Type or paste question here

Type or paste question here

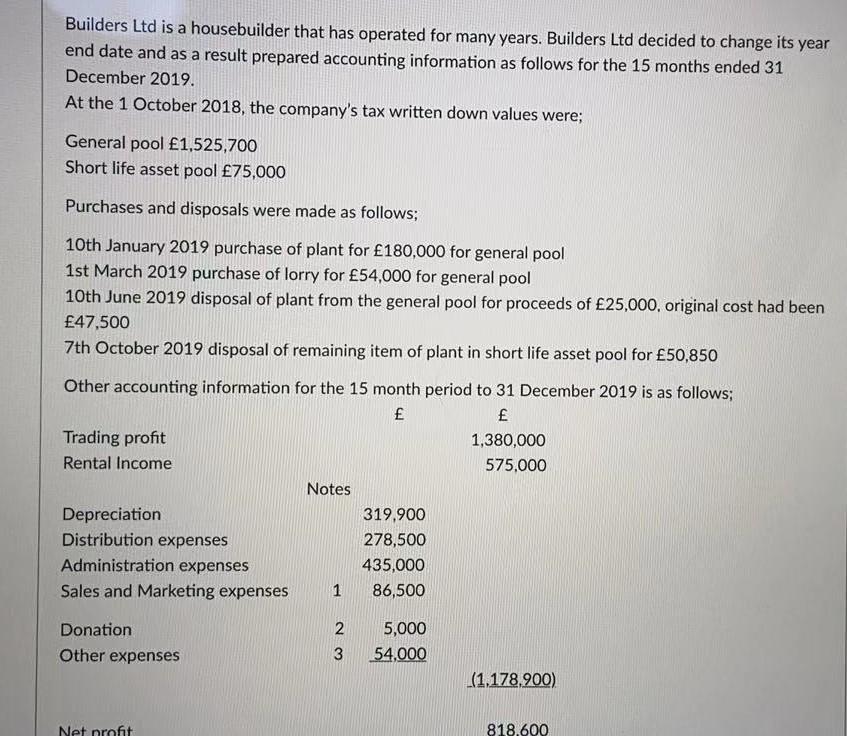

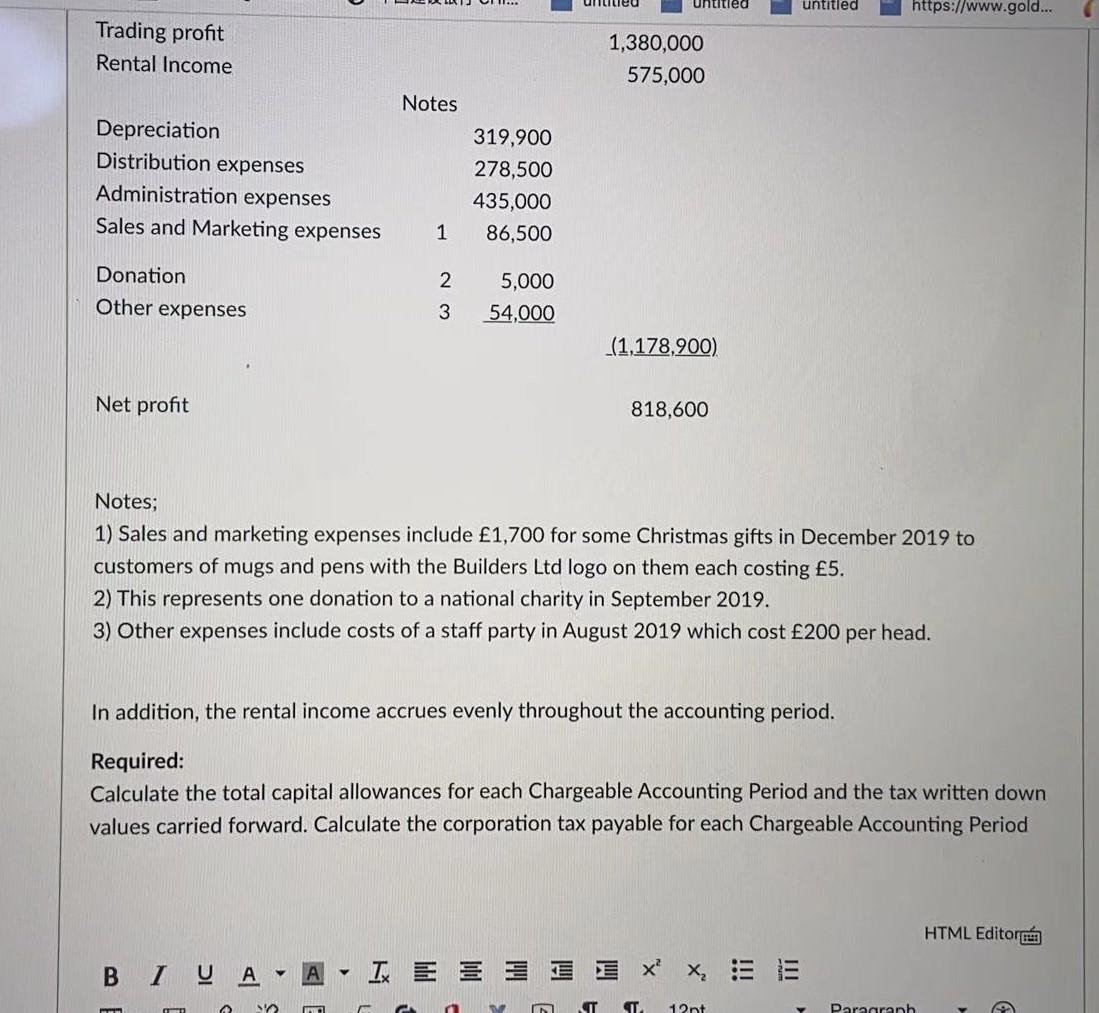

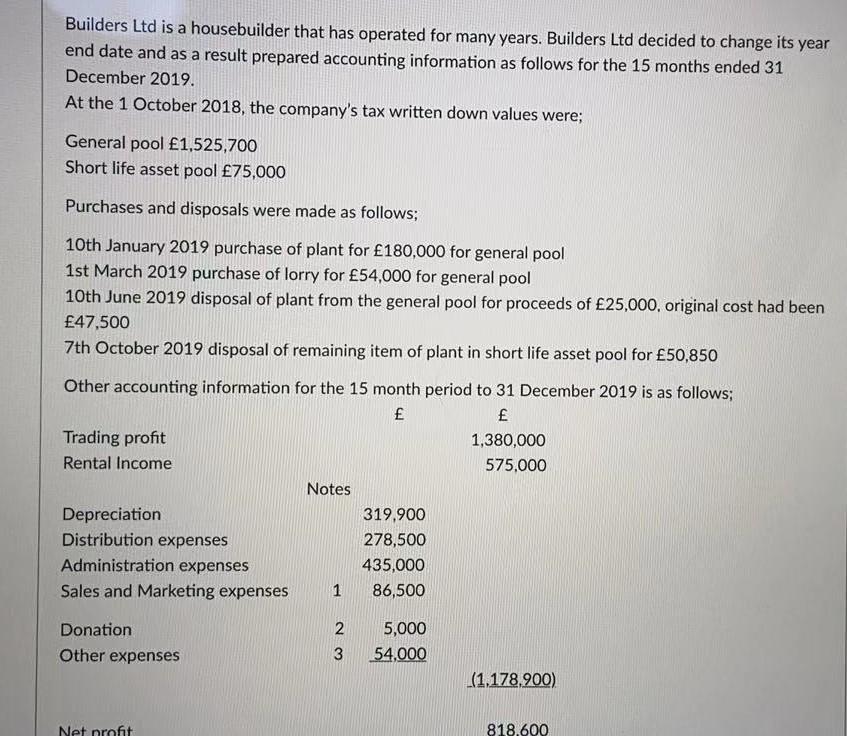

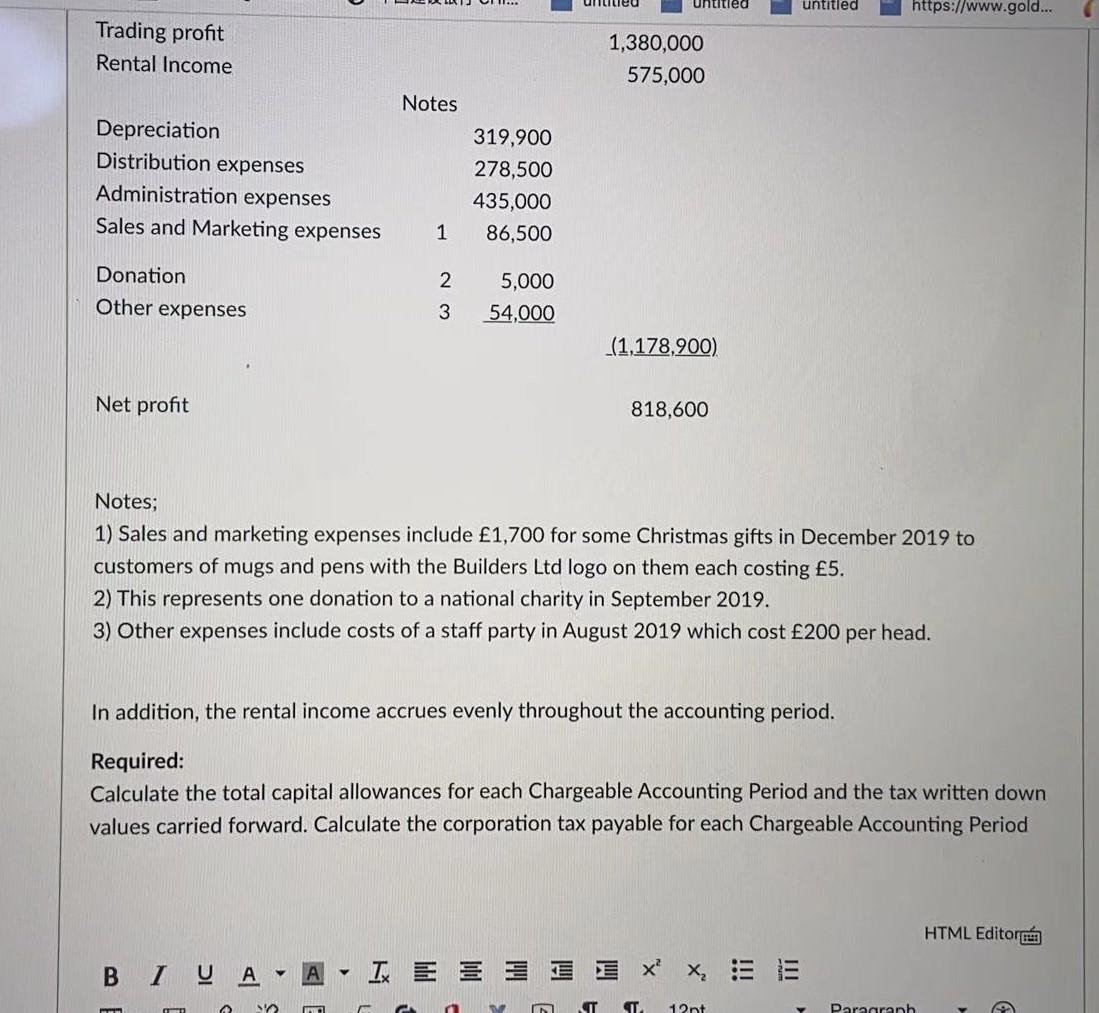

Builders Ltd is a housebuilder that has operated for many years. Builders Ltd decided to change its year end date and as a result prepared accounting information as follows for the 15 months ended 31 December 2019. At the 1 October 2018, the company's tax written down values were; General pool 1,525,700 Short life asset pool 75,000 Purchases and disposals were made as follows; 10th January 2019 purchase of plant for 180,000 for general pool 1st March 2019 purchase of lorry for 54,000 for general pool 10th June 2019 disposal of plant from the general pool for proceeds of 25,000, original cost had been 47,500 7th October 2019 disposal of remaining item of plant in short life asset pool for 50,850 Other accounting information for the 15 month period to 31 December 2019 is as follows; Trading profit 1,380,000 Rental Income 575.000 Notes