Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Typical problem progression... TAC Co. is reviewing their capital structure. They have $1,500,000 in bonds at a cost to maturity of 9%,100,000 shares of stock

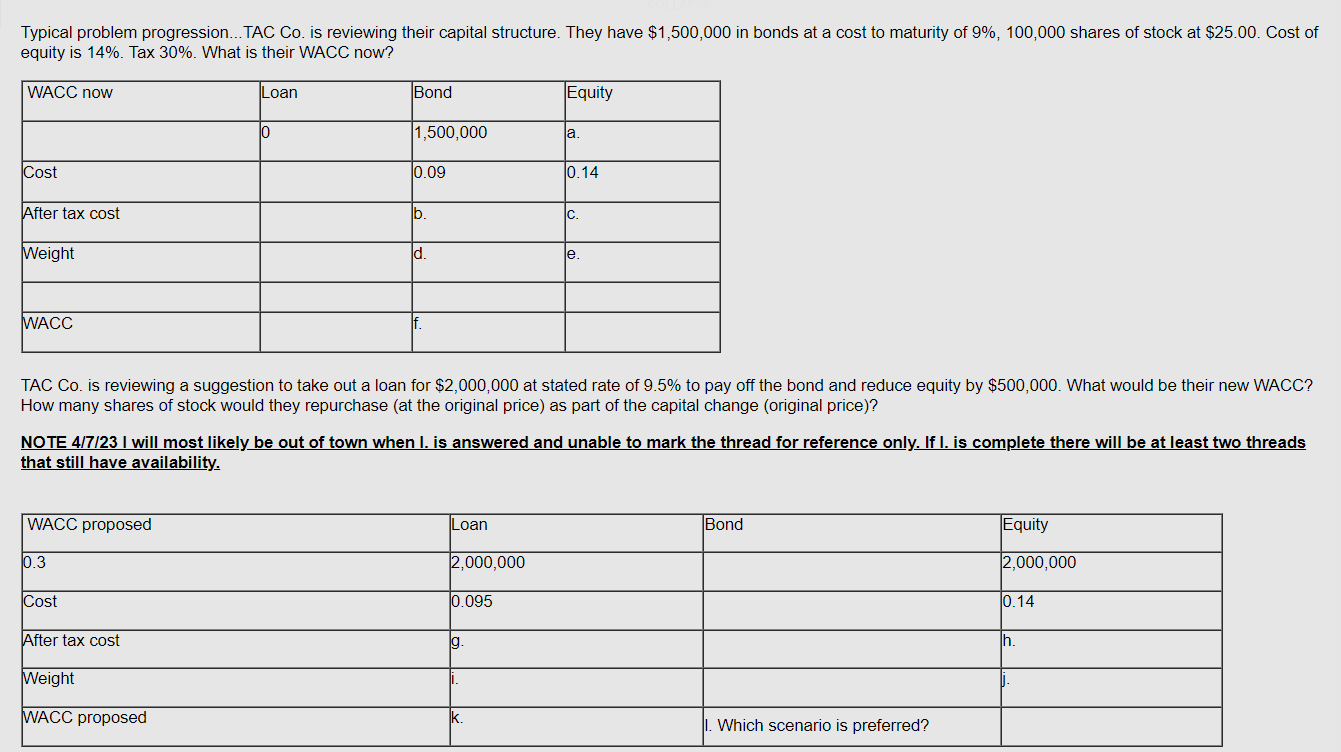

Typical problem progression... TAC Co. is reviewing their capital structure. They have $1,500,000 in bonds at a cost to maturity of 9%,100,000 shares of stock at $25.00. Cost of equity is 14%. Tax 30%. What is their WACC now? TAC Co. is reviewing a suggestion to take out a loan for $2,000,000 at stated rate of 9.5% to pay off the bond and reduce equity by $500,000. What would be their new WACC? How many shares of stock would they repurchase (at the original price) as part of the capital change (original price)? NOTE 4/7/23 I will most likely be out of town when I. is answered and unable to mark the thread for reference only. If I. is complete there will be at least two threads that still have availability

Typical problem progression... TAC Co. is reviewing their capital structure. They have $1,500,000 in bonds at a cost to maturity of 9%,100,000 shares of stock at $25.00. Cost of equity is 14%. Tax 30%. What is their WACC now? TAC Co. is reviewing a suggestion to take out a loan for $2,000,000 at stated rate of 9.5% to pay off the bond and reduce equity by $500,000. What would be their new WACC? How many shares of stock would they repurchase (at the original price) as part of the capital change (original price)? NOTE 4/7/23 I will most likely be out of town when I. is answered and unable to mark the thread for reference only. If I. is complete there will be at least two threads that still have availability Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started