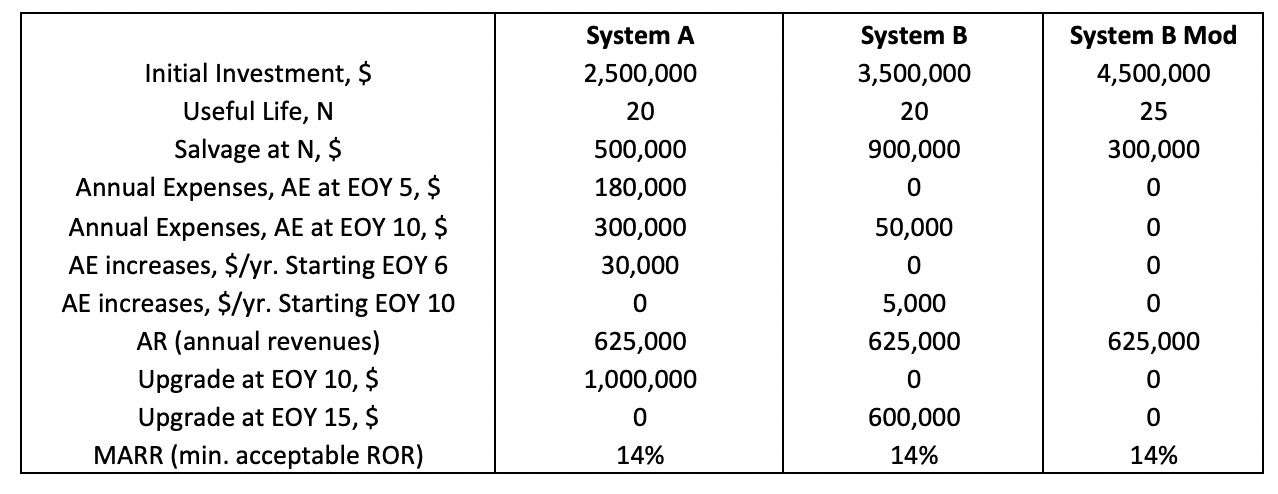

Two systems, A and B, are under consideration. Answer the following questions using excel when needed. 1. Based on PW and ignoring System B Mod, which of the two choices A or B is economically better. a. Be sure to explicitly state why either A or B was chosen. 2. Create a cash flow diagram, CFD for the choice made in question 1. 3. Calculate the ROR for which BLR would be indifferent between A and B. (Use the PW analysis for question 1 as a basis.) 4. Create a graphic display illustrating ROR v. PW of A and B on the same graph. a. Indicate the value calculated as part of question 3. b. Be sure to explain what this ROR means for the economic analysis. 5. Calculate the capital recovery, CR for all 3 options. a. Can BLR fully recover its invested capital? (Upgrades are financed as capital expenses.) 6. Economically evaluate the proposed B Mod. Is it economically justified? a. Compare these results with the results of question 1 . Which option is the better economic choice? b. Be sure to state why. 7. BLR is interested in the B Mod option. Some of the decision makers think that if the vendor of B Mod could 'adjust' their initial cost such that there is no economic difference between the A and B Mod options, the B Mod may be the less risky choice. What would the initial cost of the B Mod option have to be for it to be economically equivalent to the A option? \begin{tabular}{|c|c|c|c|} \hline & System A & System B & System B Mod \\ Initial Investment, \$ & 2,500,000 & 3,500,000 & 4,500,000 \\ Useful Life, N & 20 & 20 & 25 \\ Salvage at N, \$ & 500,000 & 900,000 & 300,000 \\ Annual Expenses, AE at EOY 5, \$ & 180,000 & 0 & 0 \\ Annual Expenses, AE at EOY 10, \$ & 300,000 & 50,000 & 0 \\ AE increases, \$/yr. Starting EOY 6 & 30,000 & 0 & 0 \\ AE increases, \$/yr. Starting EOY 10 & 0 & 5,000 & 0 \\ AR (annual revenues) & 625,000 & 625,000 & 625,000 \\ Upgrade at EOY 10, \$ & 1,000,000 & 0 & 0 \\ Upgrade at EOY 15, \$ & 0 & 600,000 & 0 \\ MARR (min. acceptable ROR) & 14% & 14% & 14% \\ \hline \end{tabular} Two systems, A and B, are under consideration. Answer the following questions using excel when needed. 1. Based on PW and ignoring System B Mod, which of the two choices A or B is economically better. a. Be sure to explicitly state why either A or B was chosen. 2. Create a cash flow diagram, CFD for the choice made in question 1. 3. Calculate the ROR for which BLR would be indifferent between A and B. (Use the PW analysis for question 1 as a basis.) 4. Create a graphic display illustrating ROR v. PW of A and B on the same graph. a. Indicate the value calculated as part of question 3. b. Be sure to explain what this ROR means for the economic analysis. 5. Calculate the capital recovery, CR for all 3 options. a. Can BLR fully recover its invested capital? (Upgrades are financed as capital expenses.) 6. Economically evaluate the proposed B Mod. Is it economically justified? a. Compare these results with the results of question 1 . Which option is the better economic choice? b. Be sure to state why. 7. BLR is interested in the B Mod option. Some of the decision makers think that if the vendor of B Mod could 'adjust' their initial cost such that there is no economic difference between the A and B Mod options, the B Mod may be the less risky choice. What would the initial cost of the B Mod option have to be for it to be economically equivalent to the A option? \begin{tabular}{|c|c|c|c|} \hline & System A & System B & System B Mod \\ Initial Investment, \$ & 2,500,000 & 3,500,000 & 4,500,000 \\ Useful Life, N & 20 & 20 & 25 \\ Salvage at N, \$ & 500,000 & 900,000 & 300,000 \\ Annual Expenses, AE at EOY 5, \$ & 180,000 & 0 & 0 \\ Annual Expenses, AE at EOY 10, \$ & 300,000 & 50,000 & 0 \\ AE increases, \$/yr. Starting EOY 6 & 30,000 & 0 & 0 \\ AE increases, \$/yr. Starting EOY 10 & 0 & 5,000 & 0 \\ AR (annual revenues) & 625,000 & 625,000 & 625,000 \\ Upgrade at EOY 10, \$ & 1,000,000 & 0 & 0 \\ Upgrade at EOY 15, \$ & 0 & 600,000 & 0 \\ MARR (min. acceptable ROR) & 14% & 14% & 14% \\ \hline \end{tabular}