Depreciation 319,900 Distribution expenses 278,500 Administration expenses 435,000 Sales and Marketing expenses 1 86,500 Donation 2 5,000 Other expenses 3 54,000 _(1.178.900) Net profit 818.600 Untitled untitled https://www.gold... Trading profit Rental Income 1,380,000 575,000 Notes Depreciation Distribution expenses Administration expenses Sales and Marketing expenses 319,900 278,500 435,000 86,500 1 Donation Other expenses 2 3 5,000 54,000 (1,178,900) Net profit 818,600 Notes; 1) Sales and marketing expenses include 1,700 for some Christmas gifts in December 2019 to customers of mugs and pens with the Builders Ltd logo on them each costing 5. 2) This represents one donation to a national charity in September 2019. 3) Other expenses include costs of a staff party in August 2019 which cost 200 per head. In addition, the rental income accrues evenly throughout the accounting period. Required: Calculate the total capital allowances for each Chargeable Accounting Period and the tax written down values carried forward. Calculate the corporation tax payable for each Chargeable Accounting Period HTML Editora Ix E 1 x? X, SE T 12nt Paragraph Builders Ltd is a housebuilder that has operated for many years. Builders Ltd decided to change its year end date and as a result prepared accounting information as follows for the 15 months ended 31 December 2019. At the 1 October 2018, the company's tax written down values were; General pool 1,525,700 Short life asset pool 75,000 Purchases and disposals were made as follows; 10th January 2019 purchase of plant for 180,000 for general pool 1st March 2019 purchase of lorry for 54,000 for general pool 10th June 2019 disposal of plant from the general pool for proceeds of 25,000, original cost had been 47,500 7th October 2019 disposal of remaining item of plant in short life asset pool for 50,850 Other accounting information for the 15 month period to 31 December 2019 is as follows; Trading profit 1,380,000 Rental Income 575.000 Notes Depreciation 319,900 Distribution expenses 278,500 Administration expenses 435,000 Sales and Marketing expenses 1 86,500 Donation 2 5,000 Other expenses 3 54,000 _(1.178.900) Net profit 818.600 Untitled untitled https://www.gold... Trading profit Rental Income 1,380,000 575,000 Notes Depreciation Distribution expenses Administration expenses Sales and Marketing expenses 319,900 278,500 435,000 86,500 1 Donation Other expenses 2 3 5,000 54,000 (1,178,900) Net profit 818,600 Notes; 1) Sales and marketing expenses include 1,700 for some Christmas gifts in December 2019 to customers of mugs and pens with the Builders Ltd logo on them each costing 5. 2) This represents one donation to a national charity in September 2019. 3) Other expenses include costs of a staff party in August 2019 which cost 200 per head. In addition, the rental income accrues evenly throughout the accounting period. Required: Calculate the total capital allowances for each Chargeable Accounting Period and the tax written down values carried forward. Calculate the corporation tax payable for each Chargeable Accounting Period HTML Editora Ix E 1 x? X, SE T 12nt Paragraph

Type or paste question here

Type or paste question here