Answered step by step

Verified Expert Solution

Question

1 Approved Answer

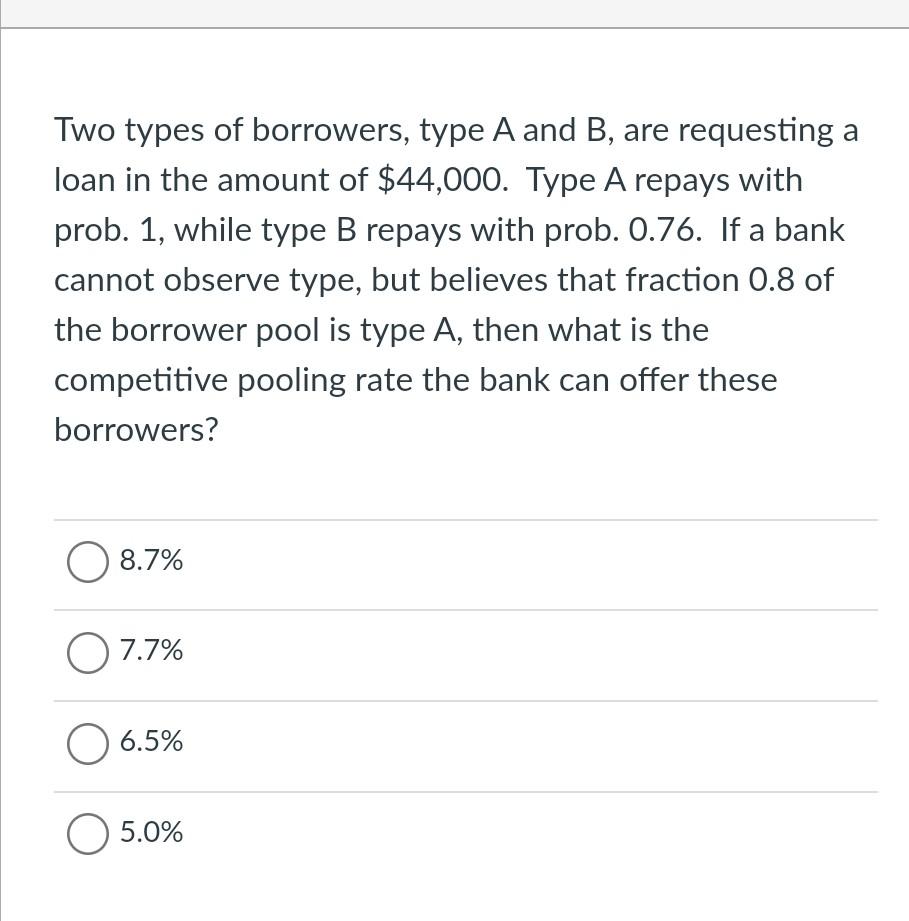

Two types of borrowers, type A and B, are requesting a loan in the amount of $44,000. Type A repays with prob. 1, while type

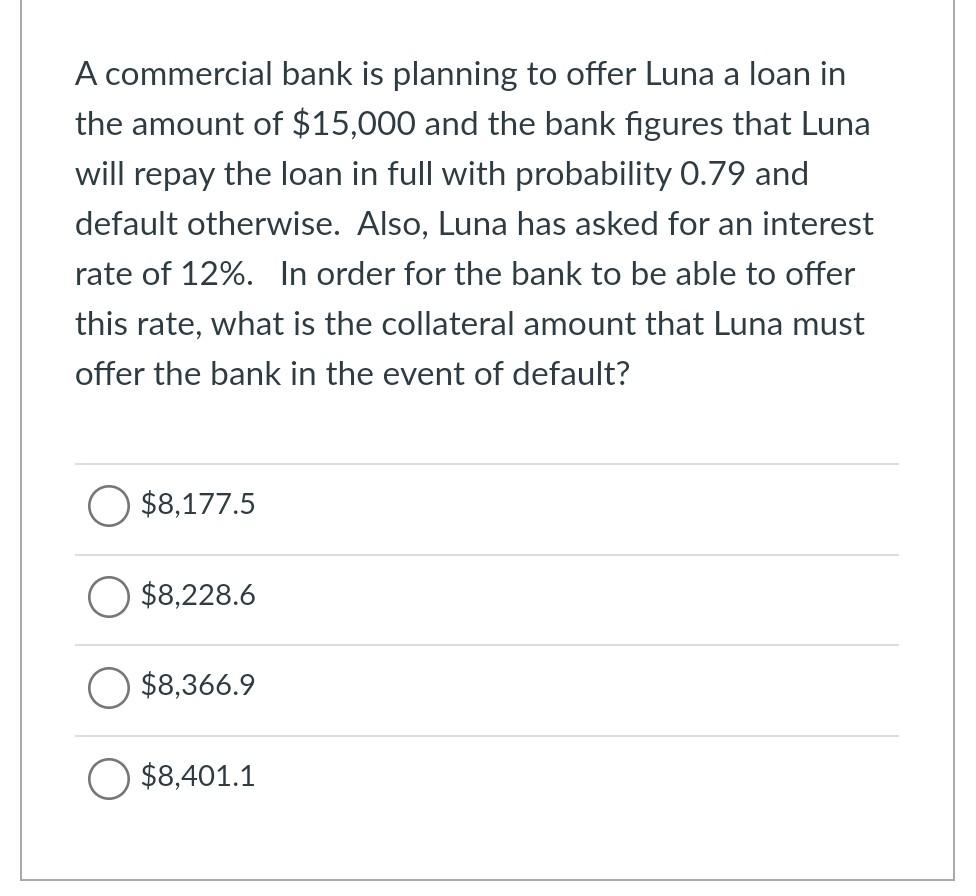

Two types of borrowers, type A and B, are requesting a loan in the amount of $44,000. Type A repays with prob. 1, while type B repays with prob. 0.76. If a bank cannot observe type, but believes that fraction 0.8 of the borrower pool is type A, then what is the competitive pooling rate the bank can offer these borrowers? O 8.7% O 7.7% 06.5% 05.0% A commercial bank is planning to offer Luna a loan in the amount of $15,000 and the bank figures that Luna will repay the loan in full with probability 0.79 and default otherwise. Also, Luna has asked for an interest rate of 12%. In order for the bank to be able to offer this rate, what is the collateral amount that Luna must offer the bank in the event of default? $8,177.5 $8,228.6 $8,366.9 O $8,40

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started