Type or paste question here

Type or paste question here

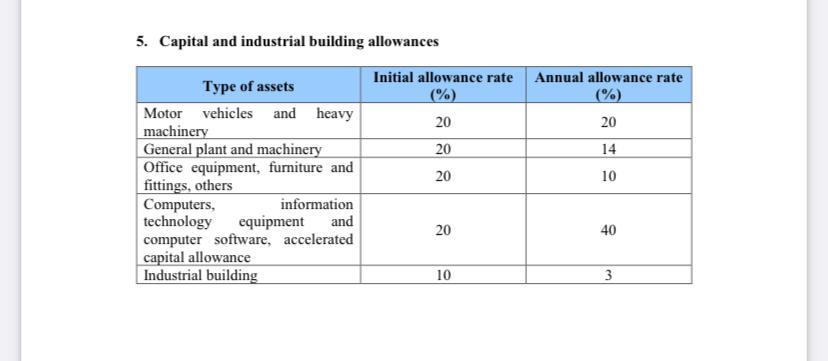

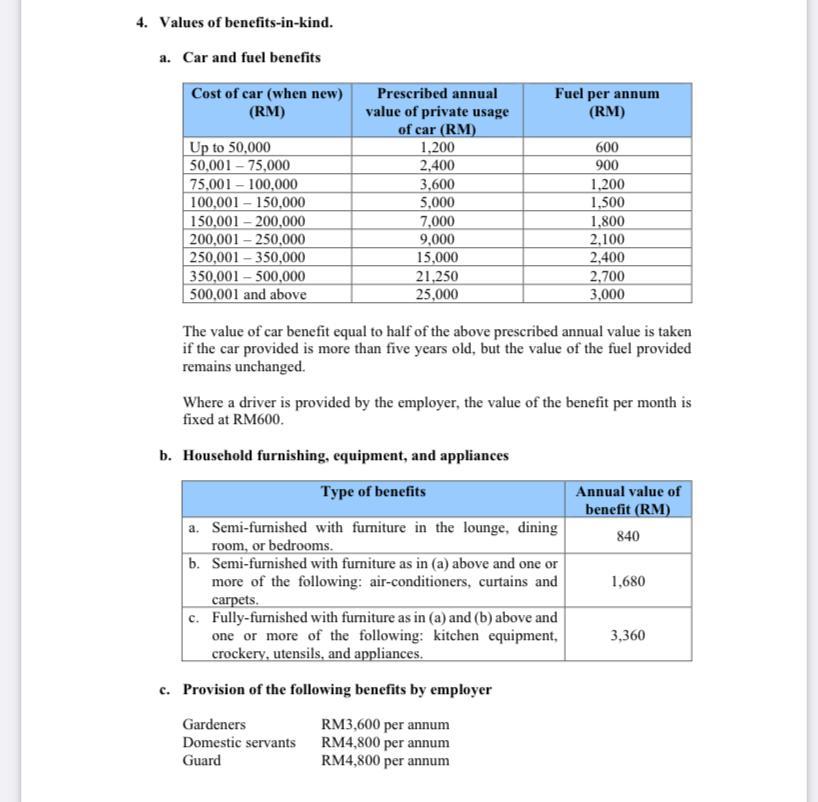

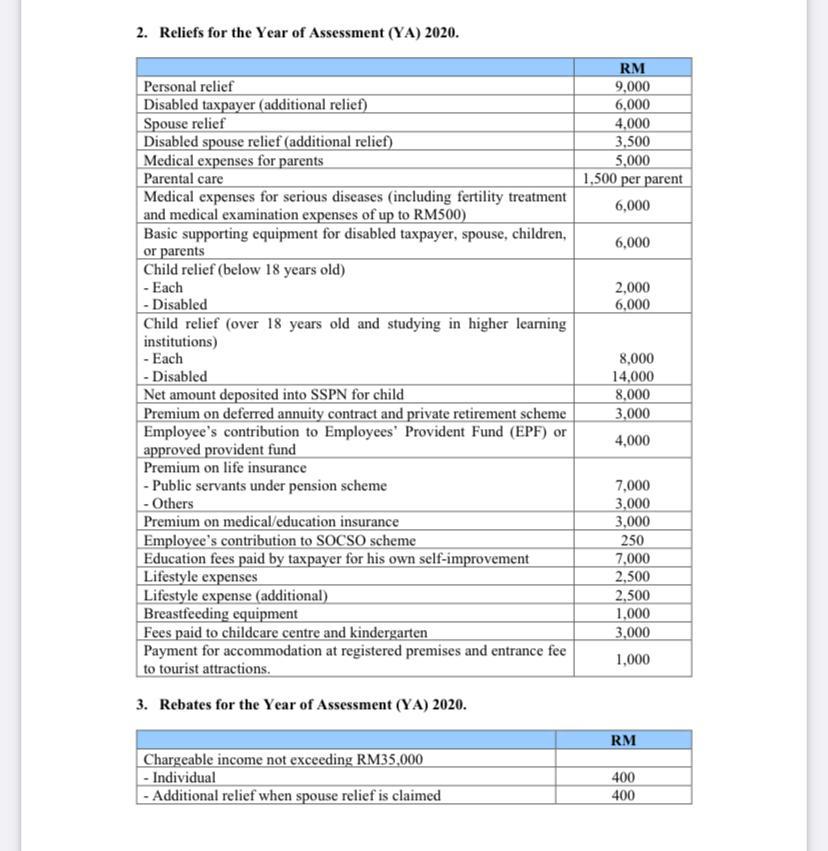

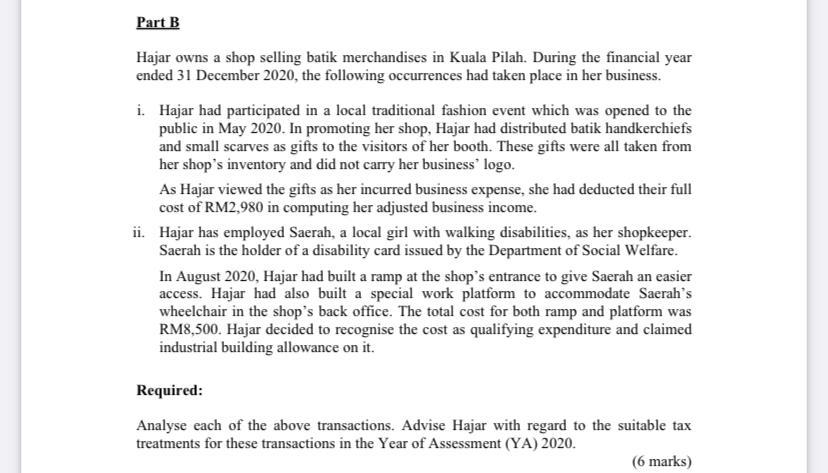

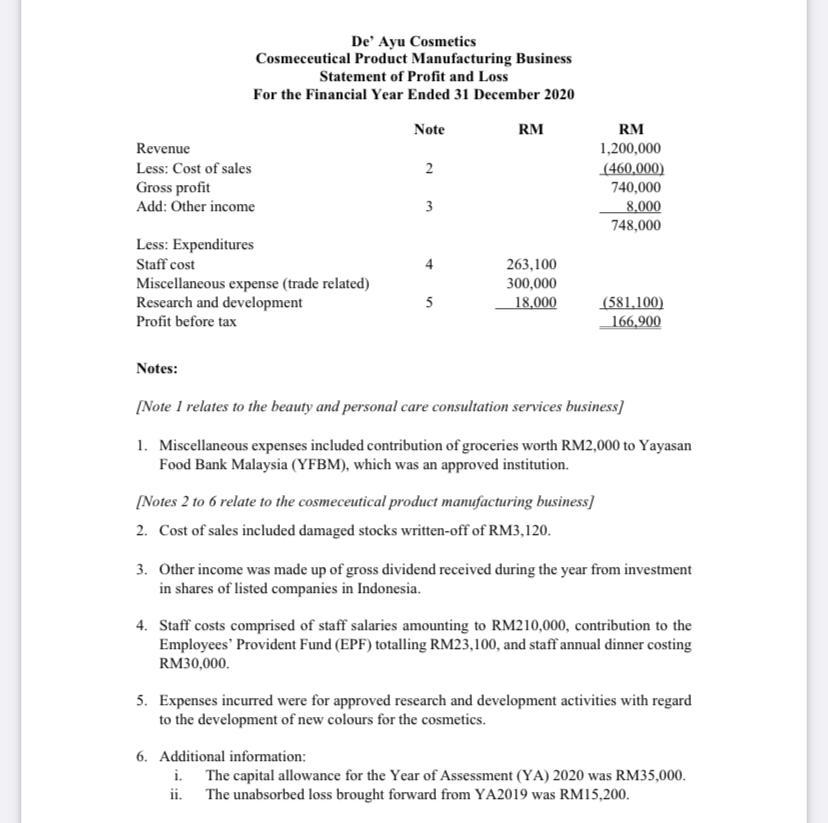

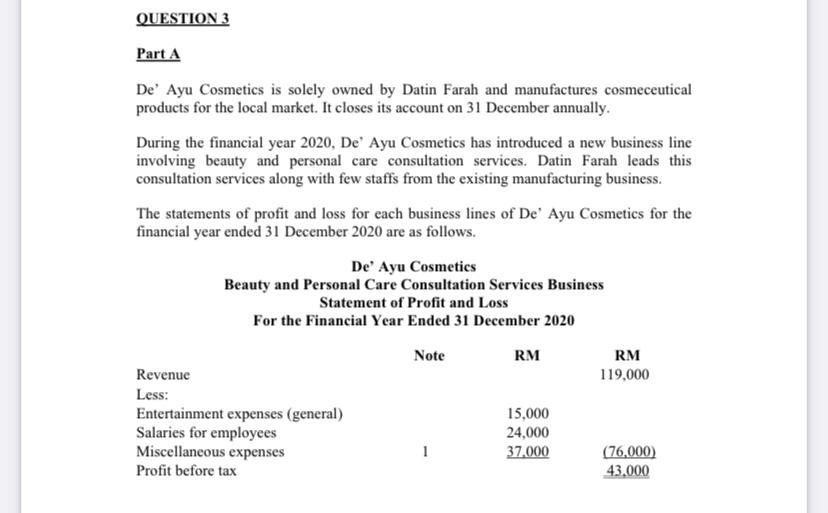

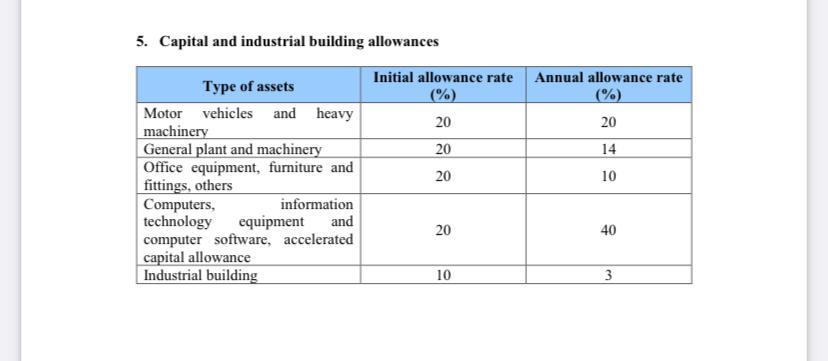

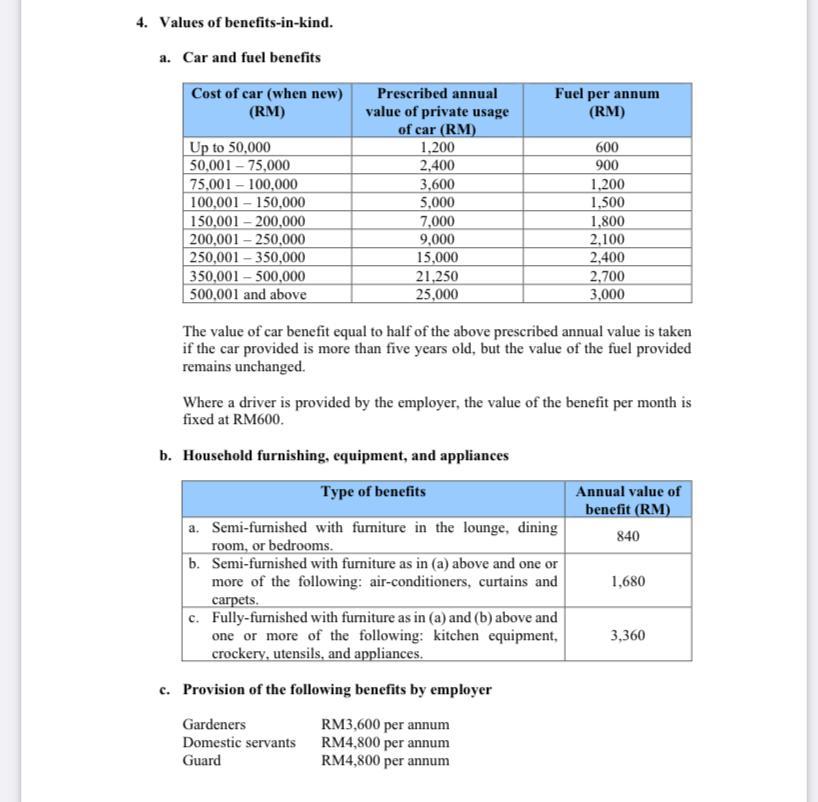

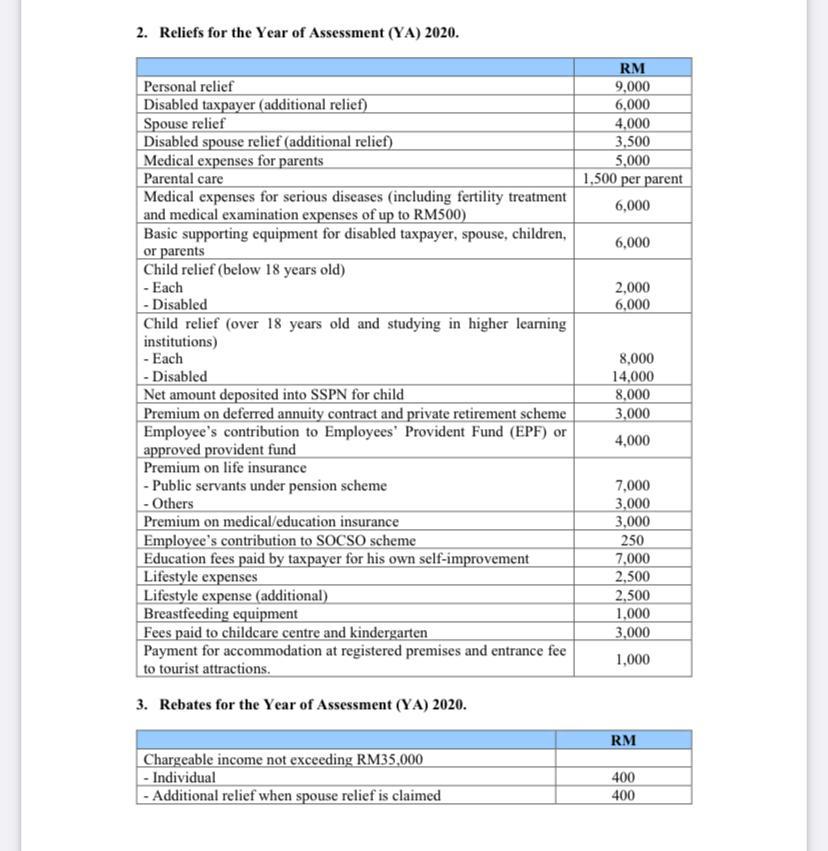

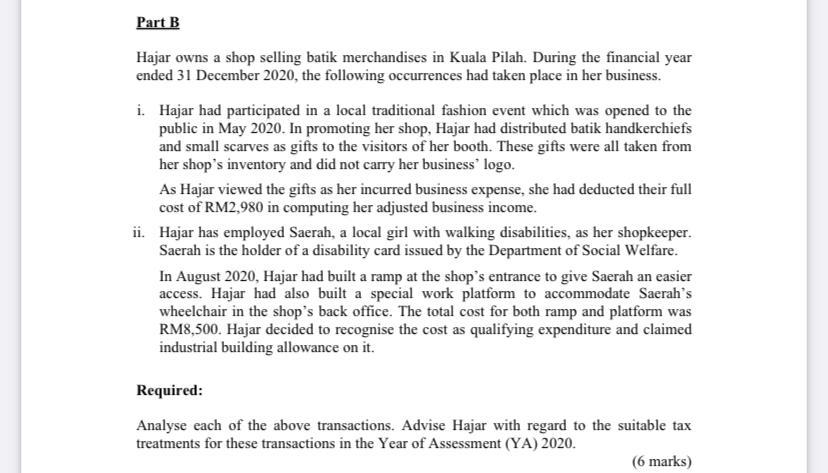

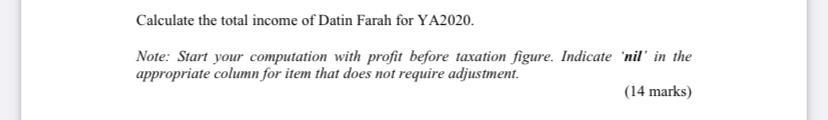

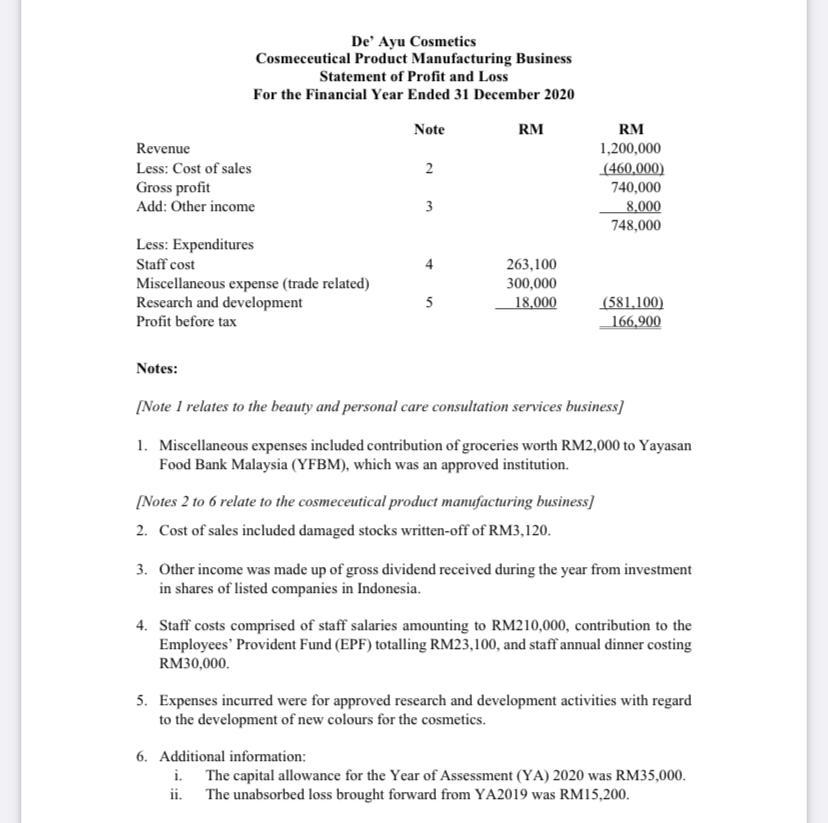

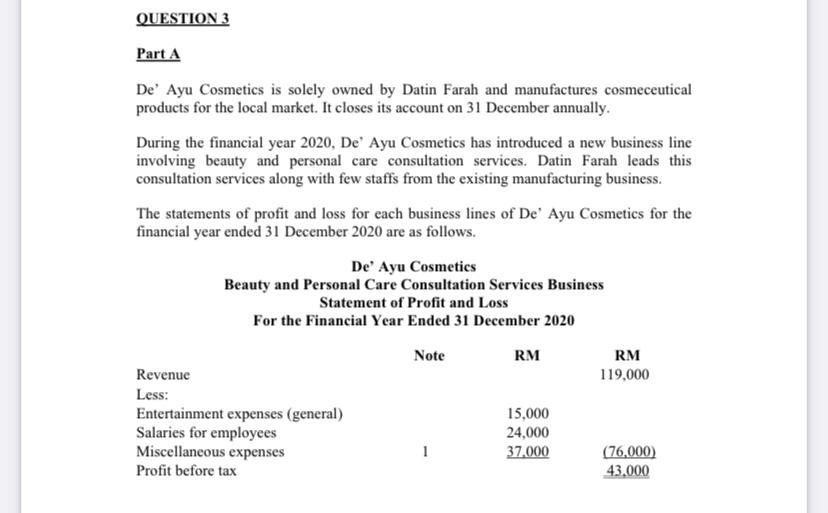

5. Capital and industrial building allowances Initial allowance rate (%) 20 20 Annual allowance rate (%) 20 14 Type of assets Motor vehicles and heavy machinery General plant and machinery Office equipment, furniture and fittings, others Computers, information technology equipment and computer software, accelerated capital allowance Industrial building 20 10 20 40 10 3 4. Values of benefits-in-kind. a. Car and fuel benefits Cost of car (when new) (RM) Fuel per annum (RM) Up to 50,000 50,001 - 75,000 75,001 - 100,000 100,001 - 150,000 150,001 - 200,000 200,001 - 250.000 250,001 - 350,000 350,001 - 500,000 500,001 and above Prescribed annual value of private usage of car (RM) 1,200 2,400 3,600 5,000 7,000 9,000 15,000 21,250 25,000 600 900 1.200 1,500 1,800 2,100 2,400 2,700 3,000 The value of car benefit equal to half of the above prescribed annual value is taken if the car provided is more than five years old, but the value of the fuel provided remains unchanged. Where a driver is provided by the employer, the value of the benefit per month is fixed at RM600. b. Household furnishing, equipment, and appliances Type of benefits Annual value of benefit (RM) 840 1,680 a. Semi-furnished with furniture in the lounge, dining