typo: resulting from exercise 4

typo: resulting from exercise 4

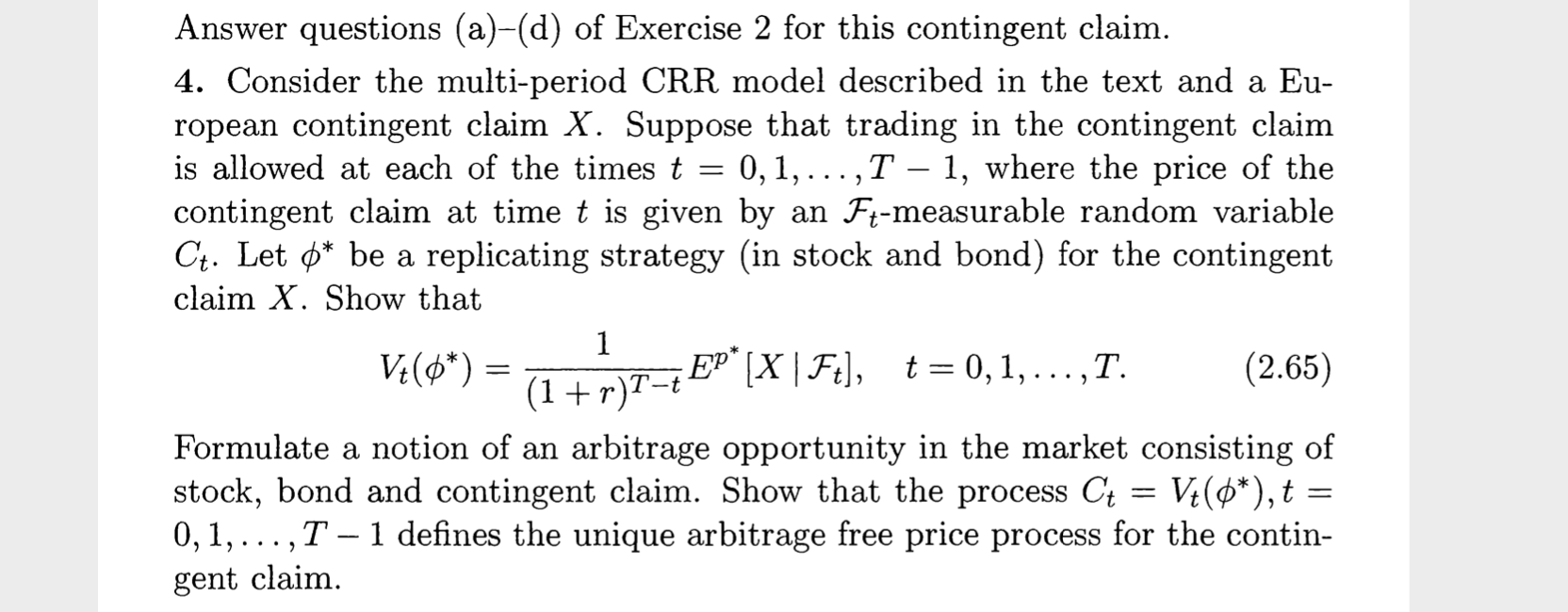

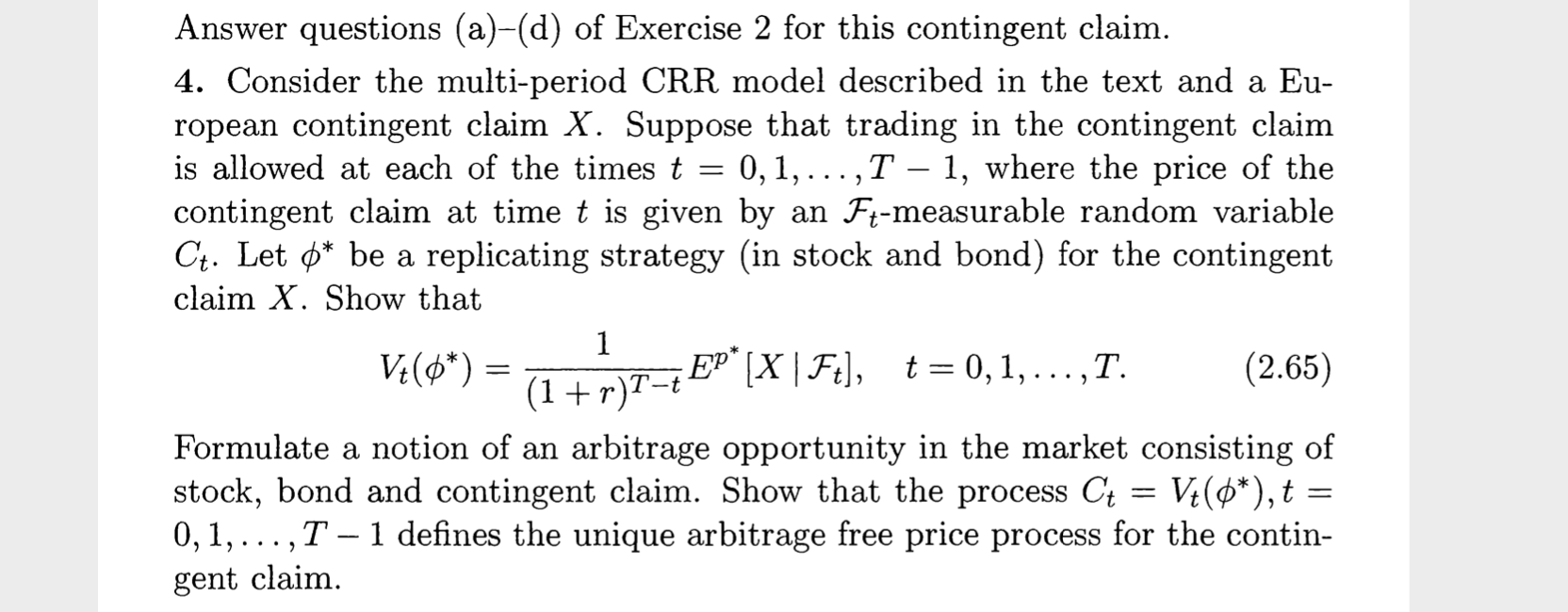

here is exercise 4:

