Question

Tyson Enterprises has decided to take its company public by offering a total of 80,000 shares of common stock to the public in an initial

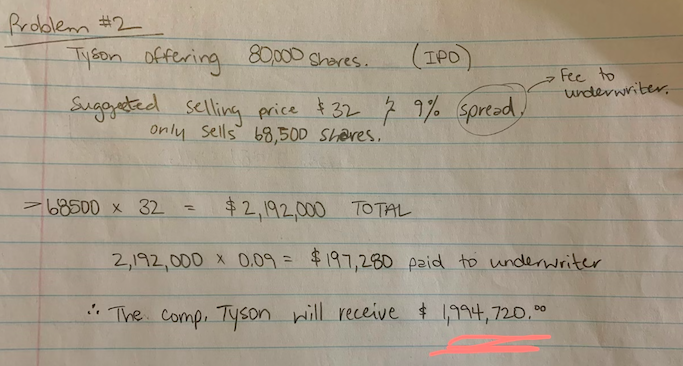

Tyson Enterprises has decided to take its company public by offering a total of 80,000 shares of common stock to the public in an initial public offering (IPO). Tyson has hired an underwriter who arranges a firm commitment underwriting and suggests an initial selling price of $32 a share with a 9 percent spread. As it turns out, the underwriters only sell 68,500 shares. How much cash will Tyson receive from the IPO?

Please check work, not sure why i got a different answer than the solutions provided

Solution: 80,000 x $32 = $2,560,000. Amount needed = 1-.09 (2,560,000) = $2,329,600

(IPO) Problem #2 Tyson offering offering 80,000 Shares. Suggested selling price $32 & 9% spread) only sells 68,500 shares, Fee to underwriter, > 68500 x 32 $2, 192,000 TOTAL 2,192,000 0.09 = $197,280 paid to underwriter DO "The comp. Tyson will receive & 1,994, 720.00Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started