Answered step by step

Verified Expert Solution

Question

1 Approved Answer

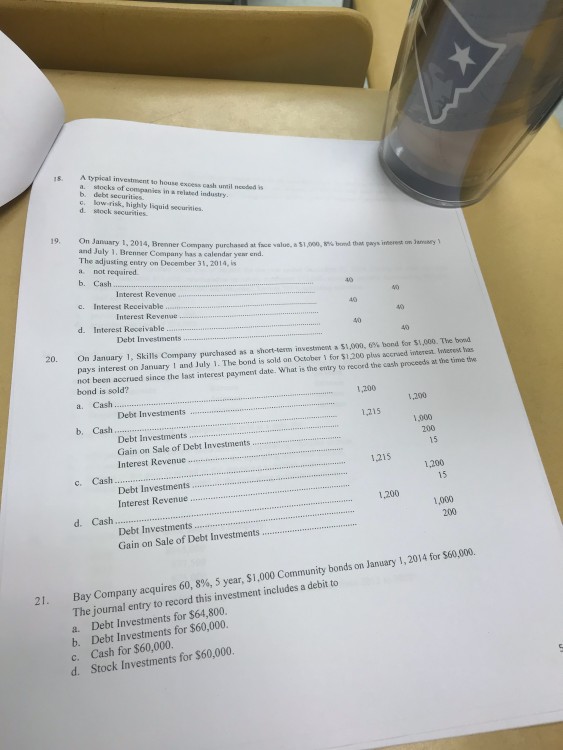

typical investnient to house excess cash umil neoded is a. stocks of conspanies in a relabed industry umi b debt secur o. low risk, highty

typical investnient to house excess cash umil neoded is a. stocks of conspanies in a relabed industry umi b debt secur o. low risk, highty liquid securinies d. stock securities 19. On Janusry 1,2014, Brenner Company purchased at face value, a 51,00, and July 1. Brenner Company has a calendar year end bond that pays interest on Jumary The adjusting entry on December 31,2014, is a not required b. Cash Interest Revenue Interest Revene Debt Investments c Interest Receivable d. Interest Receivable 40 On January 1, Skills Company purchased as a short-term investment * S1.000, 6% bond for S1,000. The bond pays interest on January I and July 1. The bond is sold on Outober 1 for $1,200 plus accrued inerest Imerest has not been accrued since the last interest payment date. What is the emry to record the cash proceeds at the time the 20. bond is sold? a. Cash.... 1,200 1,200 Debt Investments en- b. Cash 1215 1,900 Debt Investments... Gain on Sale of Debt Investments. Interest Revenue 200 15 1215 200 c. Cash Debt Investments... Interest Revenue 15 1,200 1,000 200 d. Cash. Gain on Sale of Debt Investments.. , 2014 for S60.000. Bay Company acquires 60, 8%, s year, s 1,000 Community bonds on January 1 The journal entry to record this investment includes a debit to a. Debt Investments for $64,800. b. Debt Investments for $60,000. c. Cash for $60,000 d. Stock Investments for $60,000. 21

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started