Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(Types of Opinions) A. Unmodified B. Qualified C. Adverse D. Disclaimer E. Qualified or adverse F. Qualified or disclaimer G. Disclaimer or adverse Salameh &

(Types of Opinions) A. Unmodified B. Qualified C. Adverse D. Disclaimer E. Qualified or adverse F. Qualified or disclaimer G. Disclaimer or adverse

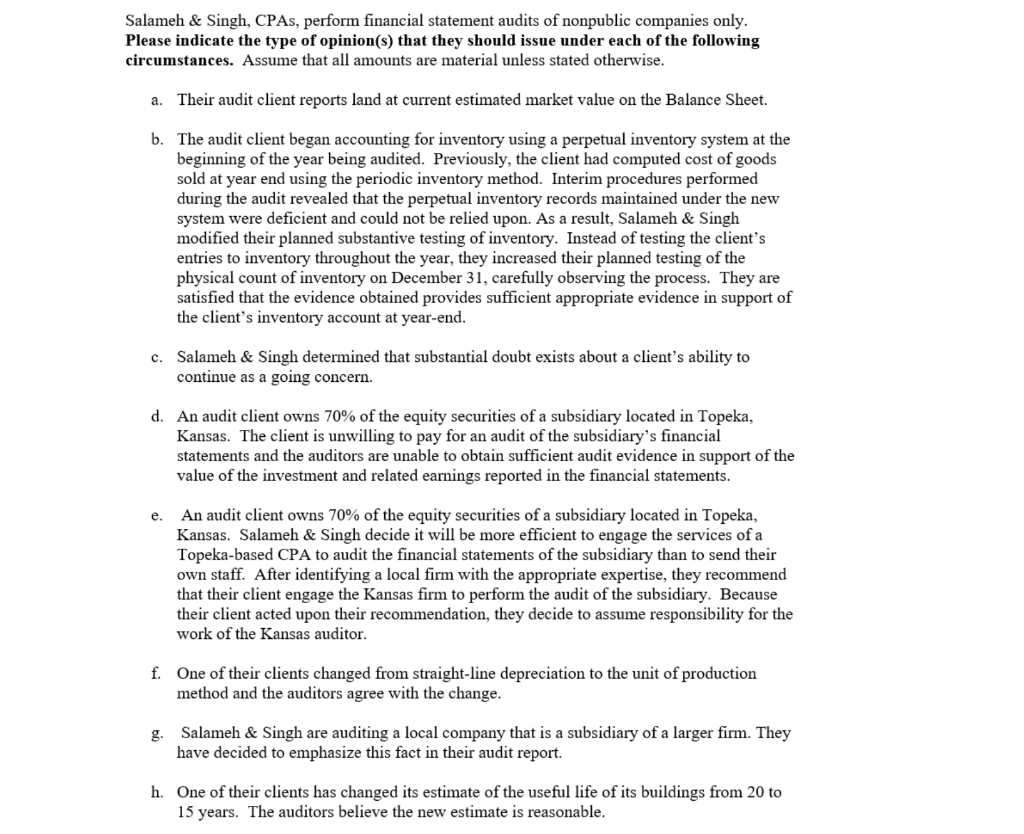

Salameh & Singh, CPAs, perform financial statement audits of nonpublic companies only. Please indicate the type of opinion(s) that they should issue under each of the following circumstances. Assume that all amounts are material unless stated otherwise. a. Their audit client reports land at current estimated market value on the Balance Sheet. b. The audit client began accounting for inventory using a perpetual inventory system at the beginning of the year being audited. Previously, the client had computed cost of goods sold at year end using the periodic inventory method. Interim procedures performed during the audit revealed that the perpetual inventory records maintained under the new system were deficient and could not be relied upon. As a result, Salameh & Singh modified their planned substantive testing of inventory. Instead of testing the client's entries to inventory throughout the year, they increased their planned testing of the physical count of inventory on December 31, carefully observing the process. They are satisfied that the evidence obtained provides sufficient appropriate evidence in support of the client's inventory account at year-end. c. Salameh & Singh determined that substantial doubt exists about a client's ability to continue as a going concern. d. An audit client owns 70% of the equity securities of a subsidiary located in Topeka, Kansas. The client is unwilling to pay for an audit of the subsidiary's financial statements and the auditors are unable to obtain sufficient audit evidence in support of the value of the investment and related earnings reported in the financial statements. e. An audit client owns 70% of the equity securities of a subsidiary located in Topeka, Kansas. Salameh & Singh decide it will be more efficient to engage the services of a Topeka-based CPA to audit the financial statements of the subsidiary than to send their own staff. After identifying a local firm with the appropriate expertise, they recommend that their client engage the Kansas firm to perform the audit of the subsidiary. Because their client acted upon their recommendation, they decide to assume responsibility for the work of the Kansas auditor. f. One of their clients changed from straight-line depreciation to the unit of production method and the auditors agree with the change. g. Salameh & Singh are auditing a local company that is a subsidiary of a larger firm. They have decided to emphasize this fact in their audit report. h. One of their clients has changed its estimate of the useful life of its buildings from 20 to 15 years. The auditors believe the new estimate is reasonableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started