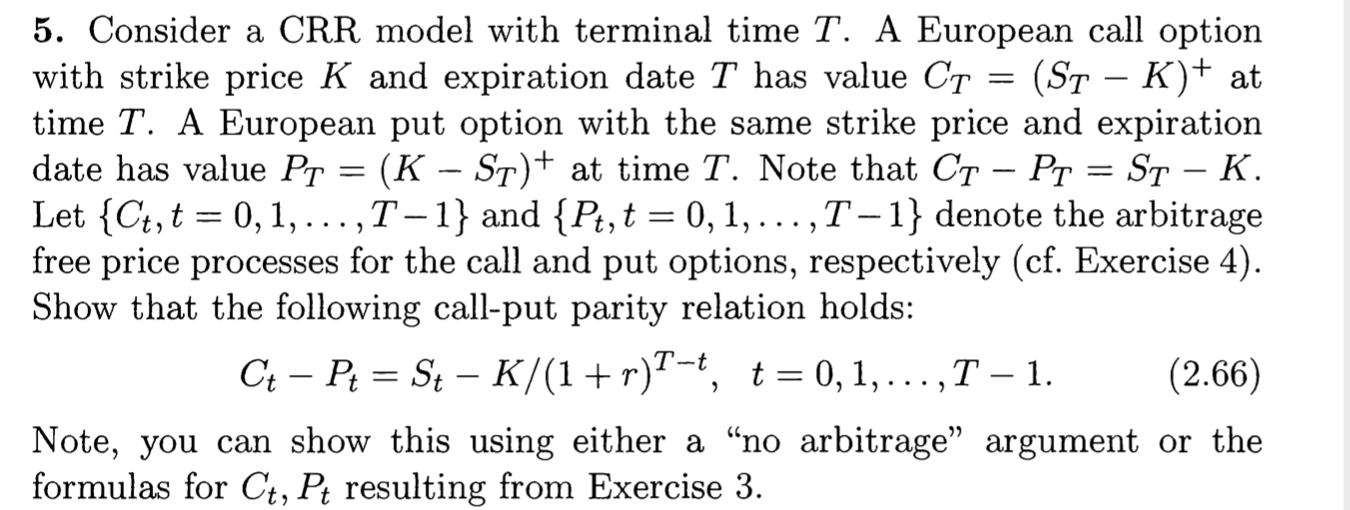

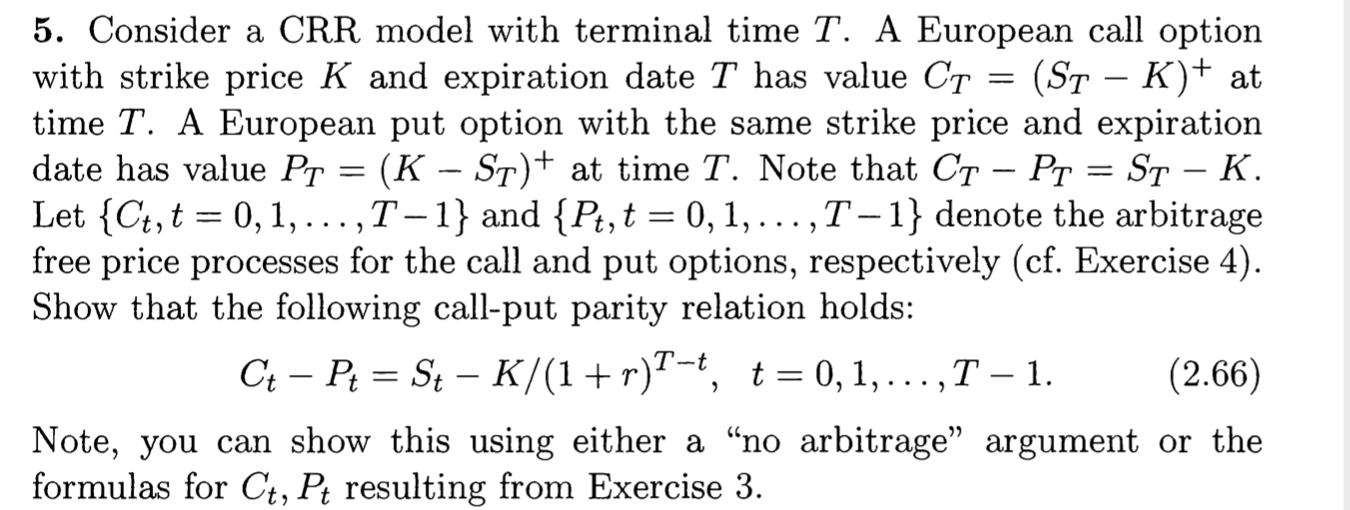

5. Consider a CRR model with terminal time T. A European call option with strike price K and expiration date T has value Ct = (ST K)+ at time T. A European put option with the same strike price and expiration date has value PT = (K ST)+ at time T. Note that CT PT = ST K. Let {Ct, t = 0,1, ...,T-1} and {Pt,t = 0,1,...,T-1} denote the arbitrage free price processes for the call and put options, respectively (cf. Exercise 4). Show that the following call-put parity relation holds: Ct Pt = St K/(1+r)7-t, t=0,1,...,T 1. (2.66) Note, you can show this using either a no arbitrage argument or the formulas for Ct, Pt resulting from Exercise 3. Answer questions (a)-(d) of Exercise 2 for this contingent claim. 4. Consider the multi-period CRR model described in the text and a Eu- ropean contingent claim X. Suppose that trading in the contingent claim is allowed at each of the times t = 0,1,...,1 1, where the price of the contingent claim at time t is given by an Ft-measurable random variable Ct. Let 0* be a replicating strategy (in stock and bond) for the contingent claim X. Show that V+(0*) = (17) T-EP" [X | Ft), t=0,1,..., T. (2.65) Formulate a notion of an arbitrage opportunity in the market consisting of stock, bond and contingent claim. Show that the process Ct = V+(0*),t = 0,1,...,T - 1 defines the unique arbitrage free price process for the contin- gent claim. 