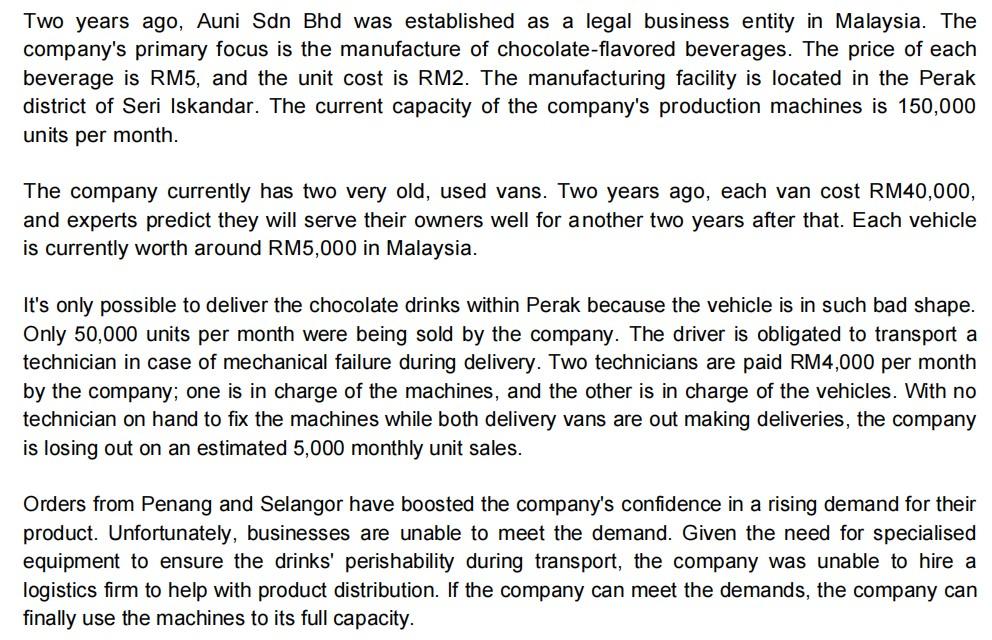

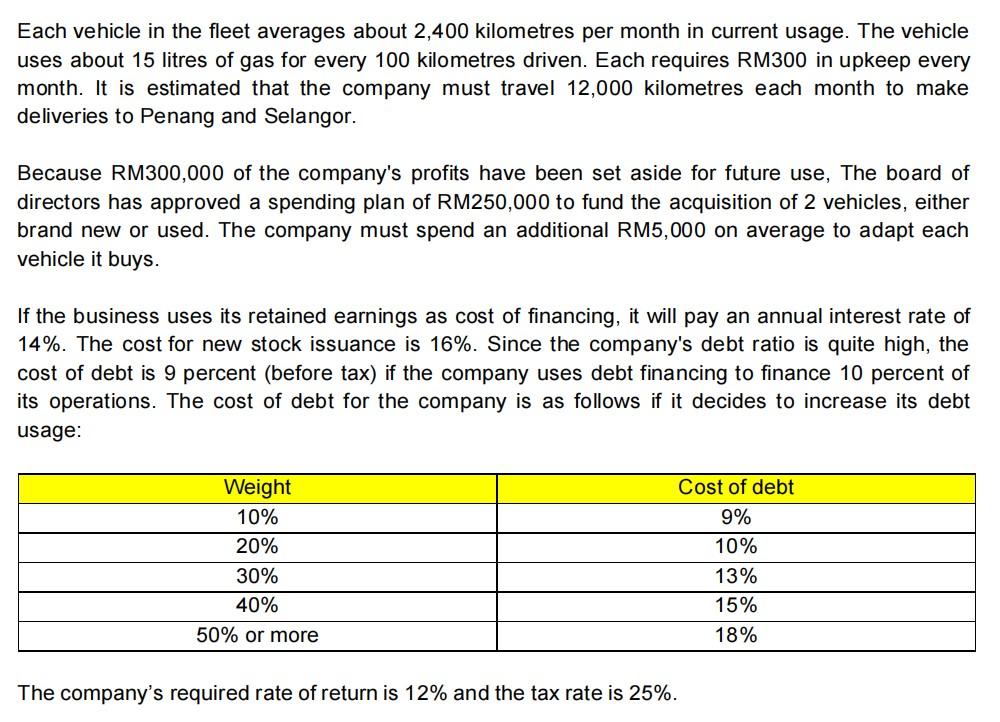

Two years ago, Auni Sdn Bhd was established as a legal business entity in Malaysia. The company's primary focus is the manufacture of chocolate-flavored beverages. The price of each beverage is RM5, and the unit cost is RM2. The manufacturing facility is located in the Perak district of Seri Iskandar. The current capacity of the company's production machines is 150,000 units per month. The company currently has two very old, used vans. Two years ago, each van cost RM40,000, and experts predict they will serve their owners well for another two years after that. Each vehicle is currently worth around RM5,000 in Malaysia. It's only possible to deliver the chocolate drinks within Perak because the vehicle is in such bad shape. Only 50,000 units per month were being sold by the company. The driver is obligated to transport a technician in case of mechanical failure during delivery. Two technicians are paid RM4,000 per month by the company; one is in charge of the machines, and the other is in charge of the vehicles. With no technician on hand to fix the machines while both delivery vans are out making deliveries, the company is losing out on an estimated 5,000 monthly unit sales. Orders from Penang and Selangor have boosted the company's confidence in a rising demand for their product. Unfortunately, businesses are unable to meet the demand. Given the need for specialised equipment to ensure the drinks' perishability during transport, the company was unable to hire a logistics firm to help with product distribution. If the company can meet the demands, the company can finally use the machines to its full capacity. Each vehicle in the fleet averages about 2,400 kilometres per month in current usage. The vehicle uses about 15 litres of gas for every 100 kilometres driven. Each requires RM300 in upkeep every month. It is estimated that the company must travel 12,000 kilometres each month to make deliveries to Penang and Selangor. Because RM300,000 of the company's profits have been set aside for future use, The board of directors has approved a spending plan of RM250,000 to fund the acquisition of 2 vehicles, either brand new or used. The company must spend an additional RM5,000 on average to adapt each vehicle it buys. If the business uses its retained earnings as cost of financing, it will pay an annual interest rate of 14%. The cost for new stock issuance is 16%. Since the company's debt ratio is quite high, the cost of debt is 9 percent (before tax) if the company uses debt financing to finance 10 percent of its operations. The cost of debt for the company is as follows if it decides to increase its debt usage: The company's required rate of return is 12% and the tax rate is 25%. Required: 1. Suggest 2 options of vehicles to be purchased by the company. [25marks] 2. Use capital budgeting techniques (payback period and NPV) to decide whether the to invest or not to invest for both options. Decide the best option. [60 marks ] 3. Calculate the optimal capital