Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two years ago a company issued $10 million in bonds with a face value of $1,000 and a maturity of 10 years. The company is

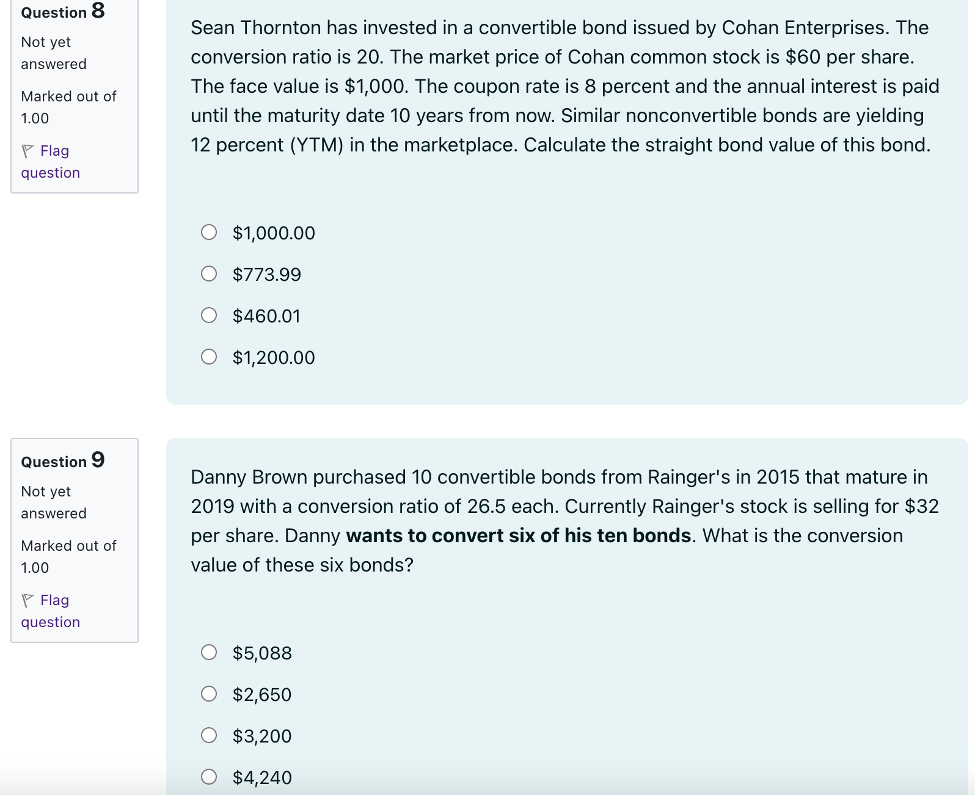

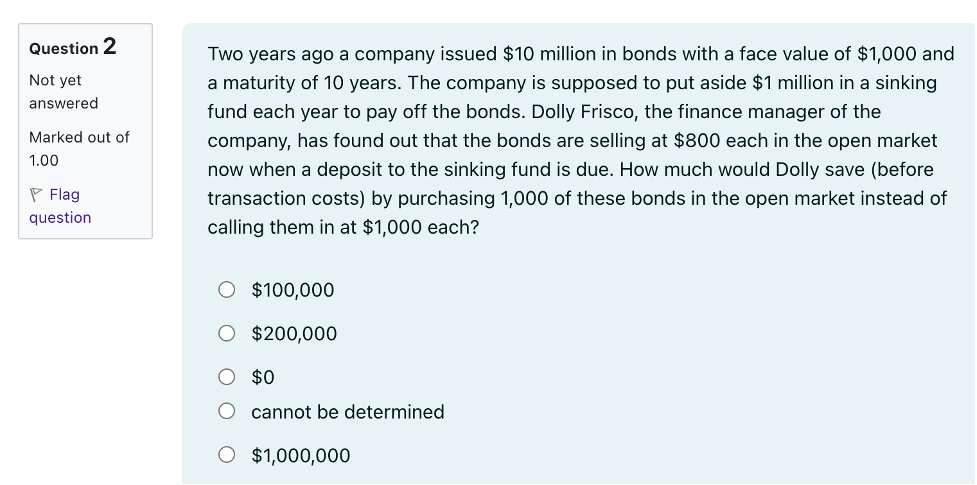

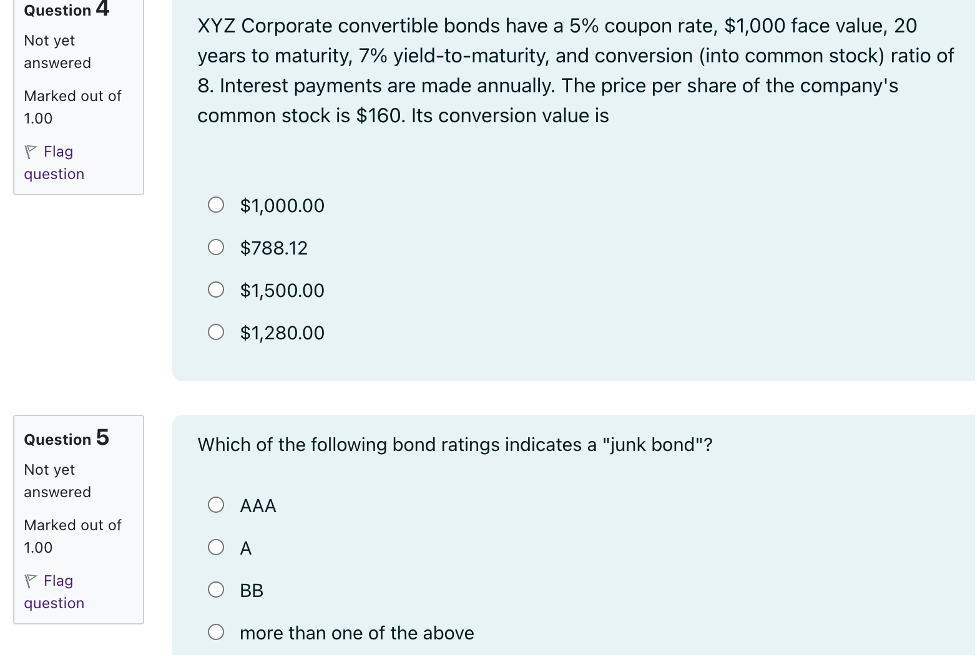

Two years ago a company issued $10 million in bonds with a face value of $1,000 and a maturity of 10 years. The company is supposed to put aside $1 million in a sinking fund each year to pay off the bonds. Dolly Frisco, the finance manager of the company, has found out that the bonds are selling at \$800 each in the open market now when a deposit to the sinking fund is due. How much would Dolly save (before transaction costs) by purchasing 1,000 of these bonds in the open market instead of calling them in at $1,000 each? $100,000 $200,000 $0 cannot be determined $1,000,000 XYZ Corporate convertible bonds have a 5% coupon rate, $1,000 face value, 20 years to maturity, 7% yield-to-maturity, and conversion (into common stock) ratio of 8. Interest payments are made annually. The price per share of the company's common stock is $160. Its conversion value is $1,000.00 $788.12 $1,500.00 $1,280.00 Which of the following bond ratings indicates a "junk bond"? AAA A BB more than one of the above Sean Thornton has invested in a convertible bond issued by Cohan Enterprises. The conversion ratio is 20 . The market price of Cohan common stock is $60 per share. The face value is $1,000. The coupon rate is 8 percent and the annual interest is paid until the maturity date 10 years from now. Similar nonconvertible bonds are yielding 12 percent (YTM) in the marketplace. Calculate the straight bond value of this bond. $1,000.00 $773.99 $460.01 $1,200.00 Danny Brown purchased 10 convertible bonds from Rainger's in 2015 that mature in 2019 with a conversion ratio of 26.5 each. Currently Rainger's stock is selling for $32 per share. Danny wants to convert six of his ten bonds. What is the conversion value of these six bonds? $5,088 $2,650 $3,200 $4,240