room, or bedrooms. b. Semi-furnished with furniture as in (a) above and one or more of the following: air-conditioners, curtains and carpets. c. Fully-furnished with furniture as in (a) and (b) above and one or more of the following: kitchen equipment, crockery, utensils, and appliances. 3,360 c. Provision of the following benefits by employer Gardeners Domestic servants Guard RM3,600 per annum RM4,800 per annum RM4,800 per annum 2. Reliefs for the Year of Assessment (YA) 2020. RM 9,000 6,000 4,000 3,500 5,000 1.500 per parent 6,000 6,000 2,000 6,000 Personal relief Disabled taxpayer (additional relief) Spouse relief Disabled spouse relief (additional relief) Medical expenses for parents Parental care Medical expenses for serious diseases (including fertility treatment and medical examination expenses of up to RM500) Basic supporting equipment for disabled taxpayer, spouse, children, or parents Child relief (below 18 years old) - Each - Disabled Child relief (over 18 years old and studying in higher learning institutions) - Each - Disabled Net amount deposited into SSPN for child Premium on deferred annuity contract and private retirement scheme Employee's contribution to Employees' Provident Fund (EPF) or approved provident fund Premium on life insurance - Public servants under pension scheme - Others Premium on medical education insurance Employee's contribution to SOCSO scheme Education fees paid by taxpayer for his own self-improvement Lifestyle expenses Lifestyle expense (additional) Breastfeeding equipment Fees paid to childcare centre and kindergarten Payment for accommodation at registered premises and entrance fee to tourist attractions. 3. Rebates for the Year of Assessment (YA) 2020. 