Question

Two years ago, the business owner John connected with a Canadian businessman, who acted as a middleman for grapes, to export and distribute grapes in

Two years ago, the business owner John connected with a Canadian businessman, who acted as a middleman for grapes, to export and distribute grapes in Canada. The company has been exporting 150,000 trays of grapes to Canada each year for the past two years. Due to recently published scientific studies that showed including grapes in peoples diet would lower risk of many diseases, the demand for grapes worldwide is expected to increase dramatically.

The company recently reached a agreement with the Canadian government, allowing it to build a facility in Canada to receive and distribute its products for the next five years. The plant and equipment will cost $800,000 CAD (year 0). The distribution centre project is expected to incur fixed costs of $200,000 CAD per year, and additional variable costs (including labour and materials) of 20% of the total sales each year (year 1 to year 5). The plant and equipment can be fully depreciated over an 8-year period on a straight-line basis. At the end of the fifth year, the fixed assets can be sold for $300,000 CAD. The project will also require an upfront investment of net working capital of $300,000 CAD at the start of the project, which will be recovered at the end of the fifth year. (Hint: Assume that current production and sales activities for year 0 would not be affected by this project.)

In Canada, demand for the company's grapes is anticipated to increase to 200,000 trays next year (year 1), with expected growth of 10% per year for the next four years (year 2 to year 5). The current wholesale price of grapes in Canada is $10 Canadian Dollars (CAD) per tray (year 0), and this price is expected to increase at 4% per year. John is considering building a distribution centre in Canada to handle the increased demand. The Canadian middleman is presently taking a 50% cut on the revenues from the sales of grapes in Canada. By eliminating the middleman, John thinks that he will be able to make a higher profit. (Hint: Sales commissions should be treated as part of Selling, General & Administrative Expense (SG&A))

Clifford, Johns son, has a master's degree in finance from the Canadian Agricultural University. John asked Clifford to help to find out the NPV of the decision of investing in this project in Australian Dollars (AUD) using the current AUD weighted average cost of capital of 16% for Johns business.

Clifford suggested the use of the Home Currency Approach and collected the following market data:

- Spot exchange rate: CAD0.93/AUD or 1 AUD = 0.93CAD

- Yield-to-maturity (YTM) of zero-coupon government bonds in Canada and Australia (refer to the table below for the YTM).

| (Annual rates %) | 1-year | 2-year | 3-year | 4-year | 5-year |

| Canadian yield-curve | 0.255 | 0.445 | 0.550 | 0.781 | 0.855 |

| Australian yield-curve | 0.013 | 0.022 | 0.217 | 0.441 | 0.610 |

(Hint: Use these interest rates and the covered-interest-parity condition to derive synthetic forward exchange rates, F(0,T)=S0[(1+r)T/(1+r)T])

The corporate tax rate in both countries is 30%.

Assume that the two markets are internationally integrated, and that the cash flow uncertainty of the project is un-correlated with changes in the exchange rate.

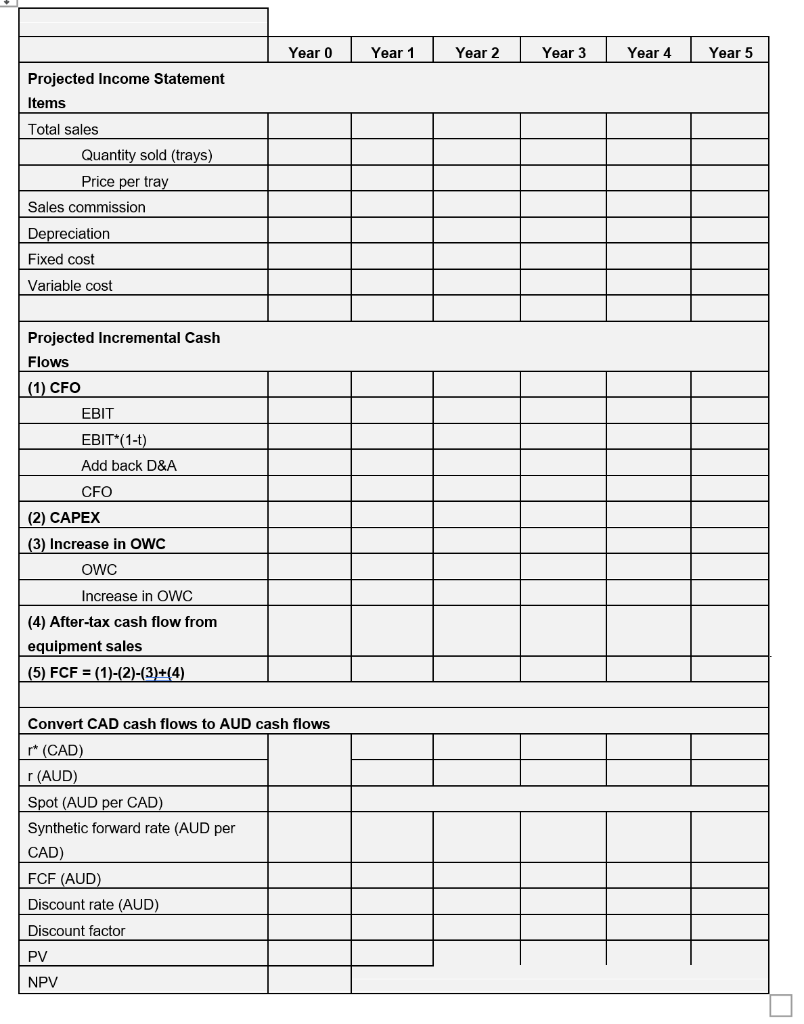

Complete the following table on an excel spreadsheet based on the previous information?, do no round any figures

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Projected Income Statement Items Total sales Quantity sold (trays) Price per tray Sales commission Depreciation Fixed cost Variable cost Projected Incremental Cash Flows (1) CFO EBIT EBIT*(1-1) Add back D&A CFO (2) CAPEX (3) Increase in OWC OWC Increase in OWC (4) After-tax cash flow from equipment sales (5) FCF = (1)-(2)-(3)+(4) Convert CAD cash flows to AUD cash flows r* (CAD) r (AUD) Spot (AUD per CAD) Synthetic forward rate (AUD per CAD) FCF (AUD) Discount rate (AUD) Discount factor PV NPV Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Projected Income Statement Items Total sales Quantity sold (trays) Price per tray Sales commission Depreciation Fixed cost Variable cost Projected Incremental Cash Flows (1) CFO EBIT EBIT*(1-1) Add back D&A CFO (2) CAPEX (3) Increase in OWC OWC Increase in OWC (4) After-tax cash flow from equipment sales (5) FCF = (1)-(2)-(3)+(4) Convert CAD cash flows to AUD cash flows r* (CAD) r (AUD) Spot (AUD per CAD) Synthetic forward rate (AUD per CAD) FCF (AUD) Discount rate (AUD) Discount factor PV NPV

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started