Type or paste question here

Type or paste question here

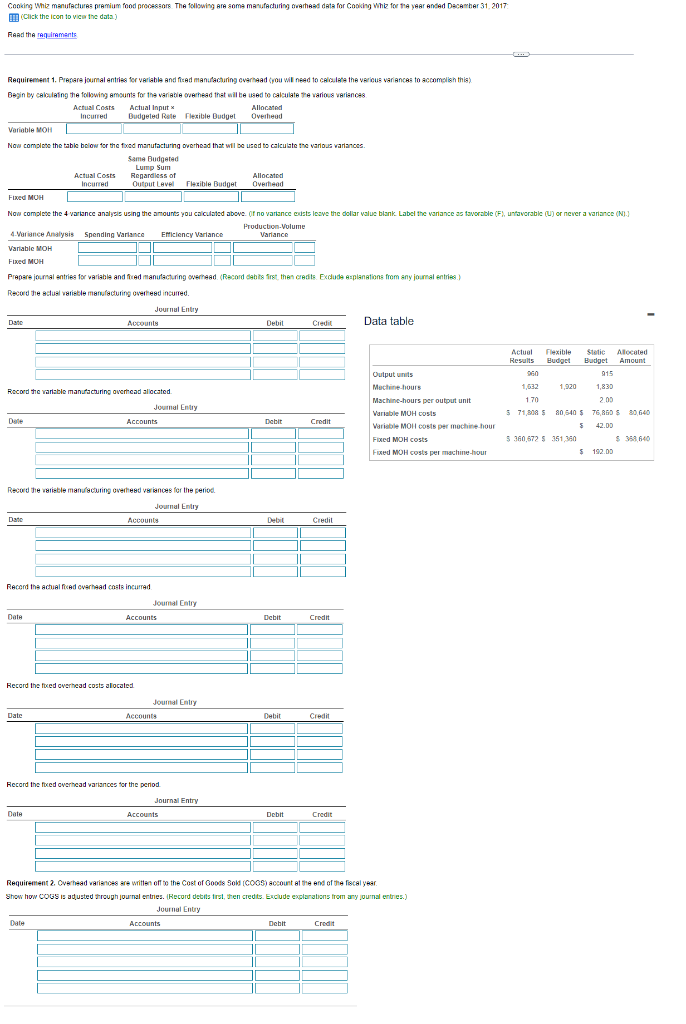

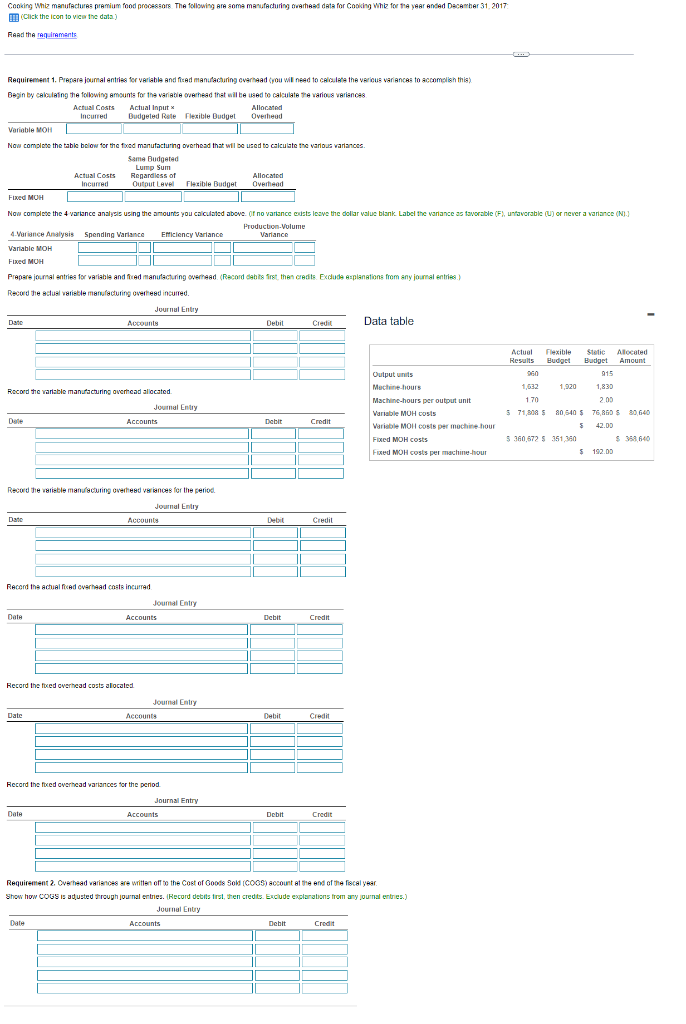

Cooking Whiz manufactures premium food processors. The following are some manufacturing overhoed data for Coricing Whiz for the year anded December 31, 2017 Click the icon to view the data) Fand the requirements Requirement 1. Precare journal entries for variable and feed manufacturing overhead you will need to calculate the various variances to accomplish this) Begin by calling the following amounts for the variable owerhead that will be used to calculate e various variances Actual Costs Actual Input Allocated incurred Budgeled Rate Flexible Dudget Overhead Variable MOH Now complete the table below for the fixed manufacturing overhead that wil be used to calculate the various variances Same Budgeted Lump Sum Actual Costs Regardless of Allocate Incurred Output Avellexible Budget Overhead Fixed MOH Now complete the 4 variance analysis using the amounts you calculated above. Of no variance odsto leave the dollar value blank Label the variance as favorable (F), unfavorable (U) or never a variance (N). Production-Volume 4. Variance Analysis Spending Variance Emiciency Variance Variance Variable MOH 11 1 Fixed MOH Prepare journal entries for variable and fed manufacturing overhead (Record debts first the credits Exclude esplanations from any journal entries Record the actual variable manufacturing overhead incurred Journal Entry Date Accounts Debil Credit Data table Flexible Budget Actual Results 960 1,632 1 70 Static Allocated Budget Amount 915 1,830 2.00 1,920 Record the variable manufacturing overhead allocated. Journal Entry Outputs Machine hours Machine-hours per output unit Variable MOH COSTS Variable MOH costs per machine hour Fixed MOH costs Fixed MOH costs per machine- hour Dale Accounts Debit Credit 5 71,808 80 540 $ 76,850 $ 80 640 $ 42.00 5 360,572 $ 351 360 $ 192.00 III III III Record the variable manufacturing overhead variances for the period. Journal Enly Accounts Dans Debit Credit III 1 III Record the Achialiced overhead costs incurred Journal Entry Accounts Data Debit Credit III Record the fored overhead costs allocated Joumal toy Date Accounts Debit Record the faxed overhead variances for the period Journal Entry Date Accounts Debit Credit Requirement 2. Overhead variances are written off the cost of Goods Sold (COO) account at the end of the fiscal year Show how COGS is ad usted rough journal entries. Record debitstrs, en credits. Exclude explanations from any journal entries) Journal Entry Dale Accounts Debit Credit 1 1 1 1

Type or paste question here

Type or paste question here