8,000 14,000 8,000 3,000 4,000 7,000 3,000 3,000 250 7,000 2,500 2,500 1,000 3,000 1,000 RM Chargeable income not exceeding RM35,000 - Individual - Additional relief when spouse relief is claimed 400 400 Part B Hajar owns a shop selling batik merchandises in Kuala Pilah. During the financial year ended 31 December 2020, the following occurrences had taken place in her business. i. Hajar had participated in a local traditional fashion event which was opened to the public in May 2020. In promoting her shop, Hajar had distributed batik handkerchiefs and small scarves as gifts to the visitors of her booth. These gifts were all taken from her shop's inventory and did not carry her business' logo. As Hajar viewed the gifts as her incurred business expense, she had deducted their full cost of RM2,980 in computing her adjusted business income. ii. Hajar has employed Saerah, a local girl with walking disabilities, as her shopkeeper. Saerah is the holder of a disability card issued by the Department of Social Welfare. In August 2020, Hajar had built a ramp at the shop's entrance to give Saerah an easier access. Hajar had also built a special work platform to accommodate Saerah's wheelchair in the shop's back office. The total cost for both ramp and platform was RM8,500. Hajar decided to recognise the cost as qualifying expenditure and claimed industrial building allowance on it. Required: Analyse each of the above transactions. Advise Hajar with regard to the suitable tax treatments for these transactions in the Year of Assessment (YA) 2020. (6 marks) Calculate the total income of Datin Farah for YA2020. Note: Start your computation with profit before taxation figure. Indicate 'nil' in the appropriate column for item that does not require adjustment. (14 marks) De' Ayu Cosmetics Cosmeceutical Product Manufacturing Business Statement of Profit and Loss For the Financial Year Ended 31 December 2020 Note RM 2 Revenue Less: Cost of sales