Type or paste question here

Type or paste question here

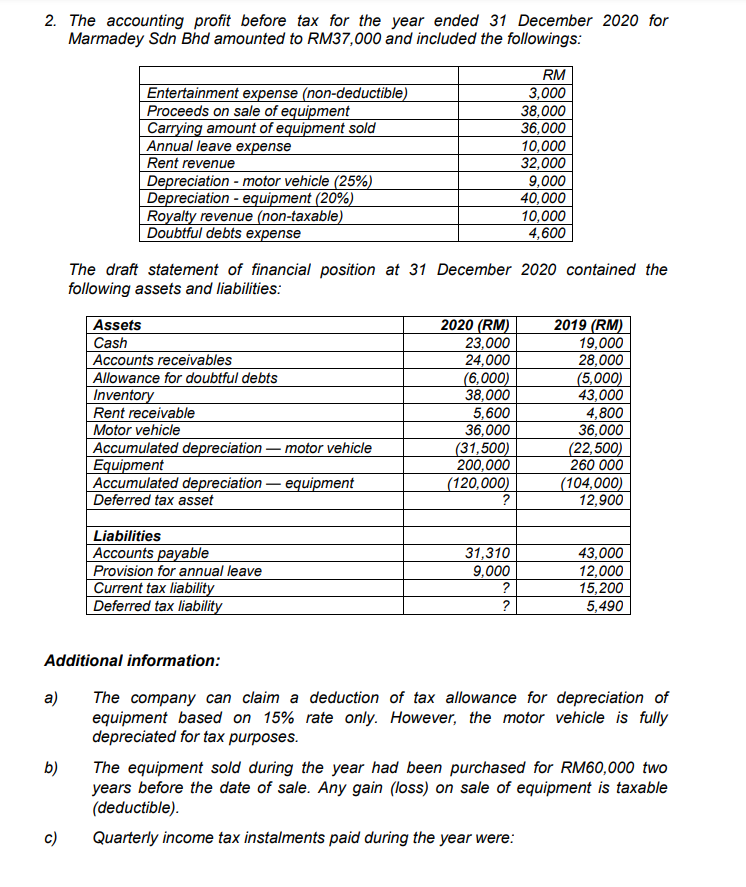

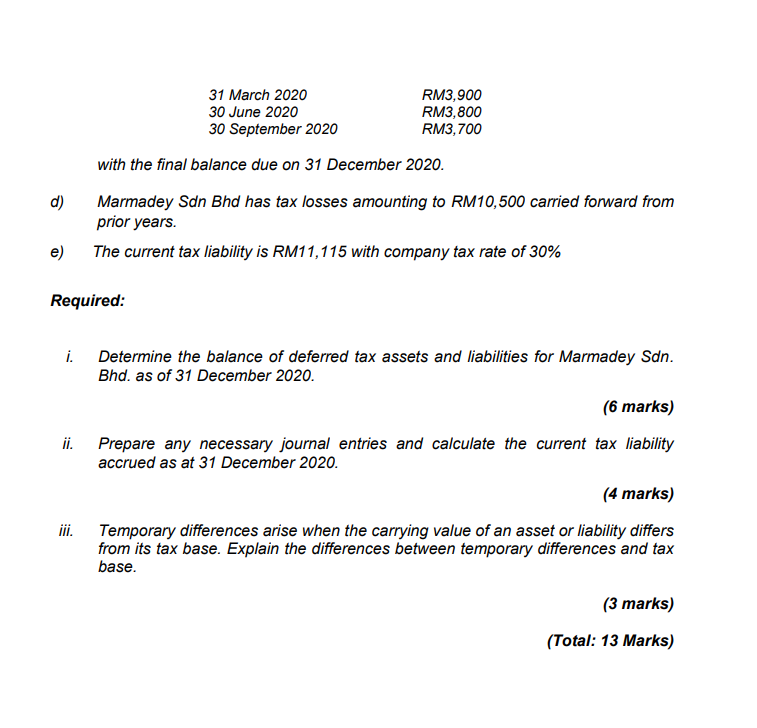

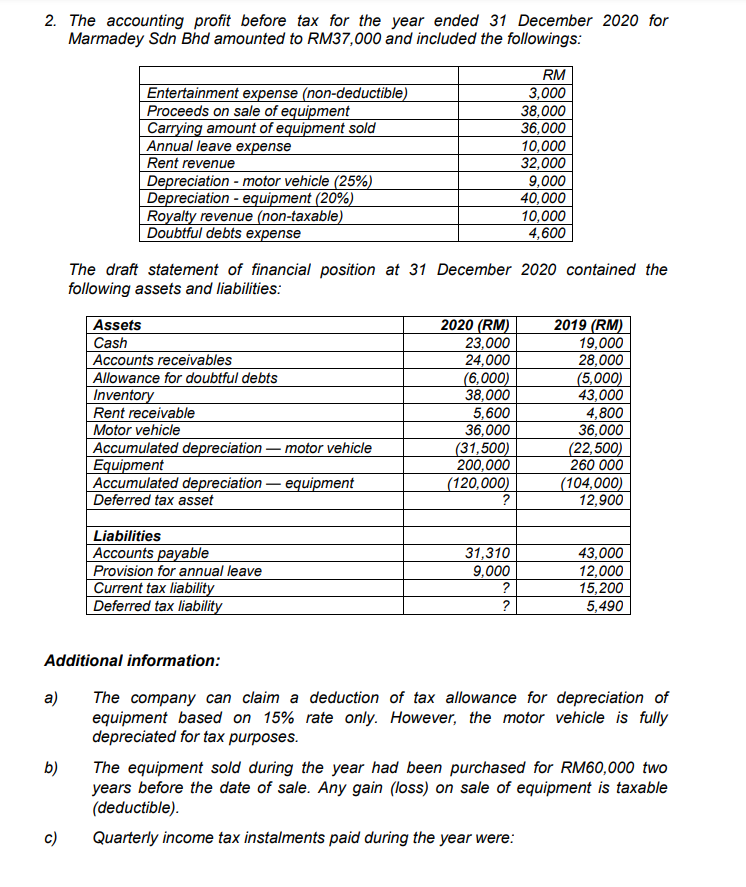

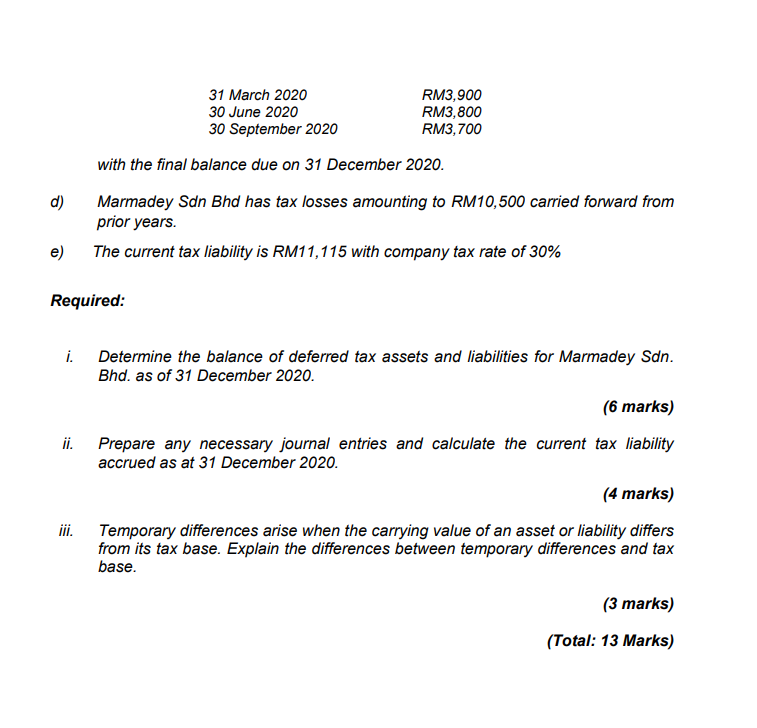

2. The accounting profit before tax for the year ended 31 December 2020 for Marmadey Sdn Bhd amounted to RM37,000 and included the followings: Entertainment expense (non-deductible) Proceeds on sale of equipment Carrying amount of equipment sold Annual leave expense Rent revenue Depreciation - motor vehicle (25%) Depreciation - equipment (20%) Royalty revenue (non-taxable) Doubtful debts expense RM 3,000 38,000 36,000 10,000 32,000 9,000 40,000 10,000 4,600 The draft statement of financial position at 31 December 2020 contained the following assets and liabilities: Assets Cash Accounts receivables Allowance for doubtful debts Inventory Rent receivable Motor vehicle Accumulated depreciation - motor vehicle Equipment Accumulated depreciation - equipment Deferred tax asset 2020 (RM) 23,000 24,000 (6,000) 38,000 5,600 36,000 (31,500) 200,000 (120,000) ? 2019 (RM) 19,000 28,000 (5,000) 43,000 4,800 36,000 (22,500) 260 000 (104,000) 12,900 Liabilities Accounts payable Provision for annual leave Current tax liability Deferred tax liability 31,310 9,000 ? ? 43,000 12,000 15,200 5,490 Additional information: a) b) The company can claim a deduction of tax allowance for depreciation of equipment based on 15% rate only. However, the motor vehicle is fully depreciated for tax purposes. The equipment sold during the year had been purchased for RM60,000 two years