Question

Tyson and Holyfield are partners in a business. They are considering a number of options regarding the partnership, including the admission of a new partner

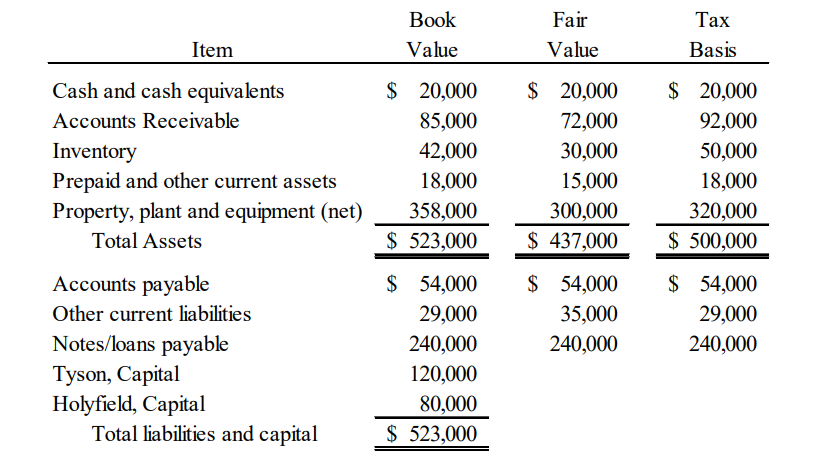

Tyson and Holyfield are partners in a business. They are considering a number of options regarding the partnership, including the admission of a new partner and a potential sale of the partnership. The following information has been prepared as a basis for evaluation the various alternatives:

The partners currently share profits and losses 60% and 40%, respectively, for Tyson and Holyfield. Given the information above, respond to each of the following items.

(a) Given the stated fair values, if Holyfield were to sell one-half of his interest in capital to someone outside the partnership, what would be a suggested asking price?

(b) Given the stated fair values, if a third party were to convey assets to the partnership in exchange for a 40% interest in the partnership, what would the value of those assets have to be?

(c) Assume a new partner was admitted to the partnership with a 40% interest in capital in exchange for a cash contribution of $60,000. What would Holyfields capital balance be as a result of this transaction, assuming use of the bonus method?

(d) Given the facts of (c) above, what would Holyfields capital balance be, assuming the use of the goodwill method?

(e) Assume a new partner was admitted to the partnership with a 30% interest in capital in exchange for a contribution of $55,000 of net tangible assets. What would the new partners capital balance be as a result of this transaction, assuming use of the bonus method?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started