Gross profit Add: Other income RM 1,200,000 (460,000) 740,000 8.000 748,000 3 Less: Expenditures Staff cost Miscellaneous expense (trade related) Research and development Profit before tax 263,100 300,000 18,000 5 (581.100) 166,900 Notes: [Note 1 relates to the beauty and personal care consultation services business) 1. Miscellaneous expenses included contribution of groceries worth RM2,000 to Yayasan Food Bank Malaysia (YFBM), which was an approved institution. [Notes 2 to 6 relate to the cosmeceutical product manufacturing business 2. Cost of sales included damaged stocks written-off of RM3,120. 3. Other income was made up of gross dividend received during the year from investment in shares of listed companies in Indonesia. 4. Staff costs comprised of staff salaries amounting to RM210,000, contribution to the Employees' Provident Fund (EPF) totalling RM23,100, and staff annual dinner costing RM30,000. 5. Expenses incurred were for approved research and development activities with regard to the development of new colours for the cosmetics. 6. Additional information: i. The capital allowance for the Year of Assessment (YA) 2020 was RM35,000. ii. The unabsorbed loss brought forward from YA2019 was RM15,200. QUESTION 3 Part A De' Ayu Cosmetics is solely owned by Datin Farah and manufactures cosmeceutical products for the local market. It closes its account on 31 December annually. During the financial year 2020, De' Ayu Cosmetics has introduced a new business line involving beauty and personal care consultation services. Datin Farah leads this consultation services along with few staffs from the existing manufacturing business. The statements of profit and loss for each business lines of De' Ayu Cosmetics for the financial year ended 31 December 2020 are as follows. De Ayu Cosmetics Beauty and Personal Care