before the date of sale. Any gain (loss) on sale of equipment is taxable (deductible). Quarterly income tax instalments paid during the year were: c) 31 March 2020 30 June 2020 30 September 2020 RM3,900 RM3,800 RM3,700 d) with the final balance due on 31 December 2020. Marmadey Sdn Bhd has tax losses amounting to RM10,500 carried forward from prior years. The current tax liability is RM11,115 with company tax rate of 30% e) Required: i. Determine the balance of deferred tax assets and liabilities for Marmadey Sdn. Bhd. as of 31 December 2020. (6 marks) ii. Prepare any necessary journal entries and calculate the current tax liability accrued as at 31 December 2020. (4 marks) iii. Temporary differences arise when the carrying value of an asset or liability differs from its tax base. Explain the differences between temporary differences and tax base. (3 marks) (Total: 13 Marks) 2. The accounting profit before tax for the year ended 31 December 2020 for Marmadey Sdn Bhd amounted to RM37,000 and included the followings: Entertainment expense (non-deductible) Proceeds on sale of equipment Carrying amount of equipment sold Annual leave expense Rent revenue Depreciation - motor vehicle (25%) Depreciation - equipment (20%) Royalty revenue (non-taxable) Doubtful debts expense RM 3,000 38,000 36,000 10,000 32,000 9,000 40,000 10,000 4,600 The draft statement of financial position at 31 December 2020 contained the following assets and liabilities: Assets Cash Accounts receivables Allowance for doubtful debts Inventory Rent receivable Motor vehicle Accumulated depreciation - motor vehicle Equipment Accumulated depreciation - equipment Deferred tax asset 2020 (RM) 23,000 24,000 (6,000) 38,000 5,600 36,000 (31,500) 200,000 (120,000) ? 