Two years ago a company issued $10 million in bonds with a face value of $1,000 and a maturity of 10 years. The company is supposed to put aside $1 million in a sinking fund each year to pay off the bonds. Dolly Frisco, the finance manager of the company, has found out that the bonds are selling at \$800 each in the open market now when a deposit to the sinking fund is due. How much would Dolly save (before transaction costs) by purchasing 1,000 of these bonds in the open market instead of calling them in at $1,000 each? $100,000 $200,000 $0 cannot be determined $1,000,000 XYZ Corporate convertible bonds have a 5% coupon rate, $1,000 face value, 20 years to maturity, 7% yield-to-maturity, and conversion (into common stock) ratio of 8. Interest payments are made annually. The price per share of the company's common stock is $160. Its conversion value is $1,000.00 $788.12 $1,500.00 $1,280.00 Which of the following bond ratings indicates a "junk bond"? AAA A BB more than one of the above Sean Thornton has invested in a convertible bond issued by Cohan Enterprises. The conversion ratio is 20 . The market price of Cohan common stock is $60 per share. The face value is $1,000. The coupon rate is 8 percent and the annual interest is paid until the maturity date 10 years from now. Similar nonconvertible bonds are yielding 12 percent (YTM) in the marketplace. Calculate the straight bond value of this bond. $1,000.00 $773.99 $460.01 $1,200.00 Danny Brown purchased 10 convertible bonds from Rainger's in 2015 that mature in 2019 with a conversion ratio of 26.5 each. Currently Rainger's stock is selling for $32 per share. Danny wants to convert six of his ten bonds. What is the conversion value of these six bonds? $5,088 $2,650 $3,200 $4,240 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started