Consultation Services Business Statement of Profit and Loss For the Financial Year Ended 31 December 2020 Note RM RM Revenue 119,000 Less: Entertainment expenses (general) 15,000 Salaries for employees 24,000 Miscellaneous expenses 1 37,000 (76,000) Profit before tax 43.000 5. Capital and industrial building allowances Initial allowance rate (%) 20 20 Annual allowance rate (%) 20 14 Type of assets Motor vehicles and heavy machinery General plant and machinery Office equipment, furniture and fittings, others Computers, information technology equipment and computer software, accelerated capital allowance Industrial building 20 10 20 40 10 3 4. Values of benefits-in-kind. a. Car and fuel benefits Cost of car (when new) (RM) Fuel per annum (RM) Up to 50,000 50,001 - 75,000 75,001 - 100,000 100,001 - 150,000 150,001 - 200,000 200,001 - 250.000 250,001 - 350,000 350,001 - 500,000 500,001 and above Prescribed annual value of private usage of car (RM) 1,200 2,400 3,600 5,000 7,000 9,000 15,000 21,250 25,000 600 900 1.200 1,500 1,800 2,100 2,400 2,700 3,000 The value of car benefit equal to half of the above prescribed annual value is taken if the car provided is more than five years old, but the value of the fuel provided remains unchanged. Where a driver is provided by the employer, the value of the benefit per month is fixed at RM600. b. Household furnishing, equipment, and appliances Type of benefits Annual value of benefit (RM) 840 1,680 a. Semi-furnished with furniture in the lounge, dining room, or bedrooms. b. Semi-furnished with furniture as in (a) above and one or more of the following: air-conditioners, curtains and carpets. c. Fully-furnished with furniture as in (a) and (b) above and one or more of the following: kitchen equipment, crockery, utensils, and appliances. 