Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tyler Dee Company uses a job order costing system. Actual direct materials and direct labor costs are accumulated for each job, but a predetermined overhead

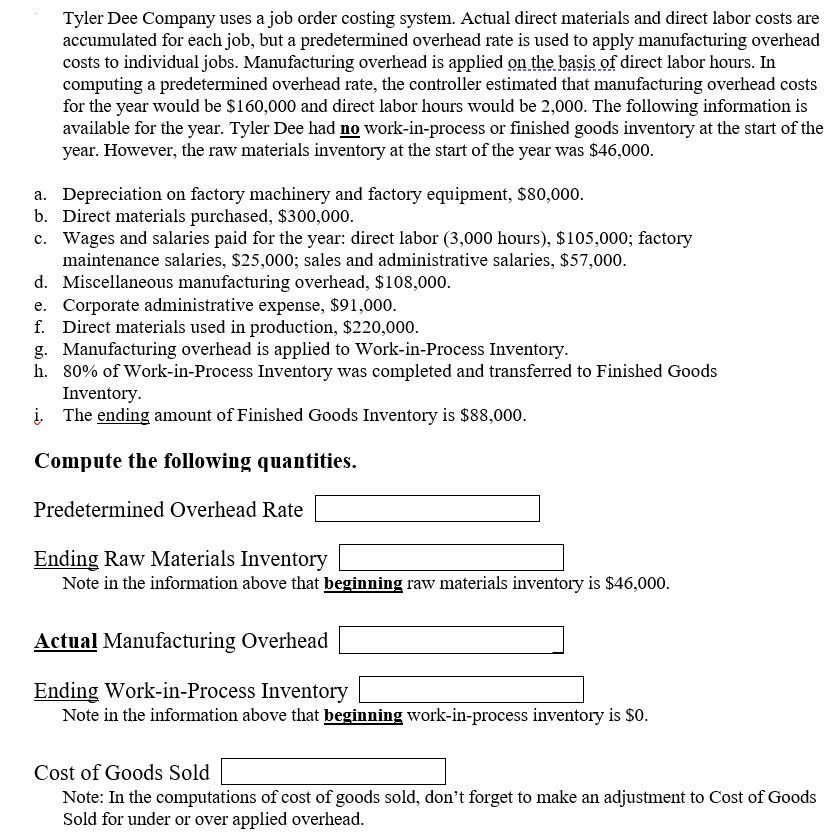

Tyler Dee Company uses a job order costing system. Actual direct materials and direct labor costs are accumulated for each job, but a predetermined overhead rate is used to apply manufacturing overhead costs to individual jobs. Manufacturing overhead is applied on the bassis of direct labor hours. In computing a predetermined overhead rate, the controller estimated that manufacturing overhead costs for the year would be $160,000 and direct labor hours would be 2,000 . The following information is available for the year. Tyler Dee had no work-in-process or finished goods inventory at the start of the year. However, the raw materials inventory at the start of the year was $46,000. a. Depreciation on factory machinery and factory equipment, $80,000. b. Direct materials purchased, $300,000. c. Wages and salaries paid for the year: direct labor (3,000 hours), $105,000; factory maintenance salaries, $25,000; sales and administrative salaries, $57,000. d. Miscellaneous manufacturing overhead, $108,000. e. Corporate administrative expense, $91,000. f. Direct materials used in production, $220,000. g. Manufacturing overhead is applied to Work-in-Process Inventory. h. 80% of Work-in-Process Inventory was completed and transferred to Finished Goods Inventory. i. The ending amount of Finished Goods Inventory is $88,000. Compute the following quantities. Predetermined Overhead Rate Ending Raw Materials Inventory Note in the information above that beginning raw materials inventory is $46,000. Actual Manufacturing Overhead Ending Work-in-Process Inventory Note in the information above that beginning work-in-process inventory is $0. Cost of Goods Sold Note: In the computations of cost of goods sold, don't forget to make an adjustment to Cost of Goods Sold for under or over applied overhead. Tyler Dee Company uses a job order costing system. Actual direct materials and direct labor costs are accumulated for each job, but a predetermined overhead rate is used to apply manufacturing overhead costs to individual jobs. Manufacturing overhead is applied on the bassis of direct labor hours. In computing a predetermined overhead rate, the controller estimated that manufacturing overhead costs for the year would be $160,000 and direct labor hours would be 2,000 . The following information is available for the year. Tyler Dee had no work-in-process or finished goods inventory at the start of the year. However, the raw materials inventory at the start of the year was $46,000. a. Depreciation on factory machinery and factory equipment, $80,000. b. Direct materials purchased, $300,000. c. Wages and salaries paid for the year: direct labor (3,000 hours), $105,000; factory maintenance salaries, $25,000; sales and administrative salaries, $57,000. d. Miscellaneous manufacturing overhead, $108,000. e. Corporate administrative expense, $91,000. f. Direct materials used in production, $220,000. g. Manufacturing overhead is applied to Work-in-Process Inventory. h. 80% of Work-in-Process Inventory was completed and transferred to Finished Goods Inventory. i. The ending amount of Finished Goods Inventory is $88,000. Compute the following quantities. Predetermined Overhead Rate Ending Raw Materials Inventory Note in the information above that beginning raw materials inventory is $46,000. Actual Manufacturing Overhead Ending Work-in-Process Inventory Note in the information above that beginning work-in-process inventory is $0. Cost of Goods Sold Note: In the computations of cost of goods sold, don't forget to make an adjustment to Cost of Goods Sold for under or over applied overhead