5. Consider a CRR model with terminal time T. A European call option with strike price K and expiration date T has value Ct = (ST K)+ at time T. A European put option with the same strike price and expiration date has value PT = (K ST)+ at time T. Note that CT PT = ST K. Let {Ct, t = 0,1, ...,T-1} and {Pt,t = 0,1,...,T-1} denote the arbitrage free price processes for the call and put options, respectively (cf. Exercise 4). Show that the following call-put parity relation holds: Ct Pt = St K/(1+r)7-t, t=0,1,...,T 1. (2.66) Note, you can show this using either a no arbitrage argument or the formulas for Ct, Pt resulting from Exercise 3. Answer questions (a)-(d) of Exercise 2 for this contingent claim. 4. Consider the multi-period CRR model described in the text and a Eu- ropean contingent claim X. Suppose that trading in the contingent claim is allowed at each of the times t = 0,1,...,1 1, where the price of the contingent claim at time t is given by an Ft-measurable random variable Ct. Let 0* be a replicating strategy (in stock and bond) for the contingent claim X. Show that V+(0*) = (17) T-EP" [X | Ft), t=0,1,..., T. (2.65) Formulate a notion of an arbitrage opportunity in the market consisting of stock, bond and contingent claim. Show that the process Ct = V+(0*),t = 0,1,...,T - 1 defines the unique arbitrage free price process for the contin- gent claim

typo: resulting from exercise 4

typo: resulting from exercise 4