3,360 c. Provision of the following benefits by employer Gardeners Domestic servants Guard RM3,600 per annum RM4,800 per annum RM4,800 per annum 2. Reliefs for the Year of Assessment (YA) 2020. RM 9,000 6,000 4,000 3,500 5,000 1.500 per parent 6,000 6,000 2,000 6,000 Personal relief Disabled taxpayer (additional relief) Spouse relief Disabled spouse relief (additional relief) Medical expenses for parents Parental care Medical expenses for serious diseases (including fertility treatment and medical examination expenses of up to RM500) Basic supporting equipment for disabled taxpayer, spouse, children, or parents Child relief (below 18 years old) - Each - Disabled Child relief (over 18 years old and studying in higher learning institutions) - Each - Disabled Net amount deposited into SSPN for child Premium on deferred annuity contract and private retirement scheme Employee's contribution to Employees' Provident Fund (EPF) or approved provident fund Premium on life insurance - Public servants under pension scheme - Others Premium on medical education insurance Employee's contribution to SOCSO scheme Education fees paid by taxpayer for his own self-improvement Lifestyle expenses Lifestyle expense (additional) Breastfeeding equipment Fees paid to childcare centre and kindergarten Payment for accommodation at registered premises and entrance fee to tourist attractions. 3. Rebates for the Year of Assessment (YA) 2020. 8,000 14,000 8,000 3,000 4,000 7,000 3,000 3,000 250 7,000 2,500 2,500 1,000 3,000 1,000 RM Chargeable income not exceeding RM35,000 - Individual - Additional relief when spouse relief is claimed 400 400 Part B Hajar owns a shop selling batik merchandises in Kuala Pilah. During the financial year ended 31 December 2020, the following occurrences had taken place in her business. i. Hajar had participated in a local traditional fashion event