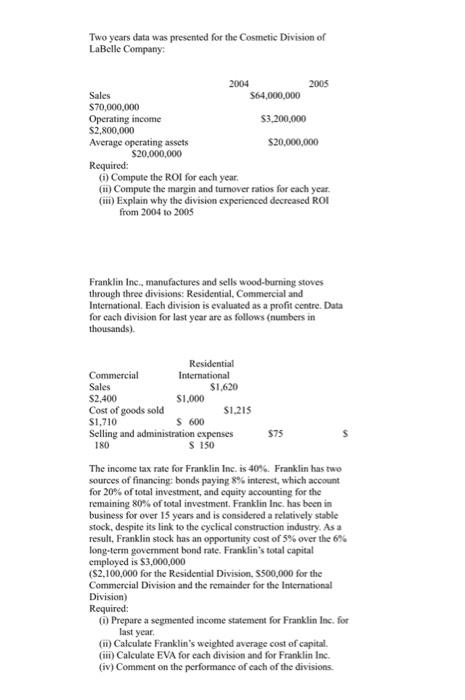

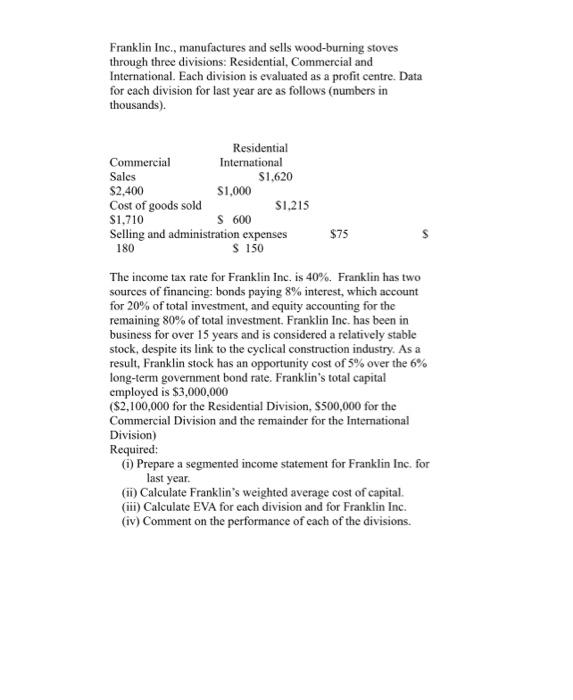

Two years data was presented for the Cosmetic Division of LaBelle Company: Required: (i) Compute the ROI for each year. (ii) Compute the margin and tumover ratios for each year. (iii) Explain why the division experienced decreased ROI from 2004 to 2005 Franklin Inc., manufactures and sells wood-burning stoves through three divisions: Residential, Commercial and International. Each division is evaluated as a profit centre. Data for each division for last year are as follows (numbers in thousands). The income tax rate for Franklin Inc. is 4086 . Franklin has two sources of financing: bonds paying 8% interest, which account for 20% of total imvestment, and cquity accotinting for the remaining 80% of total investment. Franklin Inc, has boen in business for over 15 years and is considered a relatively stable stock, despite its link to the cyclical construction industry. As a result, Franklin stock has an opportunity cost of 5% over the 6% long-term government bond rate. Franklin's total capital employed is $3,000,000 ($2,100,000 for the Residential Division, $500,000 for the Commercial Division and the remainder for the Intemational Division) Required: (i) Prepare a segmeated income statement for Franklin Inc. for last year. (ii) Calculate Franklin's weighted average cost of capital. (iii) Calculate EVA for cach division and for Franklin Inc. (iv) Comment on the performance of each of the divisions. Franklin Inc., manufactures and sells wood-burning stoves through three divisions: Residential, Commercial and International. Each division is evaluated as a profit centre. Data for each division for last year are as follows (numbers in thousands). The income tax rate for Franklin Inc. is 40%. Franklin has two sources of financing: bonds paying 8% interest, which account for 20% of total investment, and equity accounting for the remaining 80% of total investment. Franklin Inc. has been in business for over 15 years and is considered a relatively stable stock, despite its link to the cyclical construction industry. As a result, Franklin stock has an opportunity cost of 5% over the 6% long-term government bond rate. Franklin's total capital employed is $3,000,000 ( $2,100,000 for the Residential Division, $500,000 for the Commercial Division and the remainder for the Intemational Division) Required: (i) Prepare a segmented income statement for Franklin Inc. for last year. (ii) Calculate Franklin's weighted average cost of capital. (iii) Calculate EVA for each division and for Franklin Inc. (iv) Comment on the performance of each of the divisions