structure for the company. [15 marks ] Two years ago, Auni Sdn Bhd was established as a legal business entity in Malaysia. The company's primary focus is the manufacture of chocolate-flavored beverages. The price of each beverage is RM5, and the unit cost is RM2. The manufacturing facility is located in the Perak district of Seri Iskandar. The current capacity of the company's production machines is 150,000 units per month. The company currently has two very old, used vans. Two years ago, each van cost RM40,000, and experts predict they will serve their owners well for another two years after that. Each vehicle is currently worth around RM5,000 in Malaysia. It's only possible to deliver the chocolate drinks within Perak because the vehicle is in such bad shape. Only 50,000 units per month were being sold by the company. The driver is obligated to transport a technician in case of mechanical failure during delivery. Two technicians are paid RM4,000 per month by the company; one is in charge of the machines, and the other is in charge of the vehicles. With no technician on hand to fix the machines while both delivery vans are out making deliveries, the company is losing out on an estimated 5,000 monthly unit sales. Orders from Penang and Selangor have boosted the company's confidence in a rising demand for their product. Unfortunately, businesses are unable to meet the demand. Given the need for specialised equipment to ensure the drinks' perishability during transport, the company was unable to hire a logistics firm to help with product distribution. If the company can meet the demands, the company can finally use the machines to its full capacity. Each vehicle in the fleet averages about 2,400 kilometres per month in current usage. The vehicle uses about 15 litres of gas for every 100 kilometres driven. Each requires RM300 in upkeep every month. It is estimated that the company must travel 12,000 kilometres each month to make deliveries to Penang and Selangor. Because RM300,000 of the company's profits have been set aside for future use, The board of directors has approved a spending plan of RM250,000 to fund the acquisition of 2 vehicles, either brand new or used. The company must spend an additional RM5,000 on average to adapt each vehicle it buys. If the business uses its retained earnings as cost of financing, it will pay an annual interest rate of 14%. The cost for new stock issuance is 16%. Since the company's debt ratio is quite high, the cost of debt is 9 percent (before tax) if the company uses debt financing to finance 10 percent of its operations. The cost of debt for the company is as follows if it decides to increase its debt usage: The company's required rate of return is 12% and the tax rate is 25%. Required: 1. Suggest 2 options of vehicles to be purchased by the company. [25marks] 2. Use capital budgeting techniques (payback period and NPV) to decide whether the to invest or not to invest for both options. Decide the best option. [60 marks ] 3. Calculate the optimal capital structure for the company. [15 marks ]