which was opened to the public in May 2020. In promoting her shop, Hajar had distributed batik handkerchiefs and small scarves as gifts to the visitors of her booth. These gifts were all taken from her shop's inventory and did not carry her business' logo. As Hajar viewed the gifts as her incurred business expense, she had deducted their full cost of RM2,980 in computing her adjusted business income. ii. Hajar has employed Saerah, a local girl with walking disabilities, as her shopkeeper. Saerah is the holder of a disability card issued by the Department of Social Welfare. In August 2020, Hajar had built a ramp at the shop's entrance to give Saerah an easier access. Hajar had also built a special work platform to accommodate Saerah's wheelchair in the shop's back office. The total cost for both ramp and platform was RM8,500. Hajar decided to recognise the cost as qualifying expenditure and claimed industrial building allowance on it. Required: Analyse each of the above transactions. Advise Hajar with regard to the suitable tax treatments for these transactions in the Year of Assessment (YA) 2020. (6 marks) Calculate the total income of Datin Farah for YA2020. Note: Start your computation with profit before taxation figure. Indicate 'nil' in the appropriate column for item that does not require adjustment. (14 marks) De' Ayu Cosmetics Cosmeceutical Product Manufacturing Business Statement of Profit and Loss For the Financial Year Ended 31 December 2020 Note RM 2 Revenue Less: Cost of sales Gross profit Add: Other income RM 1,200,000 (460,000) 740,000 8.000 748,000 3 Less: Expenditures Staff cost Miscellaneous expense (trade related) Research and development Profit before tax 263,100 300,000 18,000 5 (581.100) 166,900 Notes: [Note 1 relates to the beauty and personal care consultation services business) 1. Miscellaneous