2019 (RM) 19,000 28,000 (5,000) 43,000 4,800 36,000 (22,500) 260 000 (104,000) 12,900 Liabilities Accounts payable Provision for annual leave Current tax liability Deferred tax liability 31,310 9,000 ? ? 43,000 12,000 15,200 5,490 Additional information: a) b) The company can claim a deduction of tax allowance for depreciation of equipment based on 15% rate only. However, the motor vehicle is fully depreciated for tax purposes. The equipment sold during the year had been purchased for RM60,000 two years before the date of sale. Any gain (loss) on sale of equipment is taxable (deductible). Quarterly income tax instalments paid during the year were: c) 31 March 2020 30 June 2020 30 September 2020 RM3,900 RM3,800 RM3,700 d) with the final balance due on 31 December 2020. Marmadey Sdn Bhd has tax losses amounting to RM10,500 carried forward from prior years. The current tax liability is RM11,115 with company tax rate of 30% e) Required: i. Determine the balance of deferred tax assets and liabilities for Marmadey Sdn. Bhd. as of 31 December 2020. (6 marks) ii. Prepare any necessary journal entries and calculate the current tax liability accrued as at 31 December 2020. (4 marks) iii. Temporary differences arise when the carrying value of an asset or liability differs from its tax base. Explain the differences between temporary differences and tax base. (3 marks) (Total: 13 Marks)

Type or paste question here

Type or paste question here