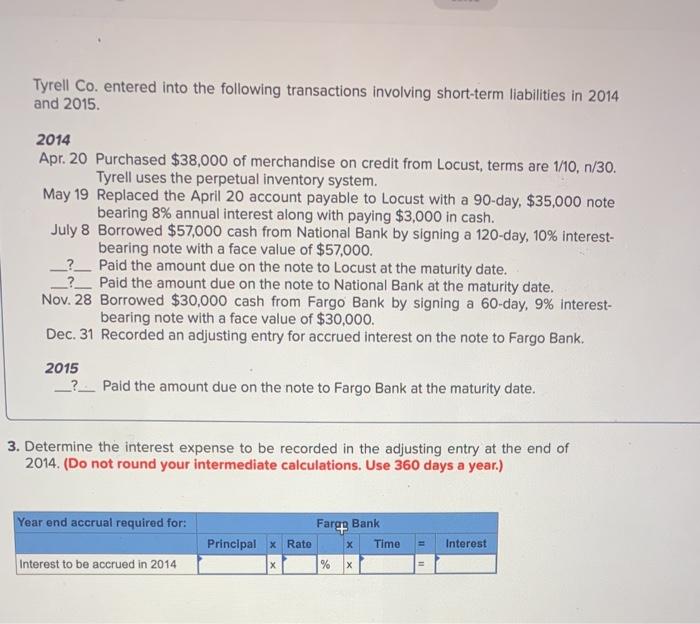

Tyrell Co. entered into the following transactions involving short-term liabilities in 2014 and 2015. 2014 Apr. 20 Purchased $38,000 of merchandise on credit from Locust, terms are 1/10, n/30. Tyrell uses the perpetual inventory system. May 19 Replaced the April 20 account payable to Locust with a 90-day, $35,000 note bearing 8% annual interest along with paying $3,000 in cash. July 8 Borrowed $57,000 cash from National Bank by signing a 120-day, 10% interest- bearing note with a face value of $57,000. __?_Paid the amount due on the note to Locust at the maturity date. Paid the amount due on the note to National Bank at the maturity date. Nov. 28 Borrowed $30,000 cash from Fargo Bank by signing a 60-day, 9% interest- bearing note with a face value of $30,000. Dec. 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank, 2015 _?__ Paid the amount due on the note to Fargo Bank at the maturity date. 3. Determine the interest expense to be recorded in the adjusting entry at the end of 2014. (Do not round your intermediate calculations. Use 360 days a year.) Year end accrual required for: Farge Bank Principal Rate Timo Interest HIHI Interest to be accrued in 2014 X % Tyrell Co. entered into the following transactions involving short-term liabilities in 2014 and 2015. 2014 Apr. 20 Purchased $38,000 of merchandise on credit from Locust, terms are 1/10, n/30. Tyrell uses the perpetual inventory system. May 19 Replaced the April 20 account payable to Locust with a 90-day, $35,000 note bearing 8% annual interest along with paying $3,000 in cash. July 8 Borrowed $57,000 cash from National Bank by signing a 120-day, 10% interest- bearing note with a face value of $57,000. __?_Paid the amount due on the note to Locust at the maturity date. Paid the amount due on the note to National Bank at the maturity date. Nov. 28 Borrowed $30,000 cash from Fargo Bank by signing a 60-day, 9% interest- bearing note with a face value of $30,000. Dec. 31 Recorded an adjusting entry for accrued interest on the note to Fargo Bank, 2015 _?__ Paid the amount due on the note to Fargo Bank at the maturity date. 3. Determine the interest expense to be recorded in the adjusting entry at the end of 2014. (Do not round your intermediate calculations. Use 360 days a year.) Year end accrual required for: Farge Bank Principal Rate Timo Interest HIHI Interest to be accrued in 2014 X %