Tyler Dee Company uses a job order costing system. Actual direct materials and direct labor costs are accumulated for each job, but a predetermined overhead rate is used to apply manufacturing overhead costs to individual jobs. Manufacturing overhead is applied on the bassis of direct labor hours. In computing a predetermined overhead rate, the controller estimated that manufacturing overhead costs for the year would be $160,000 and direct labor hours would be 2,000 . The following information is available for the year. Tyler Dee had no work-in-process or finished goods inventory at the start of the year. However, the raw materials inventory at the start of the year was $46,000. a. Depreciation on factory machinery and factory equipment, $80,000. b. Direct materials purchased, $300,000. c. Wages and salaries paid for the year: direct labor (3,000 hours), $105,000; factory maintenance salaries, $25,000; sales and administrative salaries, $57,000. d. Miscellaneous manufacturing overhead, $108,000. e. Corporate administrative expense, $91,000. f. Direct materials used in production, $220,000. g. Manufacturing overhead is applied to Work-in-Process Inventory. h. 80% of Work-in-Process Inventory was completed and transferred to Finished Goods Inventory. i. The ending amount of Finished Goods Inventory is $88,000. Compute the following quantities. Predetermined Overhead Rate Ending Raw Materials Inventory Note in the information above that beginning raw materials inventory is $46,000. Actual Manufacturing Overhead Ending Work-in-Process Inventory Note in the information above that beginning work-in-process inventory is $0. Cost of Goods Sold Note: In the computations of cost of goods sold, don't forget to make an adjustment to Cost of Goods Sold for under or over applied overhead. Tyler Dee Company uses a job order costing system. Actual direct materials and direct labor costs are accumulated for each job, but a predetermined overhead rate is used to apply manufacturing overhead costs to individual jobs. Manufacturing overhead is applied on the bassis of direct labor hours. In computing a predetermined overhead rate, the controller estimated that manufacturing overhead costs for the year would be $160,000 and direct labor hours would be 2,000 . The following information is available for the year. Tyler Dee had no work-in-process or finished goods inventory at the start of the year. However, the raw materials inventory at the start of the year was $46,000. a. Depreciation on factory machinery and factory equipment, $80,000. b. Direct materials purchased, $300,000. c. Wages and salaries paid for the year: direct labor (3,000 hours), $105,000; factory maintenance salaries, $25,000; sales and administrative salaries, $57,000. d. Miscellaneous manufacturing overhead, $108,000. e. Corporate administrative expense, $91,000. f. Direct materials used in production, $220,000. g. Manufacturing overhead is applied to Work-in-Process Inventory. h. 80% of Work-in-Process Inventory was completed and transferred to Finished Goods Inventory. i. The ending amount of Finished Goods Inventory is $88,000. Compute the following quantities. Predetermined Overhead Rate Ending Raw Materials Inventory Note in the information above that beginning raw materials inventory is $46,000. Actual Manufacturing Overhead Ending Work-in-Process Inventory Note in the information above that beginning work-in-process inventory is $0. Cost of Goods Sold Note: In the computations of cost of goods sold, don't forget to make an adjustment to Cost of Goods Sold for under or over applied overhead Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started