Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Two years ago you signed a 4 year lease on a DeLorean DMC-12. The sticker price on the car was $45,229.37, the lease rate was

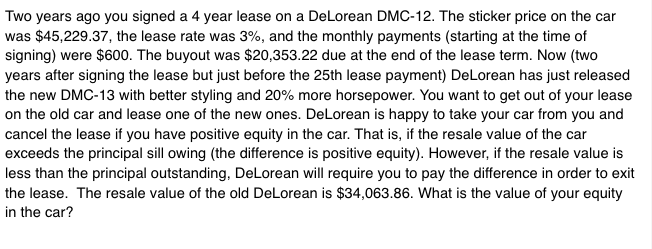

Two years ago you signed a 4 year lease on a DeLorean DMC-12. The sticker price on the car was $45,229.37, the lease rate was 3%, and the monthly payments (starting at the time of signing) were $600. The buyout was $20,353.22 due at the end of the lease term. Now (two years after signing the lease but just before the 25th lease payment) DeLorean has just released the new DMC-13 with better styling and 20% more horsepower. You want to get out of your lease on the old car and lease one of the new ones. DeLorean is happy to take your car from you and cancel the lease if you have positive equity in the car. That is, if the resale value of the car exceeds the principal sill owing (the difference is positive equity). However, if the resale value is less than the principal outstanding, DeLorean will require you to pay the difference in order to exit the lease. The resale value of the old DeLorean is $34,063.86. What is the value of your equity in the car

Two years ago you signed a 4 year lease on a DeLorean DMC-12. The sticker price on the car was $45,229.37, the lease rate was 3%, and the monthly payments (starting at the time of signing) were $600. The buyout was $20,353.22 due at the end of the lease term. Now (two years after signing the lease but just before the 25th lease payment) DeLorean has just released the new DMC-13 with better styling and 20% more horsepower. You want to get out of your lease on the old car and lease one of the new ones. DeLorean is happy to take your car from you and cancel the lease if you have positive equity in the car. That is, if the resale value of the car exceeds the principal sill owing (the difference is positive equity). However, if the resale value is less than the principal outstanding, DeLorean will require you to pay the difference in order to exit the lease. The resale value of the old DeLorean is $34,063.86. What is the value of your equity in the car Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started