expenses included contribution of groceries worth RM2,000 to Yayasan Food Bank Malaysia (YFBM), which was an approved institution. [Notes 2 to 6 relate to the cosmeceutical product manufacturing business 2. Cost of sales included damaged stocks written-off of RM3,120. 3. Other income was made up of gross dividend received during the year from investment in shares of listed companies in Indonesia. 4. Staff costs comprised of staff salaries amounting to RM210,000, contribution to the Employees' Provident Fund (EPF) totalling RM23,100, and staff annual dinner costing RM30,000. 5. Expenses incurred were for approved research and development activities with regard to the development of new colours for the cosmetics. 6. Additional information: i. The capital allowance for the Year of Assessment (YA) 2020 was RM35,000. ii. The unabsorbed loss brought forward from YA2019 was RM15,200. QUESTION 3 Part A De' Ayu Cosmetics is solely owned by Datin Farah and manufactures cosmeceutical products for the local market. It closes its account on 31 December annually. During the financial year 2020, De' Ayu Cosmetics has introduced a new business line involving beauty and personal care consultation services. Datin Farah leads this consultation services along with few staffs from the existing manufacturing business. The statements of profit and loss for each business lines of De' Ayu Cosmetics for the financial year ended 31 December 2020 are as follows. De Ayu Cosmetics Beauty and Personal Care Consultation Services Business Statement of Profit and Loss For the Financial Year Ended 31 December 2020 Note RM RM Revenue 119,000 Less: Entertainment expenses (general) 15,000 Salaries for employees 24,000 Miscellaneous expenses 1 37,000 (76,000) Profit before tax 43.000

Type or paste question here

Type or paste question here