Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tyler Corp has the following budgeted sales for the first 4 months of nest year Cash sales Credit sales January $80,000 $350,000 $430,000 February $60,000

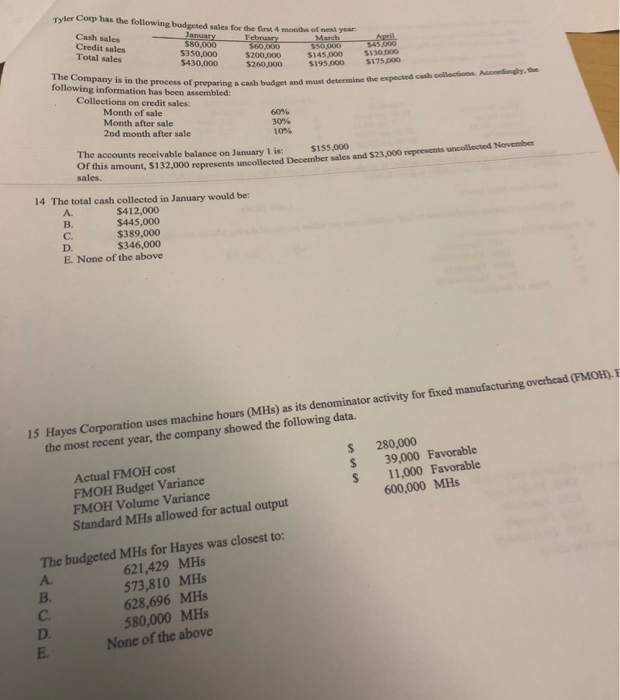

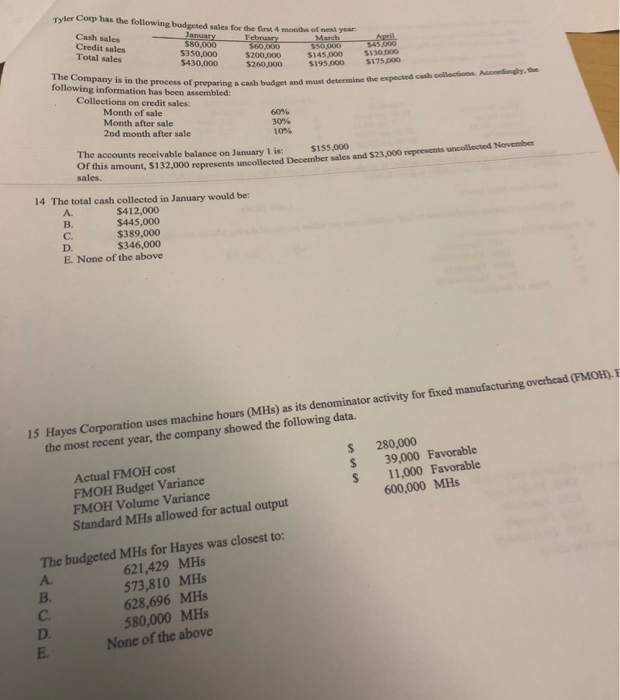

Tyler Corp has the following budgeted sales for the first 4 months of nest year Cash sales Credit sales January $80,000 $350,000 $430,000 February $60,000 $200,000 $260,000 March $50,000 $145,000 $195,000 April $45,000 $130,000 $175,000 Total sales The Company is in the process of preparing a cash budget and must determine the expected cash collections Accoedingly, the following information has been assembled: Collections on credit sales: Month of sale Month after sale 2nd month after sale 60% 30% 10% The accounts receivable balance on January 1 is: $155,000 Of this amount, $132,000 represents uncollected December sales and $23,000 represents uncollected November sales. 14 The total cash collected in January would be: $412,000 $445,000 $389,000 $346,000 E. None of the above A. . C. D. 15 Hayes Corporation uses machine hours (MHs) as its denominator activity for fixed manufacturing overhead (FMOH).E the most recent year, the company showed the following data. 280,000 39,000 Favorable $ $ $ Actual FMOH cost FMOH Budget Variance FMOH Volume Variance Standard MHs allowed for actual output 11,000 Favorable 600,000 MHs The budgeted MHs for Hayes was closest to: 621,429 MHs 573,810 MHs 628,696 MHs 580,000 MHs None of the above A

Tyler Corp has the following budgeted sales for the first 4 months of nest year Cash sales Credit sales January $80,000 $350,000 $430,000 February $60,000 $200,000 $260,000 March $50,000 $145,000 $195,000 April $45,000 $130,000 $175,000 Total sales The Company is in the process of preparing a cash budget and must determine the expected cash collections Accoedingly, the following information has been assembled: Collections on credit sales: Month of sale Month after sale 2nd month after sale 60% 30% 10% The accounts receivable balance on January 1 is: $155,000 Of this amount, $132,000 represents uncollected December sales and $23,000 represents uncollected November sales. 14 The total cash collected in January would be: $412,000 $445,000 $389,000 $346,000 E. None of the above A. . C. D. 15 Hayes Corporation uses machine hours (MHs) as its denominator activity for fixed manufacturing overhead (FMOH).E the most recent year, the company showed the following data. 280,000 39,000 Favorable $ $ $ Actual FMOH cost FMOH Budget Variance FMOH Volume Variance Standard MHs allowed for actual output 11,000 Favorable 600,000 MHs The budgeted MHs for Hayes was closest to: 621,429 MHs 573,810 MHs 628,696 MHs 580,000 MHs None of the above A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started